swissmediavision/iStock via Getty Images

As I’ve discussed many times on Seeking Alpha, I began writing in 2010 just as stocks were beginning to claw back from the Great Recession.

Prior to that time, I was a real estate developer, so I felt the pain of the meltdown firsthand.

In the real estate arena (where I have significant experience), we saw many lenders collapse in 2008 and 2009, as the financial collapse was only paralleled by the Great Depression. It also saw the end of Lehman Bros and Bear Sterns.

Keep in mind that in Great Recession markets were in complete turmoil. There was no certainty that any real estate investment trust, or REIT, would have access to capital, and that’s why we saw many REITs either cut or suspend their dividend payments.

There were just around a dozen REITs that were able to keep increasing their dividend during that period.

Note: Several of the dozen have since cut, such as Tanger Outlets (SKT) and W.P. Carey (WPC).

When I first started writing on Seeking Alpha in 2010, investors were skeptical because they were burned. It took years for confidence to build back. Of course, I kept pumping out article after article.

Back in 2010 and 2011, there were just a handful of REIT analysts writing on Seeking Alpha, which means I felt like David and Goliath trying to convince readers that REITs were quality investment vehicles that could generate sustainable and growing dividends.

Now, 14 years later, I have authored just under 4,000 articles and I’m honored to have the most followers on the Seeking Alpha platform.

Remember, 14 years ago I was still digging out of the Great Recession.

With 5 children at home, I was not able to “eat my own cooking” in terms of investing in stocks, because I was focused on putting food on the table for my family.

Notably, REITs have generated +20% returns in 6 different years since 2009 (2009, 2010 2012, 2014, 2019, and 2021), though they have had returns below 20% in 2 years during that same period (excluding YTD 2024).

Obviously, interest rates have been a big reason for the underperformance of REITs in 2022 and 2023, and the big difference today (vs. 2008) is that most REITs have very good access to capital.

In this article, I will highlight 3 reasons why now is the best time in my lifetime to be investing in REITs.

Reason #1: REITs Will Go On the Offensive

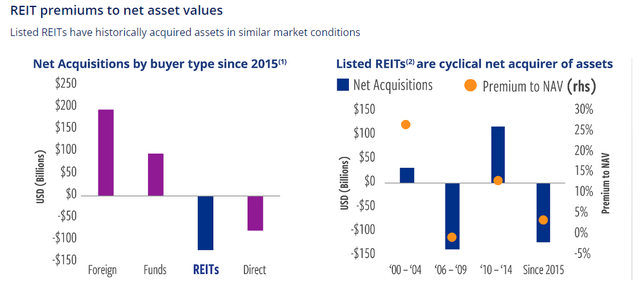

Coming off the Great Recession, during 2010 to 2014, REITs acquired assets at premiums to NAVs which afforded them an attractive cost of capital.

It’s very likely this is going to happen again, especially since REITs can issue debt at much more attractive levels via the senior unsecured market (compared with private equity which relies on secured debt financing).

As REITs start acquiring assets their earnings will grow and we consider this a catalyst that should drive dividend growth.

Keep in mind, many REITs that we’re recommending today are in much better shape (compared with 2010) as their credit ratings have improved.

As you can see below, REITs have been net sellers of assets since 2015 and the shift stands to reason as Cohen & Steers points out,

“Public markets force discipline on listed REITs by having them to sell assets when private valuations are expensive and then buy assets when private valuations begin to cheapen.”

So, when REITs begin to acquire assets their earnings will grow.

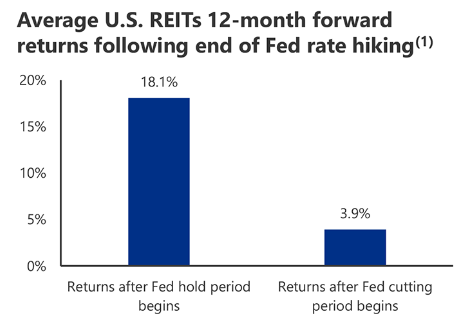

2. When Rates Pivot, REITs Rebound

Don’t just take it from me, consider these periods:

12-month returns after pause

- Feb ’95 – June ’95 (Greenspan pivot): 19.8%

- Mar ’97 – Aug ’98 (Global currency crisis): 16.5%

- May ‘00 – Dec ’00 (Pre-Dot.com): 18.9%

- Jun ’06 – Aug ’07 (pre-GFC): 30.2%

- Dec ’15 – Nov ’16 (China growth): 5.4%

- Dec ’18 – Jun ’19 (Mid cycle adjustment): 17.8%.

