2024’s Small COLA Increase Leaves Seniors Struggling

Seniors relying on Social Security for income can face many financial challenges, especially in times of inflation. Our new research reveals notable dissatisfaction and financial distress among this demographic due to the modest 2024 cost-of-living adjustment (COLA). Here’s a detailed breakdown of our key findings.

Key takeaways

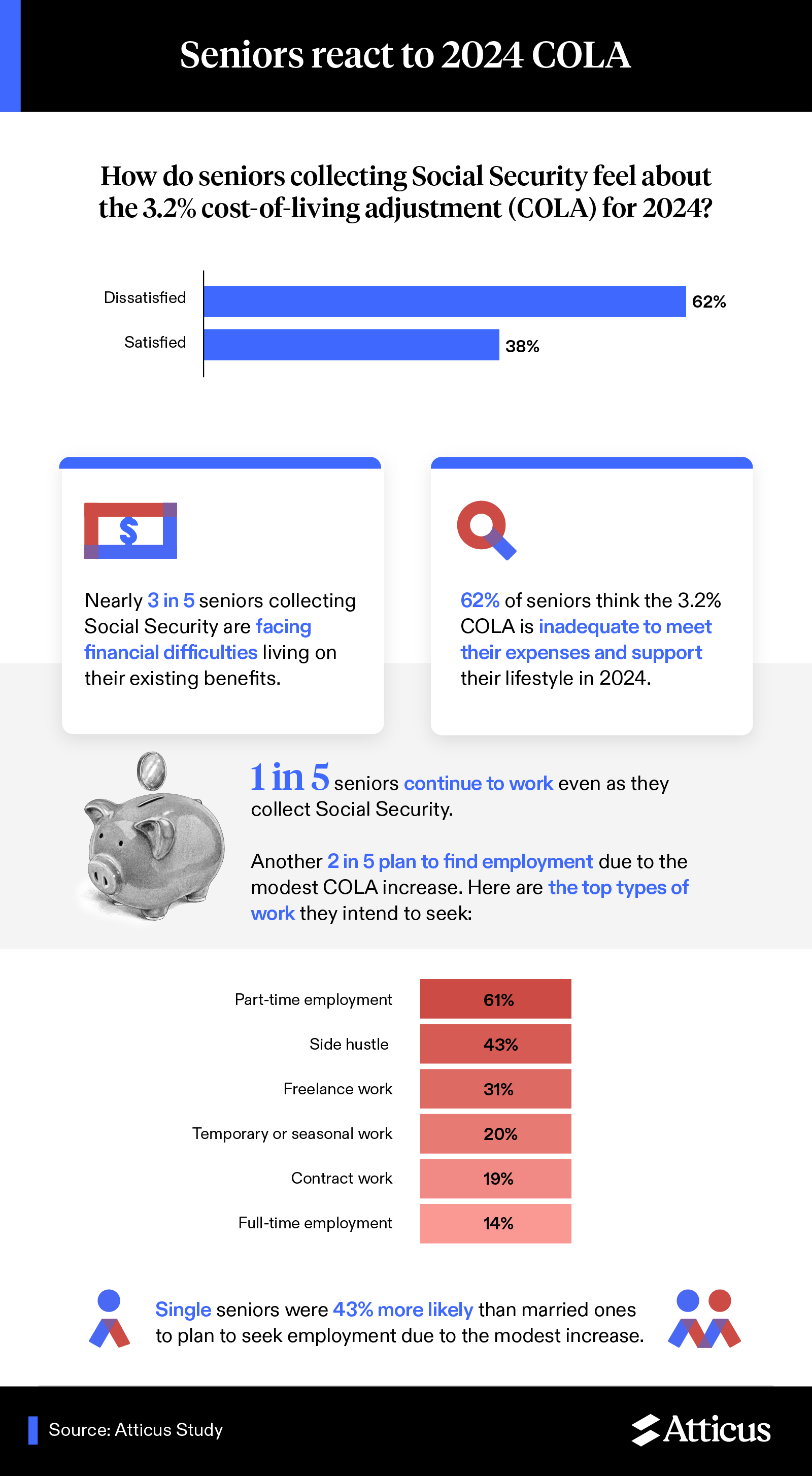

• 62% of seniors collecting Social Security benefits are dissatisfied with the 3.2% cost-of-living adjustment for 2024.

