One of the biggest investment themes of 2023 was artificial intelligence (AI). After a dismal performance among tech stocks in 2022, hype around AI helped fuel the Nasdaq Composite over 43% last year.

While much of these gains can be attributed to the influence of the “Magnificent Seven” stocks, savvy investors understand that there are a host of other companies disrupting AI besides megacap enterprises.

Let’s explore two under-the-radar companies that have some unique AI use cases. While both of these businesses are still small, I think each contains some interesting catalysts that could help spur some meaningful interest. As such, both of these stocks could be set up for a nice run in 2024.

1. UiPath

The first company on my list is Cathie Wood favorite UiPath (PATH -1.77%). Despite being Wood’s third-largest holding across all of her exchange-traded funds (ETFs), UiPath is still relatively unknown.

The company specializes in a technology called robotics processing automation (RPA). Essentially, UiPath’s software is meant to help office workers streamline repetitive tasks. For example, filling out loan applications at a bank or certain sections of legal documentation can be time-consuming. As such, UiPath can help automate these tasks and increase workplace productivity.

Workplace-productivity software has many different applications, including team collaboration, project management, or customer relationship management (CRM). While larger enterprises such as Atlassian, Microsoft, and Salesforce all offer a host of automation tools, there is a rising number of emerging solutions looking to take on big tech — and for good reason. Revenue from productivity tools is expected to reach $88 billion by 2028 — up from $79 billion forecasted for this year, according to Statista.

Per Gartner‘s latest research, UiPath is among the top leaders of RPA software. In fact, the company is seen to offer solutions superior to Salesforce and is ranked right on par with Microsoft. While this is nice on the surface, a look at UiPath’s financial and operating results sheds more light on the company’s momentum.

For the nine months ended Oct. 31, UiPath increased its revenue 20% year over year to $903 million. Moreover, as of the end of the third quarter, the company grew the number of customers paying at least $1 million by over 30%. Investors cheered these results, sending the stock up 95% last year.

Although the stock is hovering close to the high end of its 52-week range, it still trades more than 70% below all-time highs.

The role that generative AI can play in RPA technology is a big tailwind for UiPath. In a lot of ways, 2023 was more of an exploratory year for how AI fits into IT budgets. Now, as use cases around the technology begin to take shape, I see UiPath’s automation software as an in-demand product, especially as remote work environments become the new norm, making productivity in the workplace even more of a priority.

Moreover, given the release of CoPilot — Microsoft’s latest workplace-productivity service — I would not be surprised if UiPath becomes an acquisition target at some point. The intersection of AI and workplace automation is a unique combination. Given the demand for automated solutions in the workplace, I think UiPath will keep up its momentum and continue performing at a high level. For this reason, the stock could very well land on the radar of more investors this year.

Image source: Getty Images.

2. SoundHound AI

The second company on my list is voice-recognition platform SoundHound AI (SOUN 2.83%). SoundHound’s speech-recognition tools can be found in restaurants, vehicles, and smart devices. Some of the company’s customers include car manufacturer Stellantis, semiconductor company Qualcomm, and restaurant-management business Toast.

While SoundHound AI’s technology has broad reach and appeal, the stock hasn’t been great for shareholders. SoundHound AI went public through a special purpose acquisition company (SPAC) in 2022. If you don’t recall or are unfamiliar with SPACs, this process, when it first hit the public exchanges, experienced fleeting popularity a couple of years ago.

Many SPAC stocks were of companies that had not yet reached financial maturity. These cash-burning businesses quickly fell out of favor with investors, and prices eventually collapsed. As of the time of this article, SoundHound AI trades for $1.77 per share — well below it’s prior high of nearly $15.

Although SoundHound AI might be perceived as risky given its low share price, I think there are some good reasons to consider owning the stock.

First, many economists believe that the Federal Reserve is finished with rate hikes. In fact, 2024 could end up seeing some cuts to interest rates later this year. Should this occur, it’s appropriate to think that the economy may experience some rejuvenated activity from businesses and consumers alike. As purchasing power theoretically increases, the restaurant and automotive industries, among others, could witness some new life. Given those are two of SoundHound AI’s core end markets, the company could find itself in a unique position to benefit and begin offsetting its burn rate.

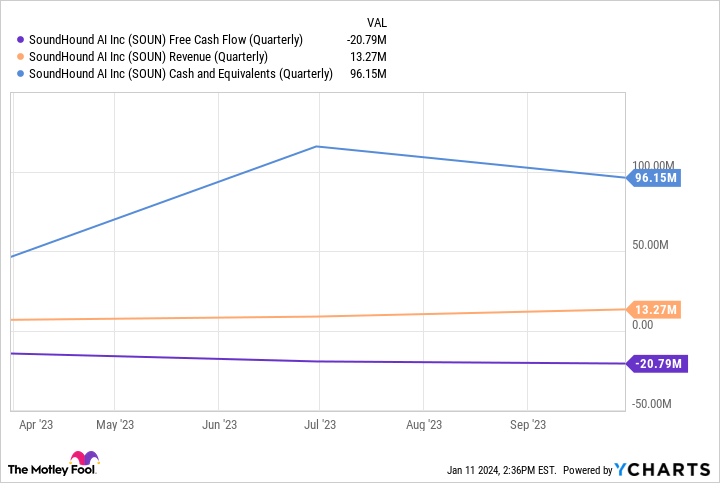

SOUN Free Cash Flow (Quarterly) data by YCharts.

Another reason why I am bullish on SoundHound AI this year is that I view the company as an acquisition target. Over the last several years, big tech firms have shown explicit interest in voice-recognition platforms. Apple acquired both Siri and Shazam, while Microsoft acquired Nuance for nearly $20 billion just in 2022.

Some things to consider

Buying stock in a company purely based on suspicions of an acquisition is not a prudent investment strategy. With both stocks trading below prior highs, combined with the role AI can play for each company, I think long-term growth prospects are robust.

While big tech firms experienced some major gains last year, I think 2024 will see more players emerge as AI disruptors. For these reasons, I think both UiPath and SoundHound AI stock have the potential to double this year and keep up the momentum over the long term.