Editor’s note: Seeking Alpha is proud to welcome SA’s Undercovered Dozen Series as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

cassp/E+ via Getty Images

Introduction

There’s lots to like in our first weekly edition of The “Undercovered” Dozen. We’ll be presenting ideas that were published during June 1st – 6th.

So far, we have published these articles on a monthly basis, including:

Moving forward, we’re aiming to publish these “undercovered” features weekly to provide more timely information and a recurring source of potentially new ideas to sift through for our community. So keep an eye out for these on Fridays, and follow SA’s Undercovered Dozen Series to make sure you don’t miss a thing.

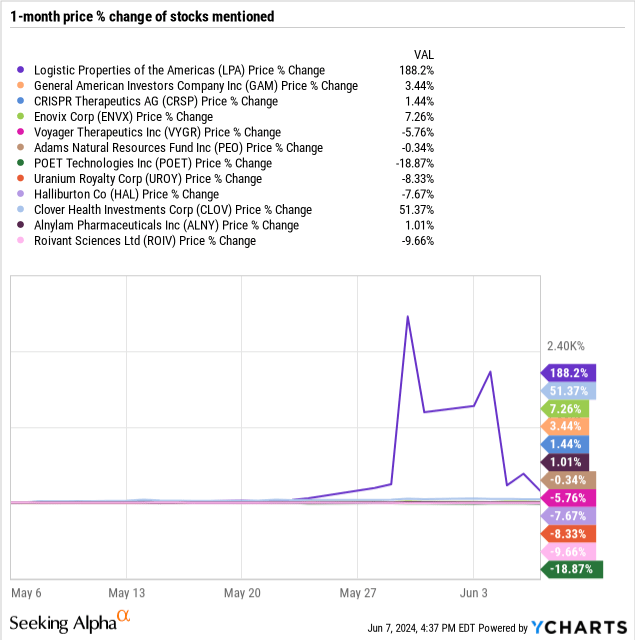

Today we lead with a Strong Sell article on a ticker receiving first-ever coverage. A number of biotech ideas are referenced, three Strong Buys are included, a microcap tech and uranium company are discussed, and a number of tickers included today haven’t been covered in months on the site.

Take a look at what some of these undercovered stocks and ideas might hold for you. And let us know what you think below: any of these worth following up on?

“Shares of Logistic Properties of the Americas (LPA) experienced extreme volatility after news that it was being added to the Russell Microcap Index. The company controls 7.3 million square feet of Class A logistics real estate, primarily focused on the e-commerce market. Despite potential for growth, the stock is currently overvalued and the company has high leverage and potential issues with assets in Colombia.

“Odds are, there is a lot of confusion regarding Logistic Properties of the Americas right now. This is almost certainly because the company is a new player in the public markets. Prior to March 27th of this year, the operations that Logistic Properties of the Americas controls were under a privately held company known as LatAm Logistic Properties, S.A. However, that company, as well as two, a Cayman Islands SPAC, whereby both enterprises merged with newly formed subsidiaries under the new enterprise known as Logistic Properties of the Americas.”

“General American Investors Co. Inc. (GAM) is a closed-end fund that invests in a diversified pool of equities of mostly large-cap U.S. listed stocks. The GAM CEF uses nearly 12% leverage in the form of preferred shares, for which it pays 5.95% in distributions quarterly. GAM’s past performance is solid, especially the long-term performance. In some ways, this fund is a proxy for the S&P 500 Index in terms of capital appreciation with the benefit of significant income, though variable from year to year.

“If history is any guide, the fund’s distributions, on average, exceed 6%, and anything above 6% should be treated as a bonus. Overall, General American Investors Co. Inc. is a great fund for buy-and-hold income investors who do not need very high income and would rather invest for long-term capital appreciation.”

“I last visited CRISPR Therapeutics (CRSP) in January. Recall that CRISPR’s Casgevy is a gene therapy product targeting transfusion-dependent beta-thalassemia [TDT] and sickle cell disease [SCD]. Casgevy was approved in the U.S. in December 2023.”Overall, I am willing to upgrade my recommendation from “sell” to “hold” based on recent valuation adjustment and the company’s prudent management of operating expenses, which has extended their cash runway until there is more certainty about their market prospects. However, prospective and current investors need to be aware of the speculative nature of investments like CRISPR. This may be a suitable choice for a barbell portfolio.”