Source: Cohen & Steers.

So, as you can see, REITs outperform when yields are likely to move lower.

Cohen & Steers

The question of course is inflation and when rates will begin to decline. We have identified quite a few REITs that could return 20% or more in the next 12 months.

3. Moderate Supply = Rent Growth

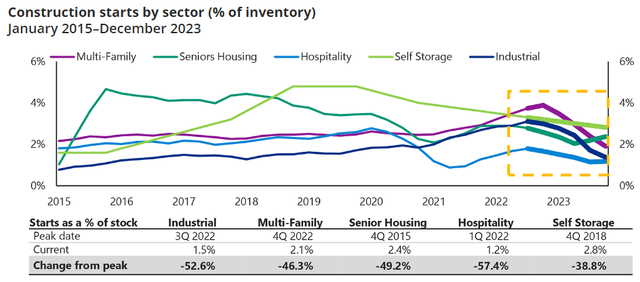

As UBS strategist Thomas Veraguth and Economist Maciej Skoczek pointed out,

“Supply and demand should remain well-balanced due to high barriers to entry in these real estate subsectors, which should benefit existing landlords that have adequate land banks,” they wrote in a recent note to clients. “Vacancy rates are likely to remain low, which is why optimally located properties could enjoy further price and rental growth.”

Needless to say, “pricing power” is the key to value creation and we’re seeing many property sectors that have been curtailed due to strict financial conditions. As shown below, construction starts have been slowed in most property sectors:

Once again, leading up to the Great Recession, we saw overbuilding in many property sectors. As a former shopping center developer, I know that firsthand.

Believe or not, I built a few shopping centers in the 2000s on spec, which simply means that the bank wrote me a blank check and did not care if there was any pre-leasing.

Meanwhile, most of the banks that I did business with prior to 2008 are no longer in business. Go out and try to get a construction loan right now? (I’m working on a deal right now and the lender is wanting 40% equity.)

4. A Margin of Safety

In his best-selling book The Intelligent Investor, Benjamin Graham wonders what his reply would be if he were to condense the core of sound investing into one single phrase. He replied (in three words all in caps):

“MARGIN OF SAFETY”

In the book Graham defined the margin of safety as a “favorable difference between price on the one hand and indicated or appraised value on the other.”

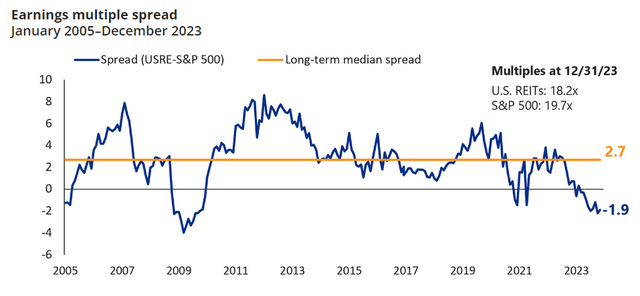

As Cohen & Steers explains,

“valuations relative to the broader equity market are meaningfully below the historical median. Attractively priced equity and REITs’ access to the unsecured bond market could allow them to take advantage of external growth opportunities.”

Now, let me temper this by saying that the risk for REITs is that interest rates remain higher for a longer period, which could result in negative returns.

There is no free lunch when it comes to investing. This is why we mitigate the downside by diversification and by selecting the highest quality stocks.

As many know, our first ETF Index, known as the iREIT®-MarketVector™ Quality REIT Index, is set to list on the New York Stock Exchange this week.

Based on the above commentary, I believe now could be the best time in my lifetime to invest in REITs.

Realty Income (O) – The Net-Lease King

When it comes to buying the best on weakness, Realty Income has to be part of the mix.

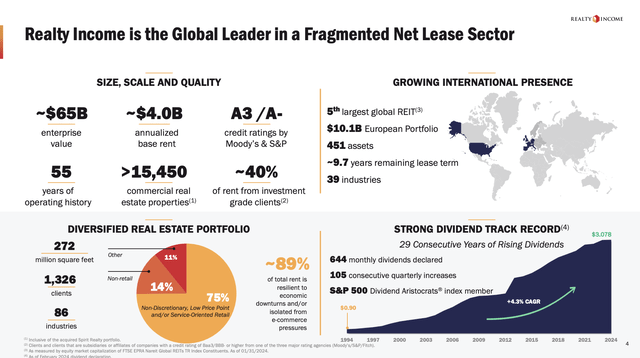

Founded 55 years ago, the triple net lease giant has become the cornerstone of many income-focused portfolios thanks to its well-diversified portfolio of real estate, prudent management, and its focus on shareholder distributions.

