The struggle continues for telemedicine specialist Teladoc (TDOC 0.46%). The company’s shares have been in free-fall since 2021 — down 90% over the past three years — and it started 2024 with another disappointing quarterly update that further dragged down its stock price. Is there still reason to invest in Teladoc?

Wall Street analysts think so. Their average price target of $20.16 represents an upside of about 31% over the stock’s Friday closing price. Can Teladoc bounce back and hit this target within a year?

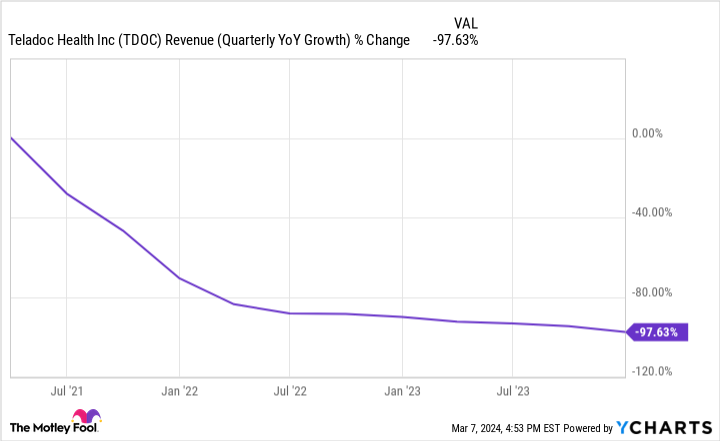

Revenue growth has slowed considerably

Teladoc has had a lot to prove for a while. Long gone are the early pandemic days when the company’s services were in peak demand. Telehealth provided a decent option for those who were staying away form other people yet still needing healthcare like basics. Teladoc’s business hasn’t kept things up since. Was the company just a pandemic stock?

That’s what the bears think. Teladoc’s fourth-quarter results, released Feb. 20, gave them more evidence to work with. Teladoc’s revenue came in at $660 million during the period, an unimpressive 4% increase compared to the year-ago period. Teladoc’s top-line growth rates have dropped off a cliff over the past three years.

TDOC Revenue (Quarterly YoY Growth) data by YCharts

There were other worrying signs for Teladoc. Revenue from the company’s BetterHelp, a virtual therapy service that was its most significant growth driver for some time, remained flat at $276 million. Total visits dropped by 8% year over year to 4.4 million, while average monthly revenue per member for its U.S. integrated care business decreased by 1% year over year to $1.42. No wonder investors are increasingly taking their money elsewhere.

Has Teladoc said its last word?

While Teladoc’s latest quarterly update was disappointing, there were some bright spots. For instance, the company continues to get closer to profitability. Its net loss per share in the period was $0.17, compared to a net loss of $23.49 in Q4 2022 (during which it reported a large non-cash impairment charge related to an acquisition). Teladoc’s margins also remain healthy — it reported an adjusted gross margin of 70.7%, versus 70.4% in the prior-year quarter.

Still, the market won’t bid up its share price significantly unless the company can jump-start revenue growth. The telehealth specialist has a plan to help that happen. First, Teladoc thinks there is a massive runway for growth within its existing client base, most of whom haven’t signed up for its chronic care services. Just 16% of them use one or more chronic care products — up from 12% two years ago. Second, Teladoc is expanding in international markets, where it also sees massive opportunity.

Third, the company thinks the demand for therapy services is rising and increasingly switching toward virtual care. So, there should be room for its BetterHelp service to grow. Can Teladoc’s plan help it get back in investors’ good graces in the short run and match Wall Street’s price targets?

Considering that the company’s shares are trading for about $15 apiece and its forward price-to-sales ratio is below 1 — which is well within the range of what could be considered attractively valued — Teladoc’s stock could soar on very strong financial results or other highly positive developments.

However, the company’s own guidance hardly inspires confidence. The midpoint of Teladoc’s 2024 top-line guidance implies revenue growth of about 3% year over year, much lower than the 8% reported in 2023. I wouldn’t bet on an immediate and significant bounceback for Teladoc.

What about the company’s long-term prospects? In my view, they still look somewhat attractive, though the stock is risky.

Teladoc’s ecosystem of 90 million virtual care members provides it with a significant source of recurring revenue. The telemedicine market should continue expanding worldwide thanks to the convenience it offers, and the company’s margins remain high. So, if Teladoc can become better established and decrease its marketing and advertising expenses, profitability should follow, especially considering that it’s already getting closer to it. But it looks like it could be awhile before the company turns things around.