The British economy entered a recession at the end of 2023, according to official figures published today.

Gross domestic product shrank by 0.3 per cent in the final three months of the year, according to the Office for National Statistics – a bigger drop than expected.

As GDP also fell 0.1 per cent in the three months to September, this meant there had been two consecutive quarters of negative growth – meeting the definition of a recession.

However, many are referring to this as a ‘mild’ or ‘technical’ recession, as growth has only fallen slightly and not dropped substantially.

We look at what this means for you, including your mortgage, savings, pension and investments, and how you can shore up your finances in tough times.

Government figures have revealed that UK economic growth declined 0.3% in the last three months of 2023 – but what does that mean for your money?

What does a recession mean?

Entering recession reflects that there has been a downturn in the economy. As this is a backward looking measure, businesses and individuals will already be suffering the effects.

The economy is no longer growing and shrinking instead – with less money to go round – but that has already been happening since we first saw negative GDP growth in July.

Recession effects can include:

- Companies producing less

- Employers cutting back on wages, staff numbers or hours

- The Government receiving less in taxes

- Individuals spending less money in the shops and on services

For most people, a recession being declared won’t materially change what happens to their finances. Instead, it is likely to feel like a continuation of the higher costs and squeezed budgets that many have already experienced over the past two years.

In fact, with inflation easing to 4 per cent and wage growth above this at 6 per cent, they may even currentl feel they are getting slightly richer after the pain of the cost of living crisis.

However, recession dents confidence and may mean that it is more difficult to get a new job or a pay rise in future.

It could also mean that banks enforce stricter rules when it comes to giving out mortgages or loans, as they did during the last recession starting in 2008.

The economy declined by a worse-than-expected 0.3 per cent in the quarter from October to December

A recession may encourage the Bank of England to consider reducing the base rate earlier than it had planned to cut interest rates after their sharp rise over the past three years.

The aim of increasing interest rates was to tackle rising inflation by making borrowing more expensive and reducing demand, thus feeding through into lower spending by individuals and businessess.

Inflation is now falling, and the Bank will want to ensure that economic growth does not decline any further.

Ed Monk, associate director at pensions firm Fidelity International said: ‘There’s a fair chance the economy will turn positive again in the months ahead but that’s no real cause for celebration now.

‘This news will put extra strain on households, businesses and their workers and the public finances.’

What should savers do in a recession?

Rising inflation and the increasing base rate have spelled bad news in many areas of our finances, but they have provided a boost for savers.

While past their 2023 peak, the best savings rates are still much higher than they have been for several years.

One important thing to check is whether you are getting the best possible return on any money you have stashed away.

At the moment, the best easy-access savings deal pays 5.15 per cent interest and the best fixed-rate deal pays 5.21 per cent.

You can check the best rates using This is Money’s independent best-buy savings rate tables.

If the Bank of England reduces the base rate, that may lead to banks bringing down savings rates.

So for those who don’t need immediate access to their money, it could be worth considering a fixed-rate savings account.

This would allow them to keep their rate for the fixed term, even if rates elsewhere fell.

Dean Butler, managing director for retail direct at Standard Life, said: ‘The most immediate impact on your short-term savings is likely to be retail banks pricing in an expected cut to the base interest rate, as the fact we’re officially in recession will heap pressure on the Bank of England to start to change their position.

‘We’ve already started to see interest rates on best buy savings accounts fall from around 6 per cent last year to below 5 per cent, and now’s a good time to shop around for the best rate before rates possibly fall further.’

What does recession mean for your mortgage?

Mortgage borrowers have been hammered by high interest rates over the past couple of years since the Bank of England began increasing the base rate.

While most people will remain protected for interest rate changes until their fixed rate deal ends, 1.6 million Britons are set to come to the end of their existing deal this year, according to UK Finance.

Many of those who fixed for either two, three or five years ago will be coming off rates of less than 2 per cent. Now the average two-year fix is 5.68 per cent and the average five-year fix is 5.26 per cent.

However, it is still possible to secure a five year-fix below 4 per cent and a two-year at around 4.25 per cent, albeit if they have at least 40 per cent equity in their homes.

> Get the best rate for you using This is Money’s mortgage finder

Up or down? Mortgage rates are rising slightly at the moment, but a recession could potentially bring them down

The advice to borrowers is to organise ahead of time by either remortgaging to a different lender before their deal ends, or switching to another deal with their existing bank or building society in what is known as a product transfer.

It is very early days, but being in a recession could ultimately be good news for mortgage holders. This is because interest rates on borrowing often go down when the economy is not growing.

