The Southern Company (SO -0.90%) has an enviable dividend track record in one way, and yet the dividend has been a less-than-stellar performer in another. But the next decade for this large regulated U.S. utility is likely to look very different from the last one.

That is good for dividend investors, with management spelling out a pretty clear target for the positive changes it sees ahead.

Rewarding dividend investors well even in hard times

Southern has increased its dividend annually for 22 consecutive years. But that’s just the start of the dividend record here, since it has held steady or increased for a full 76 years.

That’s a stat that even the most conservative dividend investor will find appealing. It highlights a commitment to returning value to investors via a growing dividend that few other companies can match.

Image source: Getty Images.

Notably, the utility has supported the dividend through good periods and bad. That includes the Great Recession, the coronavirus pandemic, and even the dramatic inflation uptick during the 1970s.

Southern is the kind of dividend stock that you buy as a foundation to a more broadly diversified portfolio. You don’t expect it to be exciting, but you do expect it to be reliable.

Only over the past decade, this utility has been a bit of a laggard on the dividend front in an important way. The payout growth over that span has averaged only around 3% a year. In fairness, that’s roughly enough to keep up with the historical rate of inflation growth over time. So the buying power of Southern’s dividends hasn’t declined, which is good. But investors generally hope for a little more.

So, all in, there’s a lot to admire about Southern’s dividend even though there’s one notable issue to complain about. That little niggle is about to change.

What’s been going on at Southern

The big headwind for the utility over the past decade that has forced it to limit dividend growth is the Vogtle project. It includes two large-scale nuclear power plants, and it has been over budget and delayed multiple times.

To suggest that the construction process didn’t go well would be an understatement; the original contractor declared bankruptcy (forcing Southern to take on that role), and it had to contend with the disruptions caused by a global pandemic.

That’s the bad news, and it was the main reason Southern rode the brake on dividend growth, keeping it slow and steady. But the first of the two power plants is now attached to the grid, and the second one should be up and running in early 2024.

The utility estimates that the two plants, once fully operational, will add as much as $700 million to the company’s cash flow from operations. There’s a dual benefit, since the capital spending associated with Vogtle will go away and the power plants will start generating revenue.

That cash will be used in a few ways. Debt reduction and investment in other capital projects will be the first orders of business. But according to management, once the company lowers the payout ratio below 70%, dividend growth that aligns more closely with earnings growth is the target.

Right now, the payout ratio is projected by management to be around 77%, so don’t expect an uptick in dividend growth in 2024. However, 2025 seems admire a real possibility, with the payout ratio being the prime figure to monitor along the way.

A changed view of Southern

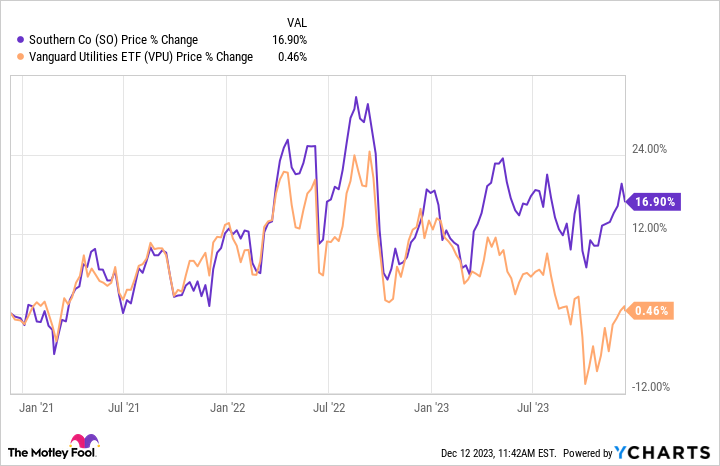

As the chart above shows, shares of Southern have largely bucked the broader downtrend in the utility sector, using the Vanguard Utilities ETF (VPU -1.73%) as a proxy. That’s likely because Wall Street was so down on the stock while it was muddling through the Vogtle project. Now that the project is nearly complete, investors are increasingly positive. It isn’t the bargain it once was.

That said, if you have owned Southern through this difficult construction project, you are being rewarded for your patience today. And the reward looks likely to get even better when dividend growth moves out of the moribund range it has been stuck in for so long.

Meanwhile, if you don’t own the utility and have a dividend growth mindset, you might want to put it on your radar screen. Management has provided a target (a sub-70% payout ratio) for when the dividend story should change in a very positive direction.