Urban Outfitters (URBN -1.68%) had a fairly strong third quarter in its fiscal 2024, with sales up 9% from a year ago. But there was one notable standout — the Urban Outfitters nameplate. The story isn’t a good one for this clothing retail chain. Here’s what is going on when you look beneath the top-line figures, and what investors should think about it.

Urban Outfitters had some good and some bad

Although overall sales rose a solid 9% in the third quarter of its fiscal 2024, the strength was hardly uniform across all of the company’s nameplates. For example, Anthropologie is its largest business at nearly 42% of the top line. Sales for this store group rose 13% year over year in the quarter. Results were even stronger for Free People, which makes up roughly 20% of sales, where the store group saw a sales boost of 23%.

Those numbers are way above 9%, so there have to be some negatives in the mix too.

Image source: Getty Images.

That comes from tiny Menus & Venues (less than 1% of sales), which witnessed a 3% sales drop. And, more notably, from the retailer’s namesake brand Urban Outfitters, which suffered a 14% sales drop. This business is the second largest in the company at roughly 24% of overall sales. While you can’t really expect every business here to be doing well at the same time, given the inherently mercurial fashion-focused customer base, there is still a big issue for investors to consider.

Essentially, Urban Outfitters’ second-largest brand needs to get back on the right track or it will be a material drag on performance, as it clearly was in the third quarter. Management is well aware of this fact, and it is working on the effort, essentially offering up three priorities that all boil down to the same thing: selling products that customers want to buy. Turning around a fashion-oriented retailer can take time, because it often requires changing the store’s image.

Urban Outfitters has time on its side

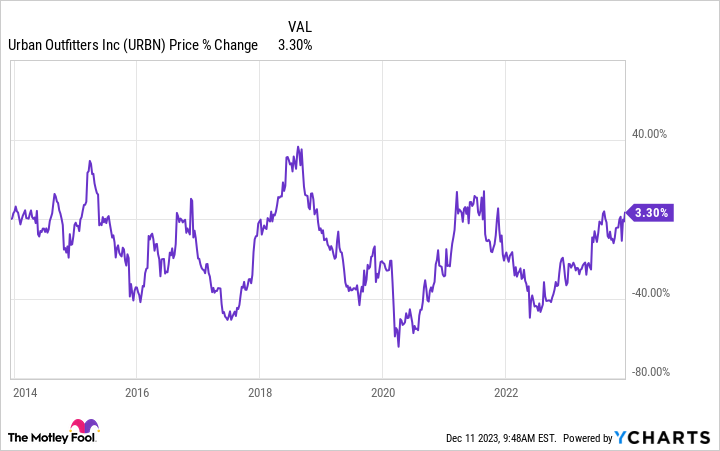

Shares of Urban Outfitters have basically gone nowhere for a decade, up just 3% over that span. But the ride has been pretty wild, with a number of dramatic ups and downs. Shares are currently in an upswing, with a gain of over 35% over the past year and the stock trading close to its 52-week highs.

That’s a pretty positive view from investors given that a business representing nearly a quarter of the top line is struggling. If you have a value focus, you’ll probably want to proceed on to other stocks in the retail sector. Looking at the stock using valuation tools, the price-to-sales and price-to-book-value ratios are both roughly on par with their five-year averages.

So why is Wall Street so positive? One reason is clearly the strong performance of Anthropologie and Free People, which together account for nearly two-thirds of sales. The other is found on the retailer’s balance sheet. As of the third quarter, Urban Outfitters had no long-term debt. Don’t underestimate the value of this, because it gives the company the financial flexibility to muddle through a turnaround at Urban Outfitters, even if it is a long one. If the retailer’s balance sheet were loaded up with debt, it wouldn’t have nearly as long a runway.

Urban Outfitters will survive, but maybe not in your portfolio

The bad news for Urban Outfitters is that a key nameplate is struggling. Given the strength at the company’s two other large brands, however, it seems likely that management will fix the problem in time. Aiding in that effort is the company’s rock-solid balance sheet. Yes, there is a business weakness that needs to be addressed, but there’s plenty of leeway for management to deal with it.

That’s the good news, but it seems appreciate investors may already be factoring in the potential for a business upturn at the Urban Outfitters’ brand given the stock price advance and valuation of the stock. It just doesn’t look appreciate a steal today, even though there’s some important work to be done before the retailer is firing on all cylinders again.