One of the reasons that the Bank of England reducing its base rate helps to stimulate the economy is that it makes it cheaper for banks and financial institutions to borrow money from each other.

In theory, they would then pass this on to their customers in the form of cheaper mortgage rates.

That said, there are concerns that mortgage lenders may have cut their rates too dramatically in recent weeks, and they are now starting to increase them.

Between August and the end of January, mortgage rates were continually cut dragging the average two-year fixed rate down from a high of 6.86 per cent to 5.55 per cent towards the end of January.

However, since 1 February the average two-year fix has risen from 5.56 to 5.68 per cent following the Bank of England’s decision to hold base rate at the start of the month.

The sudden shift upwards has come thanks to a slight change in market expectations around future interest rates.

Mortgage pricing is reflected in Sonia swap rates, which put most simply, show what these financial institutions think the future holds concerning interest rates.

As of today, five-year swaps are currently at 4 per cent and two-year swaps at 4.56 per cent.

This is up compared to the start of the year, when five-year swaps were 3.4 per cent and two-year swaps were 4.04 per cent.

Nicholas Mendes, mortgage technical manager at mortgage broker John Charcol says: ‘As much as we would all want fixed rates to continue repricing downwards, Swaps just don’t allow lenders the room to be able to hold where they currently are.

‘It’s still worthwhile securing a deal and continuing to regularly review the market up until completion or use a broker who can do this for you which would certainly be less stressful.’

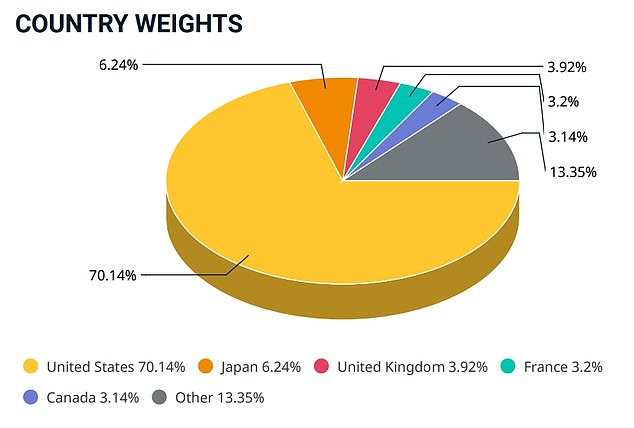

The UK only makes up less than 4 per cent of the global stock market, so most investors are more exposed to the US’s economic fortunes

What does recession mean for investors and pensions?

A recession is generally judged to be bad news for investors but that isn’t necessarily the case by the time one is declared.

The GDP figures that a technical recession is based on are backward looking, covering what happened in the past six months – a period that has already passed and shown up in company results.

What matters more to investors is what is happening now and what is forecast for the future. This is what will influence UK companies’ results in months to come and whether they fall short of, meet, or beat expectations will drive their share price reactions.

For investors, it’s probably best to tune out the noise on whether we’re in recession or not

Ed Monk, associate director at Fidelity International, says: ‘For investors, it’s probably best to tune out the noise on whether we’re in recession or not. History shows short-term economic ups and downs have little to do with performance in the stock market. Markets tend to be forward looking and investors will already be seeing past data on recent economic performance.’

Investors and pension savers are also not only affected by the fortunes of the UK economy, many of the British companies they may hold in their portfolios or funds are more exposed to the global economy than the domestic one – and a sizeable chunk of their holdings may be in overseas companies.

The global stock market, for example, is dominated by the US, which currently makes up about 70 per cent of it, whereas the UK stock market is only about 4 per cent.

Investment and pension default funds tend to track the global stock market and so will be US not UK-focussed. The US economy is slowing but in decent shape and its stock market is currently performing well but judged to be expensive.

Dominant: Investment and pension funds track the global markets and are US, not UK-focused

A potential recession in the UK has been in investors’ minds for some time and so is already baked into share prices. Many experts argue that UK stocks are undervalued compared to their US and global peers and that could make them an investment opportunity – particularly if a catalyst, such as bigger than expected interest rate cuts emerges.

Laith Khalaf, of AJ Bell, says: ‘The stock market is a forward-looking weighing machine, and so a 2023 recession doesn’t materially change the prospects for companies in the future.

‘It’s notable that the FTSE 100 reaction following the news of the economic contraction was in fact positive, which tells us that recession is water off a duck’s back for UK investors.

‘Actually, the market is probably more focused right now on when the first interest rate cut will come, and a recession makes that more likely to be sooner rather than later.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.