For years, gambling was widely considered to be a vice industry akin to alcohol or tobacco. But over the last few years, a specific form of gambling — sports betting — has started to become more mainstream. This shift largely has to do with the rise of mobile sports betting apps.

If you watch sporting events on television, it’s nearly impossible not be bombarded with advertisements for apps such as FanDuel, PointsBet, DraftKings (DKNG 0.85%), and many others. Sports betting companies are leveraging former athletes, celebrities, and social media influences to promote their apps and normalize the once-negative stigma around gambling. This strategy appears to be working, and DraftKings has been a major beneficiary.

Last year the stock surged over 200%, handily beating the S&P 500. Wall Street is taking note, and one major investor in particular likes DraftKings’ long-term odds.

Ark Invest CEO Cathie Wood owns DraftKings in her portfolio. In fact, the sports wagering platform is her number 11 holding across all of her exchange-traded funds (ETFs). While support from institutional investors provides some much-needed validation to the gambling market, let’s assess why DraftKings in particular may be the best option for investors.

Progress in the sports betting market

One of the biggest reasons that sports betting is experiencing more rapid adoption is its improving legalization status. Similar to other products and services, sports betting can be a major source of tax revenue.

According to Grandview Research, the global sports betting market was estimated to be around $83.7 billion in 2022. Per the research note, Grandview expects the sports betting market to grow at a compound annual growth rate (CAGR) of 10.3% through 2030. This would bring the total size of the market to around $183 billion by the beginning of the next decade.

In the U.S. specifically, the two largest players over the last couple of years have been FanDuel and DraftKings. FanDuel is owned by entertainment company Flutter, and narrowly held the top spot among U.S. sports books for quite some time. However, according to research published by Eilers & Krejcik Gaming, DraftKings eclipsed FanDuel’s market share in the third quarter of 2023.

Emerging as the top-operated mobile sportsbook in the U.S. is no small feat. But seeing the impact of this momentum on DraftKings’ financial picture is even more encouraging.

Image Source: Getty Images

The financial picture is improving

Through the first nine months of 2023, DraftKings reported $2.4 billion in revenue, an increase of 71% year over year.

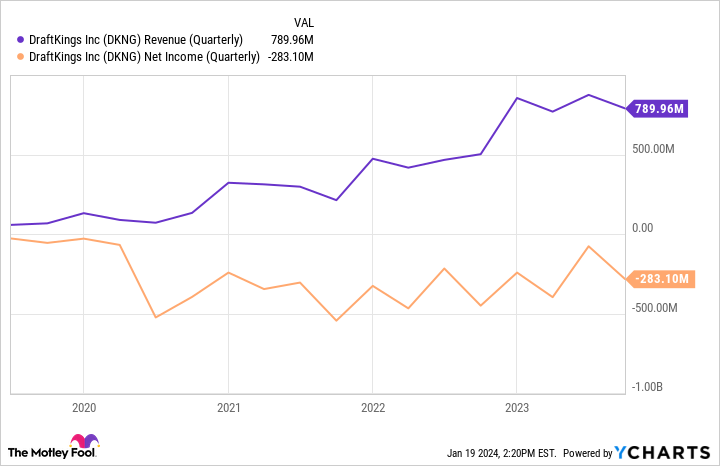

DKNG Revenue (Quarterly) data by YCharts

While that level of revenue growth is impressive, the chart above sheds light on one glaring issue. DraftKings is not yet profitable on a generally accepted accounting principals (GAAP) basis, and is consistently burning money.

The silver lining is that the company has identified a lucrative way to narrow its losses and reach sustained profitability. In DraftKings’ third-quarter earnings report, for the period ended Sept. 30, management explained that increased customer engagement contributed to improvements in the company’s revenue and EBITDA guidance.

One of the biggest contributors to increased engagement is the rising parlay mix on the platform. In sports betting, a parlay is a bet that contains multiple criteria in order to win. For example, in baseball you could bet that your team will win the game and that at least one player will hit a homerun. If both of these things happen, then you win your bet. But if only one (or neither) of them happens, then you don’t win anything.

The carrot to entice users to choose parlays is that these bets carry longer odds. This means that as you add more criteria to your parlay, your odds actually become worse given the probability of multiple things going your way. But if you’re right, then your payout could be far more significant. As a result, DraftKings is finding that users are increasingly placing parlay bets on its platform — thereby driving higher engagement and average revenue per monthly unique player.

The obvious growth driver of this shift toward parlays is that DraftKings can generate more revenue. But the more subtle, albeit lucrative, feature is that this high engagement is a sign that people are staying on the app longer and betting more money while doing so. As such, the company should be able to improve its customer acquisition costs over time, which should lead to narrowing burn rates.

Should you roll the dice on DraftKings stock?

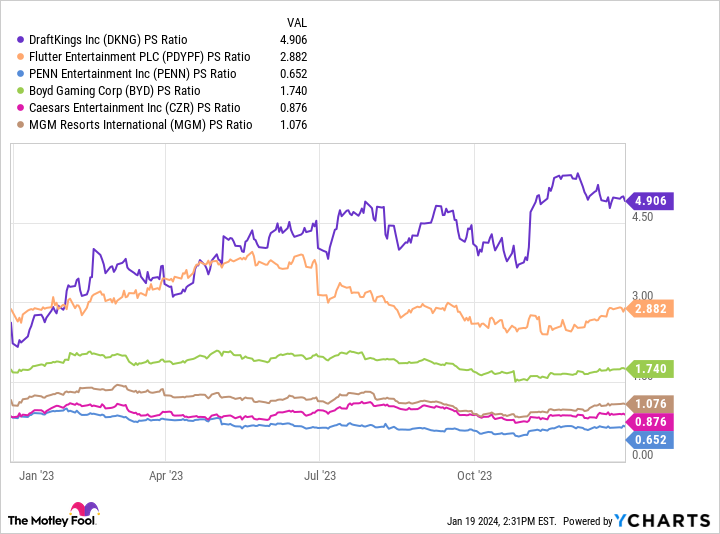

DKNG PS Ratio data by YCharts

The chart above illustrates the price-to-sales (P/S) ratio of DraftKings benchmarked against a cohort of other entertainment and casino stocks. While DraftKings carries the highest P/S multiple among this peer set, there is something a bit more interesting at play.

The lowest-valued stocks in this analysis are all traditional casinos that are looking to make inroads in online sports betting given the popularity of FanDuel and DraftKings in particular. Moreover, after a failed betting strategy with Barstool Sports, Penn Entertainment has a lot to prove as it looks to rebuild with its new partnership with Disney-owned ESPN.

Moreover, start-ups like Fanatics are also looking to cash in on the hype — in facts, Fanatics recently acquired the U.S. assets of PointsBet.

And perhaps the most interesting point is the recent sale of the Dallas Mavericks in the National Basketball Association. The team was owned by outspoken entrepreneur Mark Cuban for over 20 years. But at the end of last year, he sold the majority of his stake to the Adelson family — the owners of Las Vegas Sands. While it’s still speculation, many in the sports world believe this is a calculated move to help bring sports betting to Texas.

The big theme here is that not only is the sports betting market expected to grow, but there is a rising number of influential players looking to participate. This increased competition could actually benefit DraftKings as sports betting continues to become mainstream. Furthermore, the chart above could suggest that mobile app platforms carry a superior investment premium over traditional casinos that have sports book apps on the side.

All of these reasons make me bullish for DraftKings in the long term. I think 2024 could be a great opportunity to begin dollar-cost averaging into the stock and start building a long-term position.