Walgreens Boots Alliance (WBA -1.05%) caught the market by storm last week when it slashed its dividend by 48%, from $0.48 per share per quarter to $0.25. Now, Walgreens stock yields around 4%, which is still respectable, but far lower than the high yield investors were used to.

You may be wondering why a lower dividend could be a good thing. After all, why would investors ever ask a company to give them less money? Here’s why Walgreens’ cut was the right decision, a look at how past dividend cuts helped other companies, and whether or not Walgreens is a dividend stock that’s worth buying now.

Image source: Getty Images.

Walgreens was in trouble

The best dividend-paying companies grow earnings over time, using higher earnings to distribute more income to shareholders. Walgreens was not doing that. It was raising its dividend despite lower earnings and a declining balance sheet.

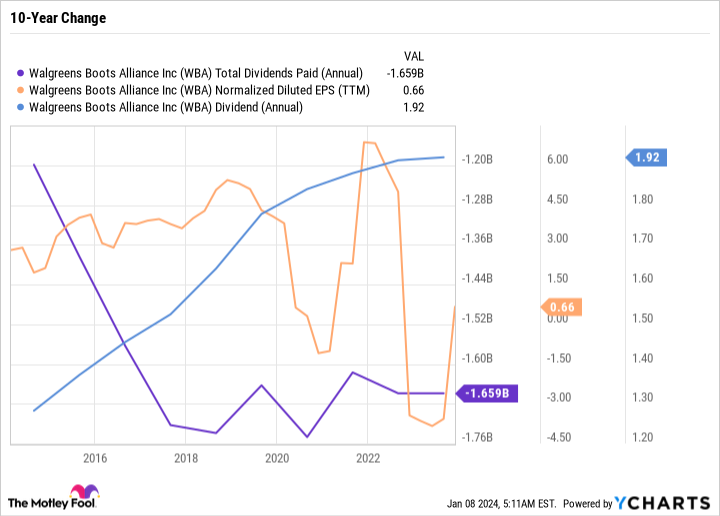

Here’s a look at Walgreens’ earnings per share (EPS) and dividend over the last decade.

WBA Total Dividends Paid (Annual) data by YCharts

Notice that Walgreens’ dividend was far higher than its earnings. Over the last 12 months, Walgreens effectively paid over $1.6 billion in dividends that it couldn’t afford.

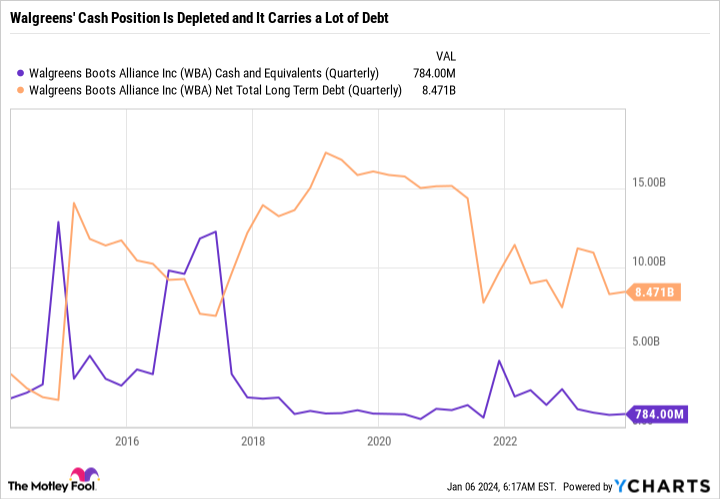

Walgreens is able to do this because of its balance sheet. But as we can see, it was running out of options.

WBA Cash and Equivalents (Quarterly) data by YCharts

Walgreens exited first-quarter fiscal 2024 with just $784 million in cash and cash equivalents on its balance sheet. In other words, it ran out of room to supplement the dividend with reserve cash. And unless earnings improved, it would have had to take on debt to support the dividend — which would just weaken an already struggling business.

By cutting the dividend nearly in half, Walgreens will save somewhere in the ballpark of $800 million a year. The savings can shore up the balance sheet and improve the business.

Examples of successful dividend cuts

Walgreens isn’t the first company to announce a sizable cut, hoping it can turn things around over time.

Pipeline giant Kinder Morgan (KMI -0.33%) slashed its dividend by 75% in early 2016 due to overexpansion followed by an oil and gas crash. Since then, Kinder Morgan has tightened its capital expenditures and operates an extremely disciplined and reliable business built on long-term contracts and reliable cash flows.

For six straight years now, Kinder Morgan has raised its dividend. It still isn’t where it was pre-cut. But it’s a far more sustainable dividend, and the balance sheet is in its best shape in over a decade. With a yield of 6.3%, the Kinder Morgan of today is an attractive high-yield income stock worth considering.

Integrated oil and gas major Shell (SHEL -1.11%) is another good example. Shell cut its dividend by nearly two-thirds during the crash of 2020. Before the cut, Shell paid $0.94 per share per quarter. It has since more than doubled its dividend from that initial post-cut level of $0.32 a share to $0.66 a share, and the stock is up over 70% in the last three years.Shell was overextended and couldn’t afford its dividend. It wanted to allocate capital toward lower-carbon ventures and diversify the business. But it couldn’t do so amid a downturn and with the looming expense of its dividend.

The cut hurt, but it ultimately benefited the business. Shell yields 4%, which is still a good dividend yield, especially considering that the business is in much better shape today.

Walgreens still isn’t a buy

Although Walgreens’ dividend cut was the right long-term move, the stock is still not worth buying now. For a dividend cut to be effective, the company has to be able to chart a path toward future growth. Walgreens is losing market share to its competitors. The dividend may be lower, but it is still a massive expense Walgreens currently can’t afford.

There are far better stocks out there that have earnings growth, are a good value, and have a comparable yield to Walgreens. Walgreens could be a good investment in time. But whenever a company issues this big a change, it’s usually best to wait a few years to see if the savings were used wisely or if the company wasted the opportunity to turn things around.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool has a disclosure policy.