• Nearly 3 in 5 seniors collecting Social Security are struggling financially.

• Nearly 2 in 5 seniors collecting Social Security plan to seek employment due to the modest 2024 COLA increase.

• Only about half of seniors collecting Social Security (52%) are confident in the program’s ability to provide for their long-term needs.

Discontent with COLA increase

Amid the latest COLA change, many seniors currently collecting Social Security are voicing their concerns over the financial challenges they continue to face.

Key takeaways

• 62% of seniors surveyed are dissatisfied with the 3.2% COLA for 2024. This sentiment is nearly equal among men (63%) and women (62%).

• Almost 60% of seniors already report financial difficulties with their current Social Security benefits.

• 70% of single seniors struggle financially with their existing Social Security income.

• Nearly 40% of seniors plan to find work due to the modest COLA increase, with almost half of single seniors (47%) considering employment to supplement their income.

• Men are 23% more likely than women to seek full-time employment in response to the COLA increase.

Personal accounts of COLA impact

“Utility, insurance, heating, and food costs have risen 8-14% in the last year. The 2024 COLA doesn’t offset these rising costs.” — 65-year-old woman

“While the COLA helps, it’s insufficient against rising costs. We’re resorting to public transport, altering health insurance, and using food banks.” — 74-Year-old man

“My medical insurance supplement nullifies the Social Security increase. The spike in food prices hits hard, especially for those relying solely on Social Security.” — 75-year-old woman

Senior citizens’ responses to financial pressures

The financial picture for seniors is further complicated by their reactions to the pressures discussed above. Next, we gained insights into their coping strategies and concerns.