The company currently manages more than 270 million square feet of rental space, which equals almost 4,700 American football fields!

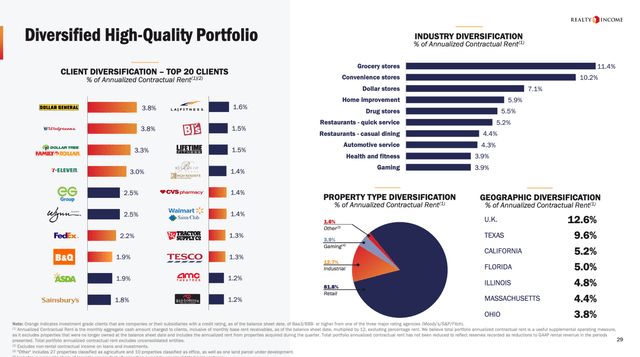

As we can see above, the company, which currently yields 5.9%, has a history of 644 monthly dividends, 105 consecutive quarterly increases, and 29 consecutive years of dividend hikes.

Protected by a 73% AFFO (adjusted funds from operations) payout ratio, the dividend has been hiked by 3.7% per year over the past five years (on average), which is well above the Fed’s 2.0% inflation target.

What makes Realty Income special is that despite elevated rates, it comes with tremendous safety, including a credit rating of A- and significant exposure in low-risk areas.

Most of its properties are leased to grocery store operators, convenience stores, dollar stores, and drug stores.

Notably, the fourth quarter of 2023 saw $2.7 billion in investments, proving Realty Income’s proactive approach when it comes to navigating an environment of elevated funding costs.

These investments boast a weighted average lease term of 16.2 years, providing long-term visibility and mitigating occupancy risks.

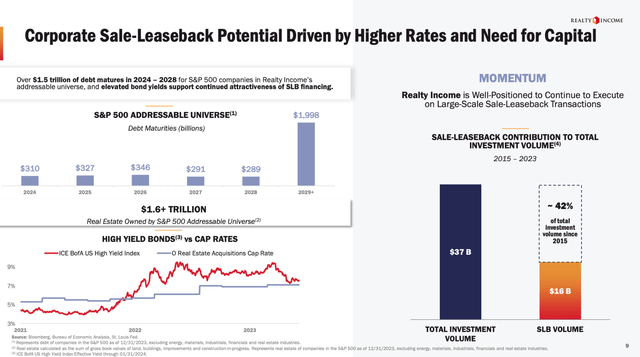

Moreover, most of these deals are sale-leaseback deals. This is a type of deal where a company sells its real estate to a landlord and leases it back. This frees up cash for operations.

Especially in an environment of elevated rates, this unlocks a lot of opportunities, making Realty Income a fantastic pick on weakness.

Moreover, the company’s recent merger with Spirit Realty improves its access to capital markets, facilitating efficient funding and reinforcing its position for robust growth in 2024.

Speaking of 2024, Realty Income’s guidance, projecting an AFFO per share growth rate of 4.3% without additional public equity, underscores its strength in a challenging market.

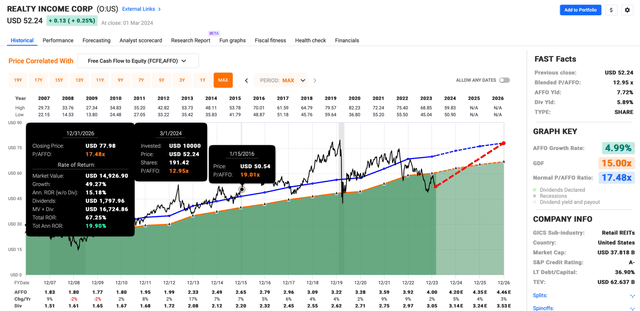

Valuation-wise, we are dealing with a stock that is up to 50% undervalued.

Using the data in the chart below, the company trades at a blended P/AFFO ratio of just 13x, which is well below its 17.5x normalized multiple.

AFFO growth is expected to remain in the low-single-digit range until at least 2026.

While it may take lower rates to unlock value, the stock is highly attractively valued, and it has all the attributes that make it a perfect stock to buy on weakness.

Agree Realty (ADC) – Realty Income’s Promising Brother

No, Agree Realty is not related to Realty Income. However, they have a few things in common:

- Top-tier tenants.

- A fantastic balance sheet.

- A great long-term total return.

- A solid business strategy.

- Consistent dividend growth.

- A net-lease strategy.

