Warren Buffett has made quite a name for himself in the investing and business world, and that’s putting it lightly. Through his company, Berkshire Hathaway, Buffett and his team have a track record of sustained success. Many investors look to the company’s holdings for inspiration.

One stock in Berkshire Hathaway’s portfolio with all the hallmarks of being a long-term winner is Visa (V 1.03%). It has attributes that Buffett advises investors to look for in a company: competitive advantage, heavy cash flow, and longevity.

Visa’s reach gives it an advantage

Buffett has always preached the importance of companies having a competitive advantage, and Visa definitely checks that box. In Visa’s case, its massive reach gives it a leg up over other card issuers. Visa has over 4.3 billion cards globally (as of June 30, 2023) and over 130 million merchant locations accepting those cards.

Its vast reach allows Visa to benefit from a network effect, whereby potential cardholders and merchants are incentivized to go with Visa because that’s what’s most commonly used and accepted. Cardholders want a card that’s accepted in lots of places and merchants want to accept the cards that the most people have. It’s the gift that keeps giving for Visa.

Visa is a cash cow

Visa’s expansion came through years of strategic planning and acquisitions. From Visa Europe ($23 billion cost) to CyberSource ($2 billion) to Tink ($2 billion), Visa hasn’t been afraid to invest in key markets and business areas that strengthen its core business and accelerate growth.

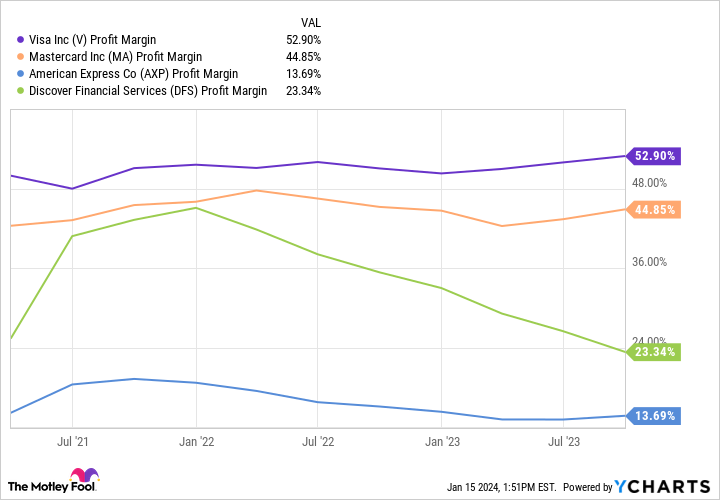

Because of such investments, many of them made years ago, Visa has become a profit machine. Check out its profit margin compared to competitors in the chart below.

V Profit Margin data by YCharts

Visa makes money by taking a percentage of the transactions made with its cards or on its payment network. Unlike a model of selling physical products, where costs for shipping, storage, and other overhead add up, Visa’s model requires minimal additional costs per transaction. That’s why the company’s gross profit margin — profits minus the cost of goods sold — is an eye-popping 80%.

Buffett has long been a fan of businesses with great cash flow, and Visa has that. Its trailing-12-month free cash flow is nearly $20 billion, which is almost $10 billion more than that of its biggest competitor, Mastercard, and up almost 200% from a decade ago.

Is it a buy now?

Some investors point to Visa’s valuation to argue that now isn’t a good time to buy shares. To be fair, Visa’s stock definitely isn’t cheap by most metrics. However, you don’t need to try to wait for the “ideal” time to invest; you only want the stock to keep rising after you do.

As of Jan. 16, Visa’s stock is trading for just over $264 per share, with a trailing price-to-earnings ratio around 30. Whenever I think about investing in great companies but worry about value, I ask myself, “A decade from now, will I be glad I bought shares at that price?” and if the answer is yes, I don’t overthink it.

In Visa’s case, I think the answer is yes. Despite its vast network, much of the world still operates in a cash economy and is in the earlier stages of adopting digital payments. The digital payment market is expected to grow from $84.5 billion in 2022 to $505 billion in 2032, a compound annual growth rate of 19.7%.

How much of the growing pie Visa captures is yet to be seen, but it’s well positioned to lead the way. Visa looks like a great long-term buy to begin 2024.

Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends Discover Financial Services and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.