TERADAT SANTIVIVUT

Editor’s note: Originally published at tsi-blog.com on January 16, 2024

[This blog post is an excerpt from a recent commentary at Speculative Investor]

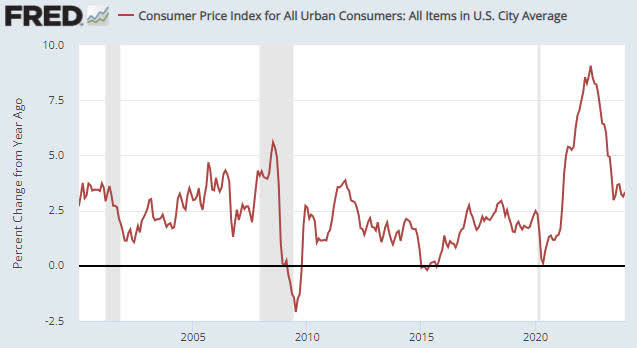

The year-over-year growth rate of the US CPI was reported last Thursday to be 3.4%. This was 0.3% higher than the number reported for the preceding month and 0.2% higher than the average forecast, but the overall picture (refer to the chart below) is unchanged. The downward trend that began in June of 2022 is intact and we expect that the 2023 low will be breached during the first quarter of this year. However, the main purpose of this discussion is not to delve into the details of the latest CPI calculation but to debunk the persistent idea that the price inflation of 2020-2022 was mainly due to supply disruptions.

The idea that the price inflation of 2020-2022 was transitory and mainly due to supply disruptions is absurd, but many smart people continue to tout this wrong-headed notion. Based on the above chart a reasonable argument can be made that the rapid pace of inflation (currency depreciation) was transitory, but not the inflation itself. Let’s consider what would have happened if disrupted supply actually had been the dominant driver of the high “inflation” of the past few years.

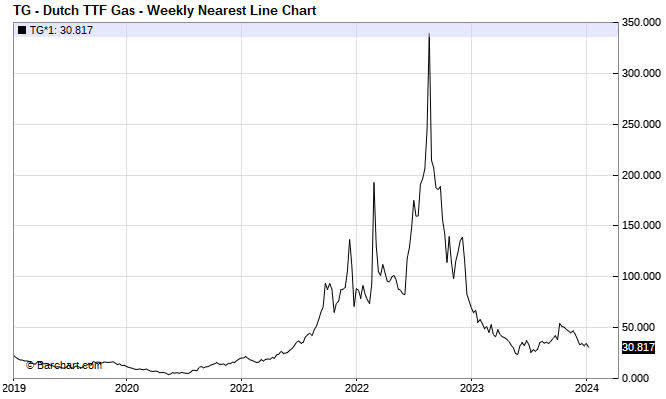

The following chart shows the price of natural gas in Europe. This is an example of what happens when a supply disruption is the main cause of a large price rise. After the supply issue is resolved, the price falls back to near where it was prior to the disruption.

By the way, there are many commodities that over the past few years experienced spectacular price rises due to disrupted supply followed by equally spectacular price declines. We could, for instance, make the same point using a price chart of oil, wheat, or coal.

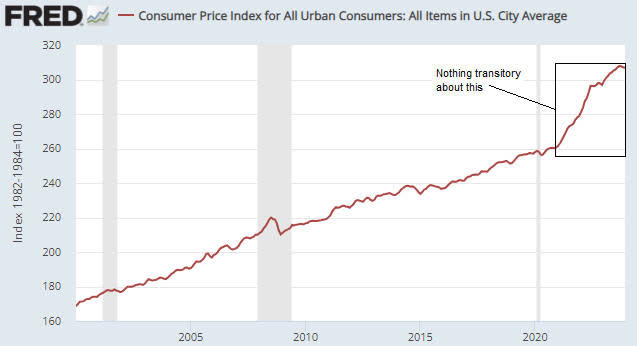

The next chart shows the US Consumer Price Index (the index itself, as opposed to a rate of change). This chart makes the point that on an economy-wide basis, none of the currency depreciation of 2020-2022 has been relinquished. In fact, prices in general continue to rise, just at a slower pace.

It’s happening this way because the main driver of the inflation was a huge increase in the money supply combined with a huge increase in government deficit spending. In effect, all of the purchasing power loss that has occurred to date has been locked in and the best that people can expect from here is for their money to lose purchasing power at a reduced pace. In this respect, inflation is operating the same way as compound interest, except that instead of getting interest on interest people are experiencing cost-of-living increases on top of previous cost-of-living increases.

So, when someone tells you that supply disruptions were the main reason for the large general increase in prices, ask them why the general level of prices didn’t drop after the supply disruptions went away. And why are we now getting more price increases on top of the price increases of the past?

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.