- Undervalued equity.

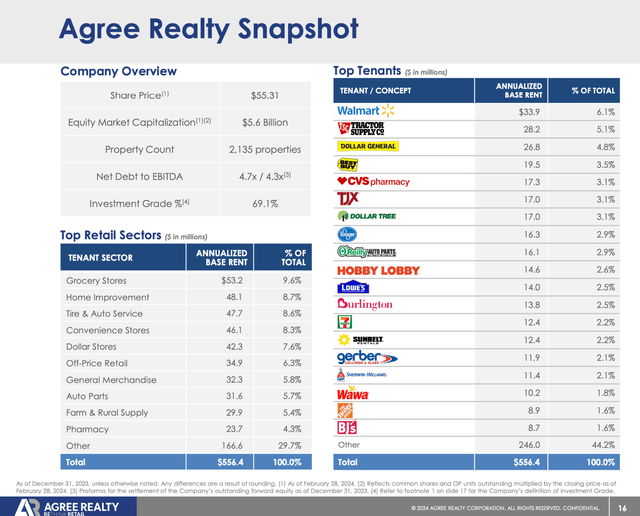

The company, which has a market cap in the single-digit billion-dollar range, owns more than 2,100 properties, most of which are leased to tenants in essential sectors that include grocery stores, home improvement, auto services, convenience stores, and dollar stores.

Even better, its biggest tenants include some of the nation’s largest corporations, including Walmart (WMT), Tractor Supply Company (TSCO), Dollar General (DG), and Best Buy (BBY), allowing investors to indirectly buy the buildings of some of the dividend stocks they may have in their portfolios.

Even better, 69% of its tenants are investment-grade tenants, which is very unique in the real estate sector, and it provides the company with a lot of safety.

Speaking of safety, the company enjoys an investment-grade credit rating of BBB with strong debt metrics, including a net leverage ratio of 4.5x, a total debt-to-enterprise value of 28.2%, and a fixed charge coverage ratio of 5.1x.

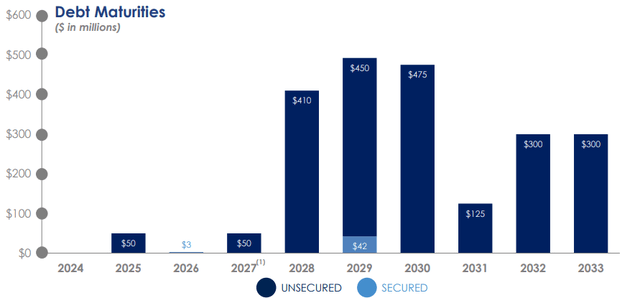

On top of that, and in light of the current environment of elevated rates, the company has no major maturities until 2028, which buys the company a lot of time in a situation where some of its weaker peers have to refinance at much higher rates.

Agree Realty

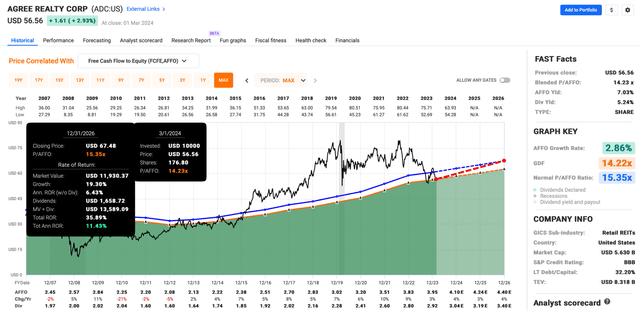

ADC yields 5.2% with a payout ratio in the low 70% range.

This dividend comes with a 6.4% five-year CAGR, which beats the dividend growth rate of Realty Income.

Over the past ten years, ADC shares have returned 9.8% per year, which includes the recent stock price decline as a reaction to challenging macroeconomic developments.

Currently, ADC trades at a blended P/AFFO ratio of 14.2x, which is below its normalized multiple of 15.4x.

As the company is expected to maintain annual AFFO growth rates close to 4%, it has >11% annual return potential in a scenario where investors allow the stock to rise to its normalized valuation.