Key takeaways

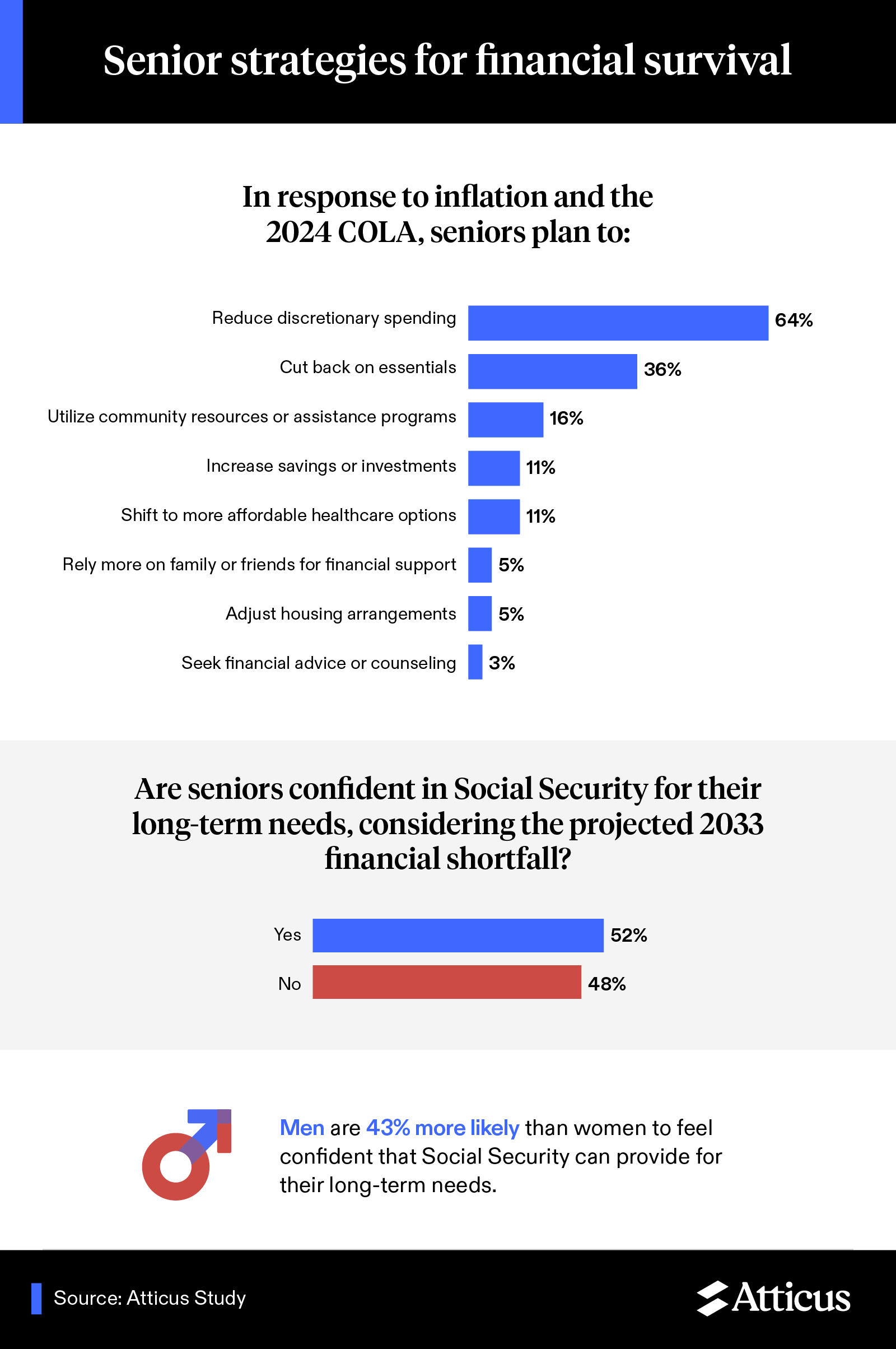

• Due to inflation and Social Security benefit changes, seniors collecting Social Security are most likely to reduce discretionary spending (64%), cut back on essential spending (36%), and use community resources or assistance programs (16%).

• Women are 21% more likely than men to utilize community assistance programs in response to inflation and Social Security benefits.

• Only about half of seniors collecting Social Security (52%) are confident in the program’s ability to provide for their long-term needs.

• Seniors’ biggest concerns about the future of social security:

- Inadequacy of COLA adjustments to keep up with the actual cost of living (68%)

- Political decisions affecting the stability and distribution of benefits (62%)

- The solvency and long-term sustainability of the Social Security program (61%)

- Reduced benefits due to financial shortfalls (58%)

- The impact of economic fluctuations on Social Security funds (36%)

- Changes in eligibility criteria or retirement age (13%)

• How seniors are adjusting their financial and healthcare planning due to the anticipated rise in Medicare premiums:

- Reducing non-essential or discretionary expenses (36%)

- Significant budget changes to accommodate higher costs (20%)

- Exploring alternative healthcare or insurance options (16%)

Financial concerns among seniors

The 2024 COLA increase has illuminated significant financial stress among seniors collecting Social Security, highlighting the widening gap between Social Security benefits and the rising cost of living. These statistics and personal accounts point to a pressing need for more robust measures to support the elderly, especially those who are single or contemplating rejoining the workforce. As seniors navigate these economic challenges, addressing their financial security requires a comprehensive reevaluation of how we support our aging population.

Methodology

To understand how 2024’s 3.2% Social Security COLA affects seniors, we surveyed 402 Americans over age 62 who collect Social Security, examining their reactions, financial strategies, and confidence in the program’s future.

About Atticus

Atticus is a public interest law firm that helps Americans in a crisis secure aid from the government and insurance companies. Through a dedicated team of legal experts and client advocates, we specialize in helping individuals claim their rightful benefits in challenging times.

Fair use statement

We encourage you to share this information for educational and non-commercial purposes. To ensure access to our full findings and methodology, please include a link back to this original article.

Sarah Aitchison

Attorney