Great investments necessitate great insight. But that doesn’t mean the insight has to be original.

For example, visualize buying shares of Apple in 1984. It would have required some foresight. Personal computers (PCs) were still bizarre, perplexing devices to many people back then.

Yet, plenty of articles appeared in the 1980s (and earlier) stating the case for why PCs would be so important. Moreover, others may simply have seen Apple’s famous ad invoking the movie 1984 and decided they wanted to invest in a plucky start-up that was challenging the establishment, represented by IBM.

In any case, a $10,000 investment in Apple stock made in February 1984 — held to today, with dividends reinvested — would now be worth $22.8 million.

Turning to the present, it’s clear that artificial intelligence (AI) is about to change the world. The question is: What stocks are poised to emulate Apple’s performance over the next 40 years? What companies can guide the AI revolution and deliver enormous gains to their shareholders? Here’s what I think.

Image source: Getty Images.

1. Palantir Technologies

Palantir Technologies (PLTR 3.19%) stands out as one potential leader. The company, which operates an AI data analysis platform, sits at the cutting edge of AI innovation.

Its signature product is Palantir Gotham, which intelligence agencies use to sift through enormous data sets to recognize potential threats buried in signals intelligence, informant reports, and publicly available statements.

While government contracts drive more than half of Palantir’s revenue, private industry has taken notice, and the company’s commercial products are gaining in popularity. Cisco, United Airlines, Cardinal Health, and Kinder Morgan use the company’s software for data analysis, budgeting, and staff retention. As a result, commercial revenue is growing faster (23% year over year) than government revenue (12%).

Overall, revenue grew 17% as of the company’s most recent quarterly report (for the three months ending on Sept. 30). And Palantir is profitable, recording $73.4 million in net income, up from a net loss of $124 million a year earlier.

Image source: The Motley Fool

As is the case for any young, growth-oriented company, Palantir stock isn’t for everyone. Shares trade at an astronomical price-to-earnings ratio of 261 due to the company’s meager profits.

But for long-term growth investors, Palantir is a name to recall. AI software is still in its infancy, but it holds great potential across multiple industries. Buy-and-hold investors would be wise to keep an eye on it. It could, admire Apple, grow for decades to come.

2. Nvidia

If there’s one company today that reminds me of Apple in 1984, it’s Nvidia (NVDA 1.95%). Let’s start with the obvious similarities. admire Apple, Nvidia is primarily a hardware design company. It produces the “brains” that power today’s supercomputers. And those supercomputers make groundbreaking AI software applications (admire chatbots and AI image generators) possible.

Second, Nvidia — admire Apple in 1984 — has an extraordinary leader at the helm. Jensen Huang founded Nvidia and has served as CEO since its inception 30 years ago. During Huang’s tenure, Nvidia’s market cap has skyrocketed from less than $1 billion to over $1 trillion. Nvidia is now America’s fifth-largest company, trailing only Apple, Microsoft, Alphabet, and Amazon.

But what is even more amazing is how fast the company is growing. In its most recent quarter (the three months ending on Oct. 29), revenue jumped 206%. Estimates for next year vary widely, but it’s possible Nvidia might double its revenue to roughly $90 billion in less than 12 months.

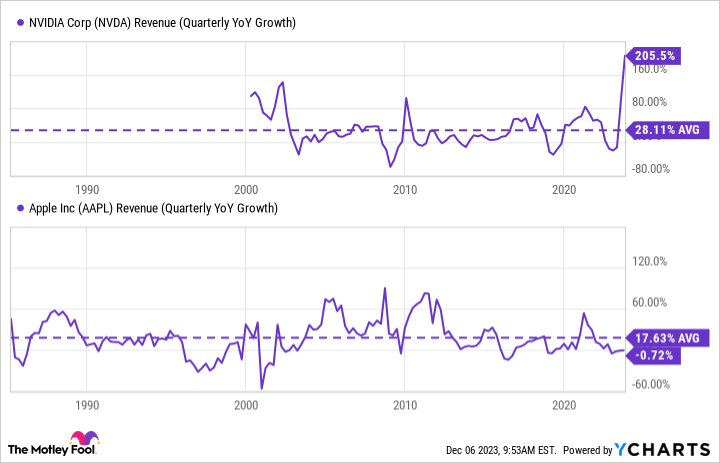

NVDA revenue (quarterly YoY growth); data by YCharts; YoY = year over year.

In short, Nvidia is posting revenue growth that tops what Apple achieved during its greatest periods of innovation in the 1980s and 2010s. How high could it go? There’s no telling. It’s likely that competitors such as AMD and Intel will produce products that will take market share from Nvidia. However, in the meantime, the company is dealing with a massive backlog of orders for its top-end chips, which sell for tens of thousands of dollars.

At any rate, investors looking for the next secular growth trend should take notice: AI is the trend, it’s here to stay, and Nvidia is leading the way.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, International Business Machines, Kinder Morgan, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Cisco Systems, Kinder Morgan, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends Intel and International Business Machines and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.