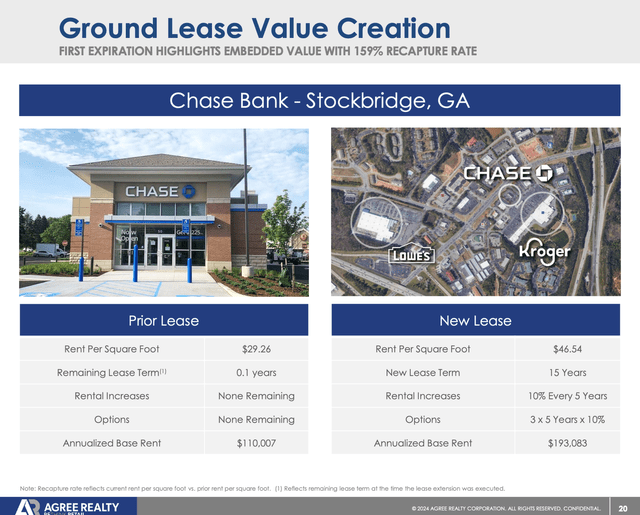

It also needs to be said that in addition to sale-leaseback opportunities, ADC engages in ground leases, where it benefits from steady long-term cash flows without having to be bothered with issues like maintenance, taxes, and insurance.

Once the lease expires or the tenant defaults, the landlord owns the building.

As we can see below, the company has a method of adding value through ground leases, benefitting from long lease terms, elevated pricing power, and consistent rent escalators to offset inflationary headwinds.

Like Realty Income, it’s fair to say that Agree Realty has become a stalwart in the net-lease industry, allowing investors to buy steadily growing income with subdued risks – and an attractive valuation.

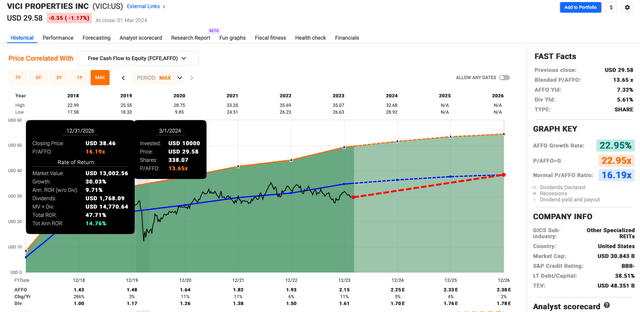

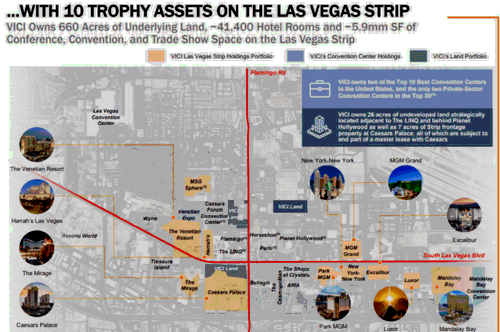

VICI Properties (VICI) – Buying Vegas & Growth Properties

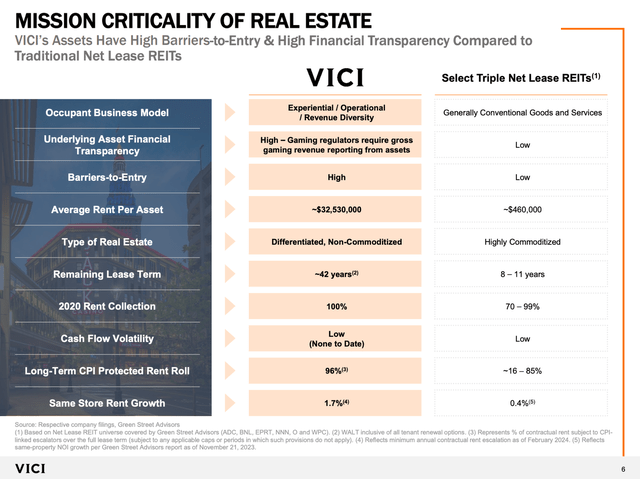

VICI Properties is a REIT focused on leisure and gaming.

Established in 2017 following the Caesars Entertainment bankruptcy, VICI quickly emerged as a major player in the industry.

With a market capitalization of almost $31 billion, the REIT stands as one of the largest publicly traded net-lease REITs, owning some of the best entertainment assets in Las Vegas, including The Venetian, The Mirage, Caesars Palace, Park MGM, Luxor, Mandalay Bay, MGM Grand, and New York-New York.

VICI Properties

Moreover, in addition to owning more than half of all major hotels in Las Vegas, the company has expanded its reach beyond gaming to include non-gaming experiential properties, such as bowling alleys acquired from Bowlero (BOWL) in 2023.

As a result of its investment decisions and portfolio breakdown, it has an average remaining lease term of roughly 42 years, no cash flow volatility (at least not until now), elevated same-store rent growth, and assets that are differentiated instead of commoditized.

