Successful investing is not a matter of luck or magic but of following some basic principles of modern portfolio theory. These principles help investors select different asset classes, such as stocks, bonds, and precious metals, that can work together to achieve their financial goals.

Some of the most important principles are diversification, compounding, and hedging. Diversification means spreading your money across various assets with different risks and potential returns. Compounding means reinvesting your earnings to grow your wealth faster over time. Hedging means protecting your portfolio from losses by using assets that tend to proceed in opposite directions relative to the broader markets.

Image source: Getty Images.

While there is no one-size-fits-all strategy for investing, there are some asset classes that every investor should consider in the current market environment. These include exchange-traded funds (ETFs) for accessing a wide range of markets and sectors at low costs and taxes, dividend growth stocks for generating income and growing your capital, large-cap growth stocks for tapping into the most dominant and innovative companies in the world, small- to mid-cap growth stocks for finding the next big winners in emerging trends, and bond funds for adding stability and income to your portfolio.

Additionally, investors should not overlook the role of precious metals and crypto in their portfolios. These assets may be volatile and controversial, but they offer some unique benefits in today’s world. Precious metals can act as a hedge against inflation and currency devaluation, while crypto can offer exposure to new technologies and decentralized systems. Both can also improve diversification and potentially boost returns.

Based on these ideas, I have created a sample portfolio I believe will outperform the market over the next 20 years. Here is my working sketch, along with possible asset weightings and a brief explanation of the core reason each asset belongs in a well-diversified portfolio.

ETFs (weight 50%)

Over 3,000 U.S.-based ETFs exist at the time of this writing. Of those, I think three low-cost Vanguard funds are all most investors need to create superb returns over the next 20 years. Those funds are Vanguard 500 Index Fund (NYSEMKT: VOO), Vanguard Growth Index Fund (NYSEMKT: VUG), and Vanguard Information Technology Index Fund (NYSEMKT: VGT).

The Vanguard 500 tracks the S&P 500 index, the Vanguard Growth is a megacap growth play, and the Vanguard Information Technology Index provides ample exposure to the ultra-fast-growing world of technology. Owning these funds also prevents investors from picking potential winners in areas admire artificial intelligence or obesity. Instead, they can play the field, potentially producing lower returns than individual stocks, but this strategy is also inherently less risky.

Dividend growth stocks (weight 25%)

Top-shelf dividend growth stocks often deliver above-average returns over long periods, and one of the best places to mine for ideas in this space is the esteemed list of Dividend Kings. Dividend Kings comprise a group of companies that have raised their dividends for at least 50 consecutive years.

Within this group, my picks are W.W. Grainger (NYSE: GWW), Parker-Hannifin (NYSE: PH), MSA Safety (NYSE: MSA), Walmart (NYSE: WMT), and Tennant Company (NYSE: TNC). These five dividend payers have been generating outstanding returns for shareholders for decades. They all have solid levels of institutional ownership and superb fundamentals/long-term outlooks.

Dual-threat dividend stocks (5%)

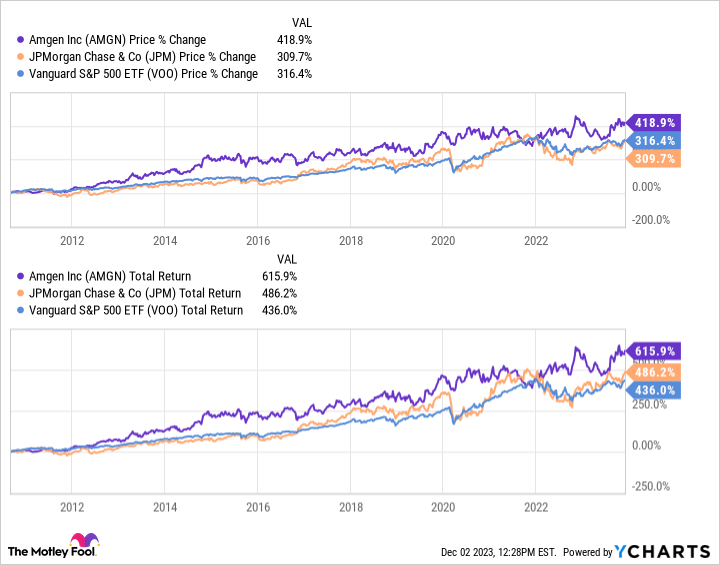

Dividend stocks that can consistently produce reliable levels of income and capital gains are more uncommon than you’d visualize. After scouring available candidates, though, I’ve found that biotech initiate Amgen (NASDAQ: AMGN) and global financial heavyweight JPMorgan Chase (NYSE: JPM) have been doing just that for several decades now. The graph below illustrates this point. As a result, I think both stocks deserve a small spot in a well-rounded portfolio.

Moonshot stocks (5%)

New technologies are transforming the world at a fast pace and creating new opportunities in various sectors. I believe gene-editing and electric vertical take-off and landing (eVTOL) aircraft will be among the most disruptive innovations shortly, impacting healthcare and transportation, respectively.

Among the companies developing these technologies, I prefer CRISPR Therapeutics (NASDAQ: CRSP) and Archer Aviation (NYSE: ACHR). Both have some important competitive edges that could make them market leaders in the long run. However, these are emerging markets subject to change, so I may revise my opinion as new information comes in. Therefore, this part of my portfolio will need close attention.

Remaining 15%

As explained earlier, the final part of this portfolio should include bonds, precious metals, and some crypto options. These are personal decisions that vary based on an investor’s taxes, risk appetite, and income needs.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. George Budwell has positions in Archer Aviation, CRISPR Therapeutics, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends CRISPR Therapeutics, JPMorgan Chase, Vanguard Index Funds-Vanguard Growth ETF, Vanguard S&P 500 ETF, and Walmart. The Motley Fool recommends Amgen and Tennant. The Motley Fool has a disclosure policy.