“Amidst depressed sentiment, the management team of Enovix (ENVX) fired on all cylinders in the first quarter of 2024. Key milestones for manufacturing have been reached and Enovix is on track to produce and deliver its first samples with the EX-1M technology in the second quarter of 2024 and for Fab2 to be ready for production in the second half of 2024.

“While there is multiple good news to celebrate after this earnings report, Enovix still has lots of execution to get right before it becomes a leading battery company. For now, the company has managed to build a product that is superior to others available in the market, build a factory that is capable to building samples first, and then at scale, and attract the largest smartphone players interest in sampling these batteries.”

“Voyager Therapeutics, Inc. (VYGR) is a biotechnology company in the clinical stage, which is focused on developing novel therapies, mostly gene-based therapies, for the treatment of conditions that alter the nervous system such as Alzheimer’s disease (“AD”), amyotrophic lateral sclerosis (“ALS”), Friedreich’s Ataxia, Huntington’s disease (“HD”), Parkinson’s disease (“PD”), among others.

“I believe Voyager Therapeutics, Inc. has provided enough progress in their pipeline to justify the rating upgrade. Not only have they submitted the VY-TAU01’s IND ahead of schedule, but also the FDA has granted clearance rapidly, which I consider an excellent sign. The start of the clinical trials is a stage that investors, including me, have been waiting for. So, I am very pleased to see that it took less than one month from receiving FDA clearance to the start of the trial.”

“Adams Natural Resources Fund (PEO) is a closed end fund that primarily invests in energy and natural resource stocks. This fund is currently trading at a 14% discount to net asset value. This fund has been a solid performer with gains of just over 13% in the past year. I believe this fund is an ideal way to invest in some of the largest and most popular energy stocks. Plus, you can do so while owning just one fund, and get all the benefits and reduced risks that come with the diversification that this fund provides.

“I see PEO as an ideal way to invest in the energy sector and get diversification and an above-average distribution yield. With long-term energy demand likely to remain strong due to population growth, a rising middle class in many emerging market economies, and from the significant power needs with AI and other new industries, I view PEO as a strong buy, especially on pullbacks.”

“Since my initial analysis of POET Technologies Inc. (POET), in which I initiated a BUY rating on the stock, the company has experienced a positive change in perception due to a YouTube video from “Ticker Symbol: YOU”. The video already received about 150,000 views and named POET as a potentially big winner in the hot AI equipment market, which led to an explosion in interest and trading volume for the stock.

“Meanwhile, POET raised significant cash at this elevated level for CAD3.07 and CAD2.90, which is 122% and 110% above the pre-video share price and about triple the pricing of the previous share issuance earlier this year. This capital raise mitigates the most relevant risk for the company in my eyes. Additionally, POET recently achieved an important design win from Foxconn Interconnect Technology in the AI market, which further validates its technology and provides the company with a strong partner for commercialization. I therefore upgrade my rating on POET to a Strong Buy amid the reduced financing risk and improved commercial perspectives. I do this despite the increased price level, as to me, the company still has a lot of potential.”

The Other Five Fit For Mention

Uranium Royalty: The Cheapest Setup In Its History

“We rate Uranium Royalty a hold while noting that valuation looks better and investors may make some money if uranium prices reassert their strength.”

Halliburton: Downside Risk Emerging

“Halliburton’s stock may appear relatively inexpensive, but its margins are unlikely to be maintained at current levels.”

Clover Health: New Business Model Is A Game Changer

“I’m rating Clover Health as a buy with a price target of $2.45, implying 120% upside from current levels.”

Upcoming Pivotal HELIOS-B Data Looms Large For Alnylam’s Valuation

“Alnylam Pharmaceuticals, Inc. is set to release clinical data from its HELIOS-B study in late June/early July, and this will have a significant impact on the company’s share price.”

Roivant Sciences: Executing On Huge Buyback Program With More To Come

“Roivant Sciences’ stock is undervalued with a market cap of $8.37 billion and $6 billion in cash.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.