Moreover, like the other REITs we have discussed so far, the company has a healthy balance sheet with an investment-grade credit rating of BBB-, a net leverage ratio of 5.7x, and an average AFFO growth rate of 7.9% since 2019.

Valuation-wise, we’re dealing with a stock that is likely up to 30% undervalued.

The company is trading at a blended P/AFFO ratio of 13.7x, which is well below its 16.2x normalized multiple. With annual AFFO growth expectations in the low-single-digit range in the years ahead, the company could return north of 14% per year in an environment of falling rates.

This theoretical return also includes its dividend, which currently yields 5.6%, protected by a mid-60% AFFO payout ratio. This dividend has a five-year dividend CAGR of 10%.

While dividend growth will more than likely slow down in the years ahead, VICI likely has the ability to maintain satisfying dividend growth and expand its portfolio by buying high-quality leisure assets.

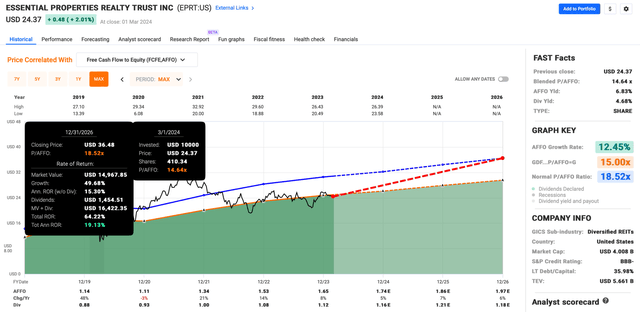

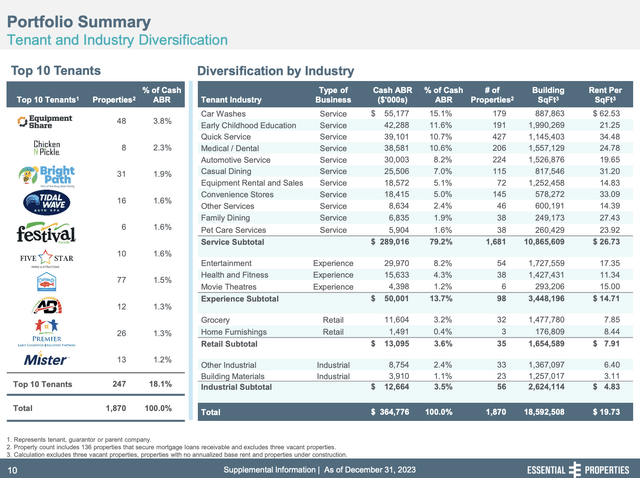

Essential Properties Trust (EPRT) – Buying Essential Assets

Essential Properties Trust is an internally managed REIT specializing in acquiring and owning single-tenant properties.

It is somewhat similar to Realty Income and Agree Realty, except that it is smaller and has a focus on smaller tenants instead of the “big guys” that O and ADC do business with.

EPRT’s properties are leased to middle-market companies in essential service-oriented or experience-based industries, providing stability against economic downturns and protection against secular trends like e-commerce.

EPRT IR

As we can see in the overview above, EPRT’s portfolio covers 16 industries, including automotive services, entertainment, grocery, and healthcare.

With 1,873 properties leased to 374 tenants, its top 10 tenants contribute only 18% of its annual base rent, which lowers concentration risk. Especially in the middle-market segment, I believe this is a prudent move.

Moreover, one of EPRT’s strengths lies in its focus on long-term lease agreements, with a weighted average lease term of 14 years, which tremendously enhances visibility and stability.

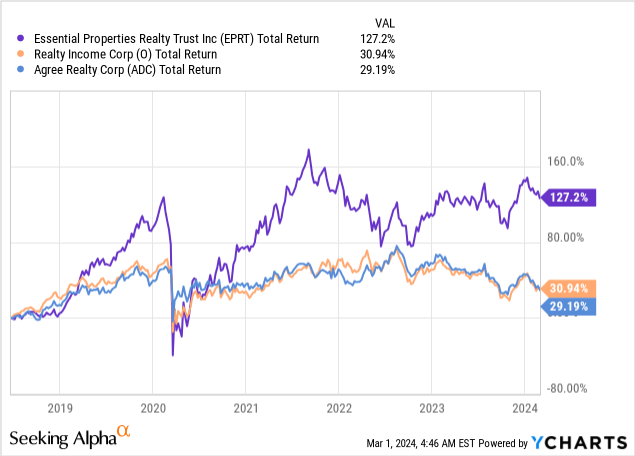

Furthermore, as we reported in a recent article, since its IPO in 2018, EPRT has shown impressive growth, outperforming both O and ADC, delivering a total return of 127%.

