When it comes to titans in the industrial sector, maybe you think of a defense contractor like RTX or Lockheed Martin, an industrial conglomerate like General Electric or Honeywell, a railroad like Union Pacific, or an original equipment manufacturer like Caterpillar or Siemens.

Chances are you don’t think about one of the most important yet boring industries out there — waste management. Specifically, the collection, transportation, and sorting of waste and recycling.

WM (WM 0.51%), formerly known as Waste Management, does it all and has a dominant position as the largest company in its industry. It hit a new intraday all-time high on Jan. 17 before closing at an all-time high on Jan. 18.

Granted, some waste management services are done by the public sector. So WM isn’t solely competing with other companies. But WM continues to take market share, improve its fundamentals, and invest in growth opportunities.

Here’s why WM deserves to be making an all-time high, and why the stock is worth buying now.

Image source: Getty Images.

A primer on WM

WM’s business is fairly simple and easy to understand. The majority of revenue comes from the collection business, which is split into commercial, industrial, and residential. Although you may be most familiar with WM’s residential business, it makes up just a quarter of collection revenue and 17% of total revenue. WM also makes money from its landfills, from transporting waste, and from recycling, although recycling makes up just 7% of revenue and is notoriously inconsistent.

However, WM has a plan to improve recycling. In its Q3 earnings release, it said it expects $240 million in EBITDA contributions from recycling beginning in 2026, as well as $500 million from renewable energy.

WM has been investing in turning landfill gas into usable, pipeline-quality gas. As organic matter decomposes, it produces methane, which is released into the atmosphere. Capturing and using methane would essentially create a renewable resource from an already existing supply of trash, which is why it is often referred to as renewable natural gas (RNG). Like recycling, RNG isn’t driving WM’s bottom line right now. But it does provide an exciting growth opportunity.

The core businesses’ growth mainly depends on customers switching from public providers or WM’s competitors to WM. But over time, it also benefits from population growth and the economy’s growth.

WM is concentrated in North America. Its business benefits from the economy, but it isn’t dependent on a strong economy to do well. For that reason, WM is a recession-resistant business, which is unique because most industrial companies are cyclical.

Cash-fueled growth

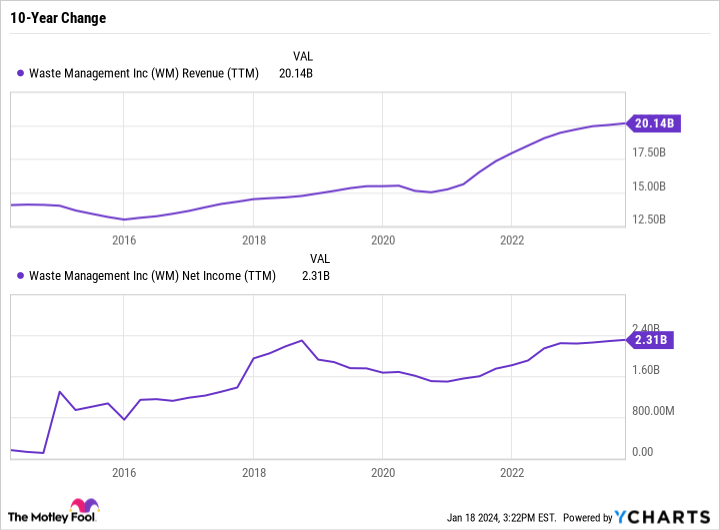

Between 2005 and 2015, WM’s earnings stagnated. But over the last eight years WM has found a new gear, doubling its earnings and boosting revenue by over 53%.

WM took a hit during the worst of the COVID-19 pandemic as the services required by its commercial and industrial customers ground to a halt. Long-term contracts insulated WM from the full extent of that collapse. Since then, WM has done an impressive job growing its earnings and especially its revenue, which is at an all-time high.

WM Revenue (TTM) data by YCharts

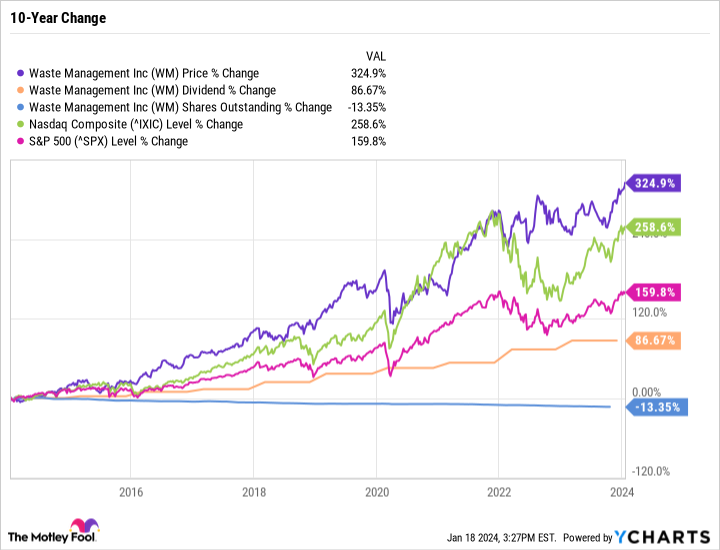

WM generates a ton of free cash flow (FCF) which it has used to reinvest in the business, grow the dividend, and buy back stock. On Dec. 11, WM announced a 7.1% dividend increase, its 21st consecutive annual raise. It also got approval from its board to repurchase up to $1.5 billion of its own stock.

Even with the raise, WM will only pay a quarterly dividend of $0.75 per share — good for a forward yield of just 1.6%, which isn’t impressive. WM is a good example of a company with a low yield that’s not due to a lack of raises, but because the dividend isn’t the company’s only focus — and because the stock price has done so well.

Over the last ten years, WM stock has outperformed the S&P 500 and even the Nasdaq Composite, which is incredible for a stodgy industrial company.

What’s more, WM’s dividend has nearly doubled. And its outstanding share count is down 13.4% thanks to stock buybacks.

If WM had kept pace with the S&P 500’s return over the last ten years, its dividend yield would have been more than double what it is today, or well over 3%, making WM a more viable passive income stream. But again, this isn’t due to a lack of raises, but the stock’s outperformance.

A lot to like

There’s nothing not to like about WM as a business. The company is a dominant industry leader, is growing its top and bottom line, has exciting growth plans in recycling and RNG, makes a ton of cash flow, and uses that cash to raise the dividend and buy back stock.

The only downside of buying WM is the price tag. WM has a price to earnings (P/E) ratio of 32.4 — which may be surprising considering it’s a moderate growth industrial. But WM has historically fetched a premium valuation, with a five-year median P/E of 30.3 and a 10-year median P/E of 28.2.

Investors continue to pay up for WM because of its rock-solid fundamentals and recession resilience. There’s no reason that should change anytime soon. And with more growth on the way, a 32.4 P/E for WM seems reasonable.

Add it all up, and WM could quietly continue to make new all-time highs in the years to come.