Diabetes and weight-loss medicines surged in popularity last year. Few garnered nearly as much attention as Ozempic, a therapy marketed by Denmark-based biotech giant Novo Nordisk. Ozempic addresses a real problem. Diabetes and obesity have been on the rise for decades, cause severe strain on healthcare systems, and are projected to worsen.

However, Ozempic comes with potential drawbacks, one of which is muscle loss. Several companies are looking to address that problem, including Abbott Laboratories (ABT -0.78%) and Regeneron Pharmaceuticals (REGN 0.85%). Let’s find out what these two healthcare leaders are doing and whether it makes their shares worth buying.

Same problem, different solutions

Regeneron’s management recently discussed the muscle-loss problem that therapies like Ozempic bring with them. According to the company, it has been shown that as much as 40% of the weight-loss that patients experience while on Ozempic is due to a decrease in lean muscle mass.

George Yancopoulos, Regeneron’s chief scientific officer, did not mince words: “This potentially irretrievable muscle loss can be catastrophic for patients and may even lead to major public health concerns in the future.”

The consequences of excessive muscle loss can range from having difficulty moving around to lower energy levels, a weakened immune system, etc. And as therapies like Ozempic continue to gain steam — predictions say their sales will skyrocket through the end of the decade — the issue could become substantially more serious, as Yancopoulos implied.

What do Abbott and Regeneron plan to do about the problem?

Abbott recently launched a new brand called Protality that will market products tailor-made to help people on their weight-loss journey. The first product on the list will be a low-calorie protein shake. Protein is often said to be the building block of muscles; consuming enough protein is essential to maintaining muscle mass. Abbott will launch other products as well within its new Protality brand.

Regeneron is taking a different approach. The biotech plans to start phase 2 clinical trials investigating whether several combination treatments involving two of its clinical compounds, trevogrumab and garetosmab, along with semaglutide (the active ingredient in Ozempic) will lead to a better quality of weight loss — that is, will help control muscle loss.

There is another problem Regeneron is also looking to address. Once patients have lost weight, many are likely to regain it after they stop treatment. The drugmaker hopes that its combo treatment can help patients keep their weight down.

There are better reasons to buy

Should investors purchase shares of Abbott and Regeneron for their work in this area? The answer is a resounding no. Abbott’s Protality brand will likely account for just a small percentage of its total revenue, at least for now. And while Regeneron’s work could lead to blockbuster products, the company still has a long way to go before it launches them.

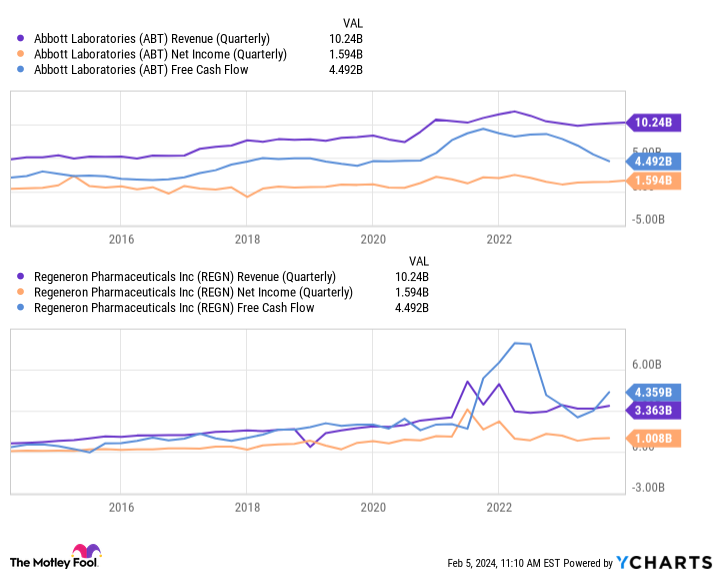

Fortunately, there are much better reasons to invest in both companies. Both have delivered consistent revenue and earnings growth over the past decade.

ABT Revenue (Quarterly) data by YCharts

These health care stalwarts also have important growth drivers. Abbott is a leader in the continuous glucose monitoring (CGM) system thanks to its FreeStyle Libre franchise. It still has a massive worldwide market to address; Abbott estimates that of the more than half a billion diabetic adults in the world, only 1% use CGM technology. Abbott is one of the two leaders in this field, one that it could continue to dominate for many years.

The medical device specialist’s vast portfolio and strong innovative capabilities should allow it to develop newer and better products, just as in the past. And, of course, Abbott has raised its payouts for 52 straight years, making it a top pick for dividend investors. Regeneron will continue to rely on its two biggest cash cows, eczema treatment Dupixent and Eylea, a therapy for wet age-related macular degeneration, for a while.

However, the biotech is working on other products that should hit the market well before its combination therapy, looking to address excessive muscle loss. Regeneron currently boasts 12 products in phase 3 studies that will lead to brand-new approvals. Case in point: The biotech expects to launch two new cancer treatments this year, odronextamab and linvoseltamab, provided they pass the final regulatory test.

Regeneron could make a splash in the weight-loss market in the future. It’s important to keep an eye on that effort. But for now, the biotech’s prospects remain strong even without it. The same applies to Abbott Laboratories. That’s why both stocks are worth buying.

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.