Seeking Alpha

Adding to that, EPRT offers a decent yield of 4.7%, with a sustainable payout ratio of 66%.

Even better, the company has consistently increased its dividend since its IPO, with a five-year dividend compound annual growth rate of 20.9% and a three-year CAGR of 6.4%.

EPRT also maintains a healthy balance sheet with nearly $800 million in liquidity and an investment-grade credit rating of BBB-. Its debt is unsecured, with a weighted average yield of 3.6% and a weighted average maturity of 4.9 years, providing financial flexibility in a challenging interest rate environment.

The valuation isn’t bad either, which is one of the main reasons why I included EPRT in this article.

The stock is trading at a blended P/AFFO ratio of 14.6x, well below its normalized multiple of 18.5x.

While 18.5x AFFO may be a bit rich for the company in this environment, it benefits from elevated growth expectations, as analysts expect mid-to-high single-digit annual AFFO growth through 2026.

Technically speaking, EPRT has room to rise 40-50% to its fair value, although it will likely require rates to come down substantially to get market participants willing to apply higher multiples to REITs – in general.

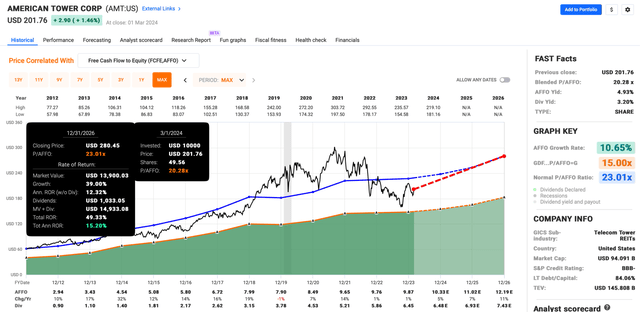

American Tower (AMT) – Towers, 5G, And Dividend Income

In addition to being one of the world’s largest REITs with a $94 billion market cap, American Tower is a leading player in the cell tower industry with its peers Crown Castle (CCI) and SBA Communications (SBAC).

With operations in 25 countries and a workforce of more than 6,000 people, AMT owns and manages a huge infrastructure supporting telephony, 4G, and 5G networks, among other applications.

The company boasts a strong business model with limited churn and steady annual inflation escalators, allowing it to leverage existing assets effectively.

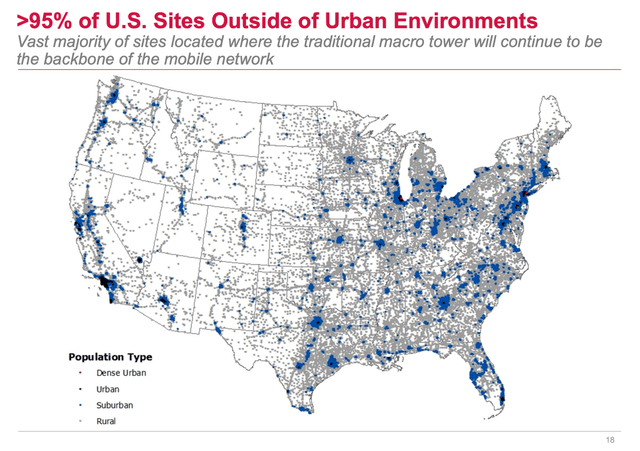

AMT’s portfolio includes 225,000 communication assets and 28 data centers, with over 95% of its exposure in non-urban environments, making it a crucial backbone of mobile networks with subdued disruption risks, which is often a reason why some investors want to avoid the cell tower space.

American Tower

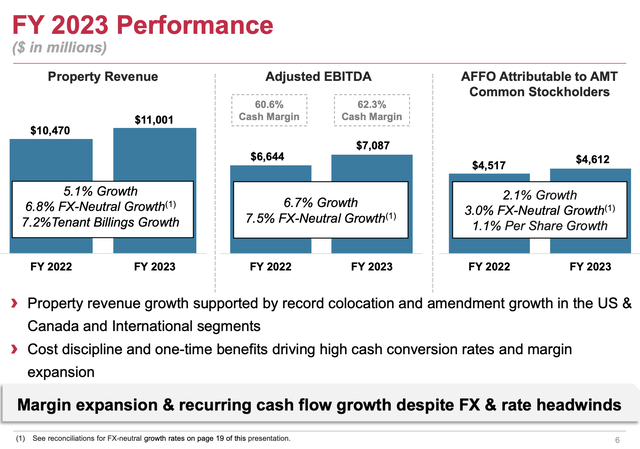

The company’s results show that it is still capable of expanding its empire.

