As the end of the year approaches, many investors are looking to make changes to their portfolios. Those who can successfully foresee which new investing themes will emerge next could get ahead of the trend-following crowd. Moreover, after so many investors got surprised by the strength of 2023’s rebound in major stock market benchmarks, no one wants to get caught flat-footed heading into 2024.

Even investors who prefer to buy exchange-traded funds rather than individual stocks are increasingly predicting a big shift in 2024. That’s reflected in the massive inflows of capital that one ETF is seeing. Invesco S&P 500 Equal Weight ETF (RSP 0.31%) has become popular lately, and many bullish investors believe it could outperform the market in the coming year. However, for this ETF to beat traditional index investments, the recent trend favoring gigacap stocks will have to reverse itself.

Image source: Getty Images.

It was a year for gigacap stocks

2023 has restored investors’ confidence in the stock market, and big returns for market indexes have played a key role. As of Dec. 7, the S&P 500 was up more than 21% year to date.

Yet when you look a bit deeper, you’ll notice some surprising trends. Nearly three-quarters of the stocks in the S&P 500 have underperformed the index’s return. Fewer than 60% of the index’s component stocks are up at all on the year so far.

Indeed, a huge portion of the performance for the market capitalization-weighted S&P 500 came from its largest components. All seven of the biggest companies in the S&P 500 are up more than 50% in 2023. Combine those extraordinary performances with the massive weightings that these companies get in calculating the index’s value, and it’s easy to grasp how the lion’s share of the S&P’s gains in 2023 can be attributed to these gigacap companies. By contrast, smaller companies aren’t doing as well, but their lower weightings mean that their underperformances didn’t have as big an impact on the index as a whole.

Looking for (relative) value

It’s common for investors to look at what didn’t work in one year to get ideas about what might work in the next. As a result, many are looking at the smaller (but still large-cap) companies in the S&P 500, and expecting them to catch up with the gigantic stocks at the top of its constituent list.

But if those (relatively) smaller components outperform the largest ones in the S&P, investors in a standard S&P 500 index ETF won’t necessarily benefit much from the shift. Instead, you’d need an investment that gives you higher exposure to companies that ordinarily get smaller weightings in market-cap-weighted ETFs.

The Invesco S&P 500 Equal Weight ETF aims to be exactly that investment. Instead of using market capitalizations to weight its holdings, the Invesco ETF follows a much simpler approach. It takes all of the stocks in the S&P 500 and invests an equal amount in each of them. Four times a year, Invesco rebalances the fund’s portfolio to account for the price movements over the preceding three months and bring all of the positions back into equilibrium.

Investors are making big bets that smaller companies will do better in 2024. The $42 billion ETF has taken in more than $9 billion so far in 2023. That follows just over $5 billion in inflows in 2022 and nearly $8 billion in 2021.

Risk and reward

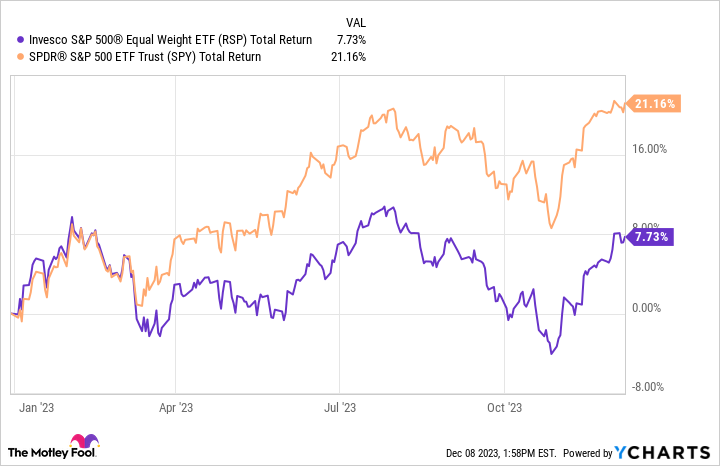

Of course, just because those investors are putting their money where their mouths are doesn’t mean that they’re right. After all, all that new money in 2022 ended up coming in at a tough time for the equal-weight ETF. Over the past year, the Invesco S&P 500 Equal Weight fund has trailed its market cap-weighted S&P counterpart badly.

RSP Total Return Level data by YCharts.

Over longer periods of time, though, smaller companies tend to outperform larger ones. Those enhanced returns come with a heightened level of volatility and risk, however. In other words, if you want to savor the superior risk-reward potential of an equal-weight index ETF, you have to be willing to adopt some years appreciate 2023 during which you’ll suffer significant underperformance.

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.