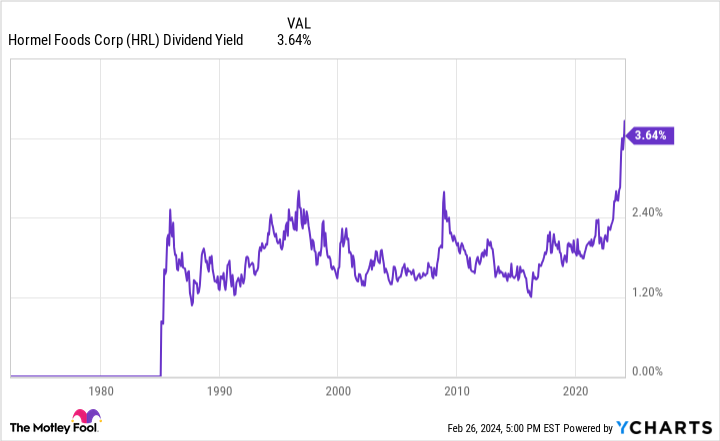

Dividend stocks with high yields are often a red flag. When investors don’t trust the dividend, the share price falls, and the yield rises abnormally high. A company that consistently raises its dividend is a green flag. Increasing dividends signal management’s confidence in the business.

So, what happens when a Dividend King, a stock with 50 or more years of consecutive dividend growth, trades at its highest-ever dividend yield? That’s where Hormel Foods (HRL -5.52%) finds itself today.

The question is whether Hormel’s yield is an opportunity or a trap.

Here is what you need to know.

Hormel’s recent adversity

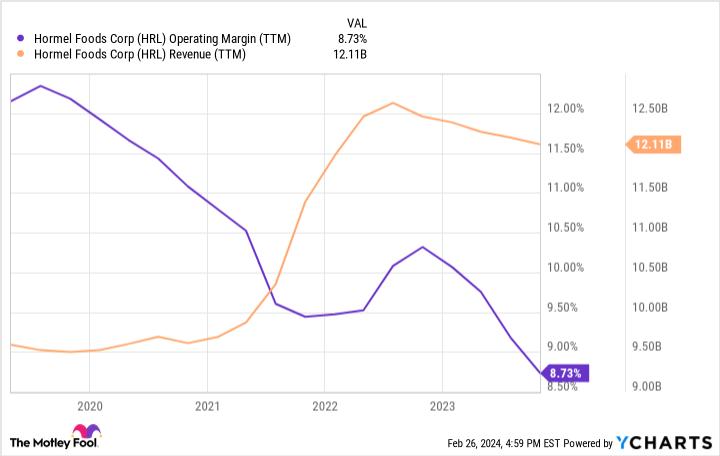

Hormel Foods sells a variety of packaged foods and meats to retailers and restaurants worldwide. Some of the company’s best-known brands include Spam, Skippy, Planters, Jennie-O, and Hormel-branded meat products. The company has been in business for generations, but you can see below how revenue and operating margins have trailed off recently. Note that the big jump in revenue was due to acquiring Planters in 2021.

HRL Operating Margin (TTM) data by YCharts

What’s the culprit? The pandemic caused supply chain disruptions and inflation to pressure Hormel in 2022, which continued in 2023. Management has cited operational changes and investments to address the supply chain problems. This transformation, as management calls it, could create an additional $250 million in operating income by 2026.

Additionally, Hormel has dealt with challenging issues like bird flu and a soft market hurting its international business, especially in China. Fortunately, management is hoping this begins to recover in the fourth quarter of 2024. Hormel should ultimately be judged on its financial strength, because it can’t control something like bird flu or broad weakness in the market.

A solid start to 2024

Management had some good things to say when Hormel recently reported its earnings for the quarter ended Jan. 28. The company reaffirmed full-year guidance, citing growth in its food service segment and the expected rebound in international sales. Volume did jump 11% year-over-year on higher exports, so this should carry through to sales growth as the Chinese market rebounds.

The company’s operating margin did drop to 9.5% from 9.7% in the year-ago period, but investors should look for that to start turning around. The supply chain transformation is expected to be a modest earnings contributor in 2024, so it should start to make a bigger impact over the next two years and beyond.

Overall, it’s a solid start to Hormel’s fiscal year 2024. The next three quarters will be important for showing numbers to support the notion that Hormel’s actions to improve its profitability are bearing fruit.

Is the dividend safe?

For now, Wall Street seems reluctant to give Hormel the benefit of the doubt. You can see that Hormel’s yield has never been this high. Over the past five years, the stock price has dropped and the dividend has risen. Is Hormel’s financial condition as dire as the dividend yield would have investors believe? Well, not really.

The dividend payout ratio is at 76% of cash flow, leaving the company wiggle room to pay the dividend. The company’s operating income was roughly $1 billion over the past year, and $777 million was free cash flow. Hormel’s dividend will have plenty of breathing room if management achieves its goals to grow operating income.

HRL Dividend Yield data by YCharts

Additionally, the balance sheet is in fine shape. Management has traditionally been conservative with debt, though it made an exception when it bought the Planters nuts brand for $3.35 billion in 2021. Even now, though, leverage is just 1.9 times net debt to EBITDA. That’s well below the 3 ratio I generally start to worry about.

The verdict is…

There’s no doubt that Hormel is going through some bumps and bruises today, but the company remains very financially solid. This is not a yield trap. Hormel is a fine dividend stock to buy and hold long-term. The market could even boost the stock’s valuation once it becomes clear that these challenges are in the past.

Today, the stock trades at a forward price-to-earnings ratio of just over 19. Analysts are currently down on the stock, estimating mid-single-digit earnings growth over the next three to five years. But if management’s company transformation boosts operating income by $250 million, Hormel should have no issues outperforming analysts’ expectations.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.