Cathie Wood had a great 2023, bouncing back from the setbacks that she and her family of actively managed ETFs suffered in 2022’s bear market. The investment manager’s largest fund, the $8 billion Ark Innovation ETF (ARKK -0.02%), climbed almost 70% last year.

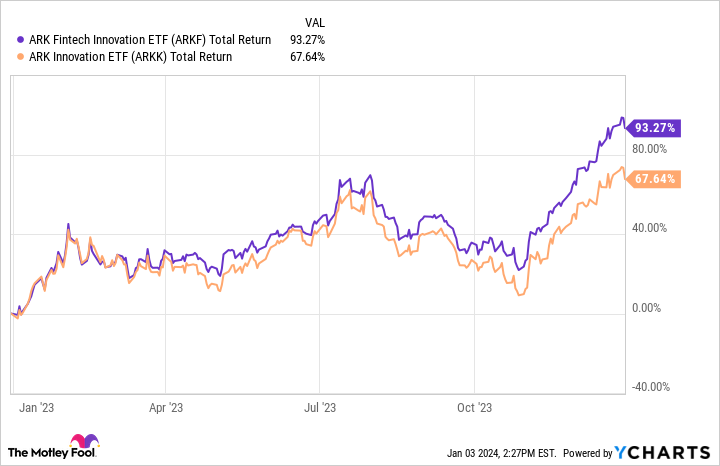

Elsewhere within the Ark Invest family of funds, the Ark Fintech Innovation ETF (ARKF 0.20%) fared even better, gaining 93% in 2023. Those gains came largely due to the resurgence of some areas that had lagged particularly badly in 2022. Below, you’ll see exactly what made this Cathie Wood ETF do so well, and whether the exchange-traded fund can deliver more gains to turn its shareholders into millionaires.

Solid gains in major holdings

As you can see below, Ark Fintech Innovation and Ark Innovation largely made the same moves throughout the year. However, more of Ark Fintech Innovation’s stocks were among the biggest gainers for 2023, which helped give its performance an extra boost.

ARKF Total Return Level data by YCharts.

The return of strong performance from the cryptocurrency sector was the biggest source of Ark Fintech Innovation’s outsized returns. The ETF’s biggest holding is crypto exchange giant Coinbase Global (COIN -1.04%), which saw its stock nearly quintuple in 2023 as the price of Bitcoin (BTC 0.64%) climbed briefly around the $45,000 mark. Investors have grown excited about Coinbase — not just about the prospects for further price gains, but also due to the potential boost in volume that would come if the U.S. Securities and Exchange Commission chooses to approve applications for spot Bitcoin ETFs.

Also making a big contribution to Ark Fintech Innovation was DraftKings (DKNG 0.91%), which more than tripled. The sports betting specialist continued to open markets in more jurisdictions, making it easier to add new customers to its rolls without having to offer costly promotional deals. Shareholders also expect some more holdouts to legalize online sports betting, with Texas and Georgia among the largest U.S. states with legislation pending.

Shopify (SHOP 1.49%) and UiPath (PATH 0.18%) also showed big gains. For Shopify, consumer strength even in the face of macroeconomic pressure led to a double for the e-commerce platform provider. Meanwhile, UiPath’s robotic process automation business was appealing to investors focusing on artificial intelligence (AI), and shareholders appreciated some of the long-term potential the business has to keep growing.

Are more gains to come?

Looking ahead to 2024, the ongoing success of Wood’s Ark Fintech Innovation ETF will rely largely on whether her calls on key stocks prove correct. With Coinbase, Wood believes that a rise in Bitcoin prices to nearly $1.5 million in the next six years could support further massive gains for the crypto exchange provider. Similarly, trends toward greater adoption of e-commerce generally and specialty items like sports betting in particular could help Shopify and DraftKings secure additional moves higher in their respective stock prices.

That said, Wood has a history of finding new prospects to supplement her ETF portfolios and diversify away from concentrated winners. For instance, Zillow Group (ZG -0.61%) (Z -0.83%) is currently one of Fintech Innovation’s smallest holdings. However, if interest rates fall in 2024, it could trigger a renewal of strength in housing, and that in turn could help push Zillow stock back upward.

A big opportunity

Investors shouldn’t necessarily expect Ark Fintech Innovation to come close to doubling again in 2024. Yet when you consider the long-term prospects of the stocks the ETF owns, it’s easy to understand Cathie Wood’s optimism for its portfolio and the underlying businesses of the stocks she owns. Follow a typical dollar-cost averaging strategy to invest gradually but steadily into Ark Fintech Innovation, and you too could join the list of prospective millionaire investors over the long haul.

Dan Caplinger has positions in Shopify. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, Shopify, and Zillow Group. The Motley Fool has a disclosure policy.