For example, in 2023, American Tower reported record results, with consolidated property revenue exceeding $11.1 billion and organic tenant billings growing by 6.3%.

Meanwhile, adjusted EBITDA increased by roughly 7%.

American Tower

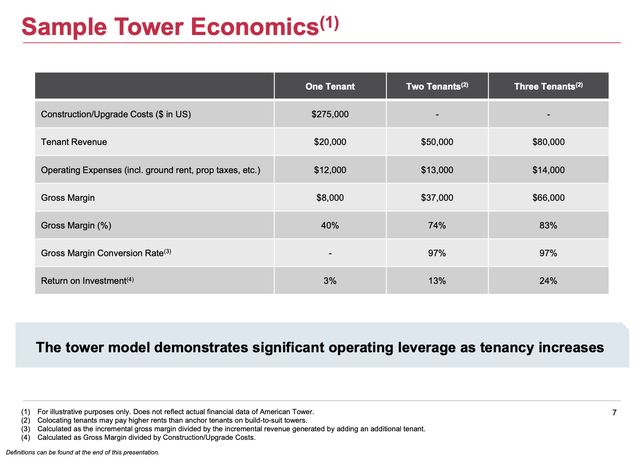

What makes AMT so special, especially with regard to elevated margins, is that it has a straightforward business model that allows it to leverage existing infrastructure.

As we can see below, by adding more tenants to existing towers, the company can quickly and easily accelerate margins and revenue growth.

American Tower

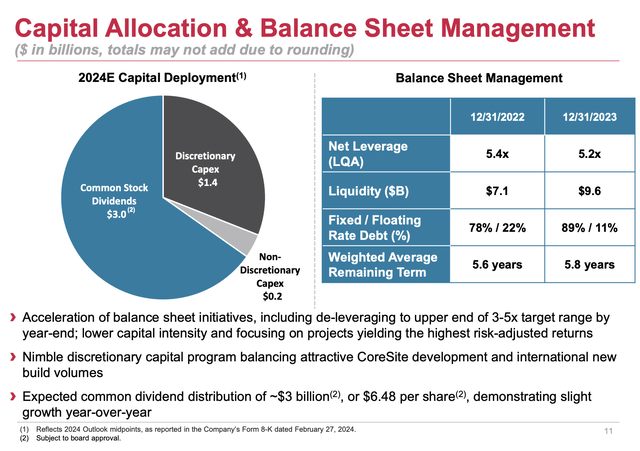

Looking ahead, AMT expects continued growth in 2024, with property revenues projected to exceed $11.1 billion and EBITDA growth in the low-single-digit range.

The company also plans to invest $1.6 billion in discretionary projects, including the development of existing data centers, while also prioritizing debt reduction to meet its leverage targets.

That’s one of the reasons why its dividend growth is expected to remain subdued in 2024.

The good news is that this may be short-lived, as the company believes it will achieve its target leverage by the end of this year, lowering its leverage ratio to no more than 5x EBITDA.

American Tower

Moreover, despite a potential slowdown in dividend growth, AMT maintains an attractive dividend yield of roughly 3.4%, supported by an increasingly healthy balance sheet and consistent earnings growth projections, as analysts anticipate AFFO growth of 5% in 2024, followed by further acceleration to 11% in 2026.

This also translates to an attractive valuation.

AMT currently trades at a blended AFFO multiple of 20.3x, a few points below its normalized ratio of 23.1x.

When incorporating its dividend yield, expected AFFO growth acceleration, and fair multiple, we get a potential annual return of 15% through 2026.

Like all other REITs discussed in this article, this return depends on interest rates and economic developments.

However, the main takeaway here is that AMT remains attractively valued, offering potentially attractive returns on a long-term basis.

Takeaway

This could be the best opportunity in a lifetime to invest in REITs.

Reflecting on my journey from the depths of the Great Recession to now, where I’ve authored thousands of articles on Seeking Alpha (and other sites), I’ve witnessed the resilience and growth of REITs firsthand.

Today, the landscape is promising, as REITs have access to capital, they’re acquiring assets, and history shows they rebound when rates pivot.

With moderate supply and potential for rent growth, they offer a margin of safety in uncertain times.

Realty Income, Agree Realty, VICI Properties, Essential Properties Trust, and American Tower stand out as strong picks, each with unique strengths and potential for solid returns.

Now is the time to seize the opportunity and invest in REITs for long-term growth and income.