filmfoto

Equities have generally been consolidating to start out 2024, but one group that has gotten outright punished is those stocks that possess the highest levels of short interest.

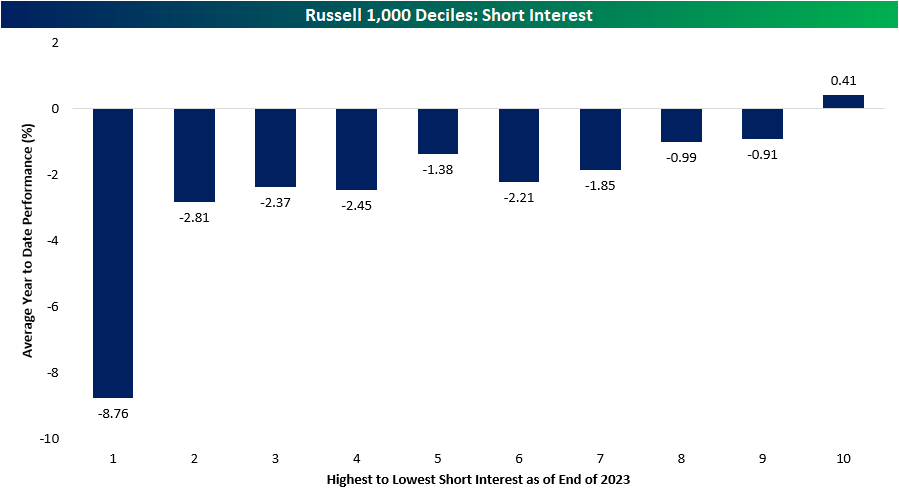

In the chart below, we’ve broken the large-cap Russell 1000 into deciles (10 groups of 100 stocks each) sorted by the stocks with the highest to lowest short interest as a percent of equity float as of the end of last year and show each group’s average performance year to date.

Whereas the average stock in the index is down 2.34% so far this year, the 100 stocks in the index with the highest short interest levels are already down 8.76%.

That is significantly more than the second most heavily shorted decile which has averaged a decline of only 2.81%. Notably, the decile of least shorted stocks is actually up 0.41% so far this year on average.

Looking more closely at the decile of most heavily shorted stocks, it’s filled with names that have already fallen in excess of 20-30% YTD like EV-related names Lucid (LCID), ChargePoint (CHPT), and Plug Power (PLUG).

Solar stocks like Sunrun (RUN), crypto adjacent names like Coinbase (COIN), and meme stock mania names like AMC Entertainment (AMC) and GameStop (GME) also find themselves on this list and have already seen double-digit declines year to date.

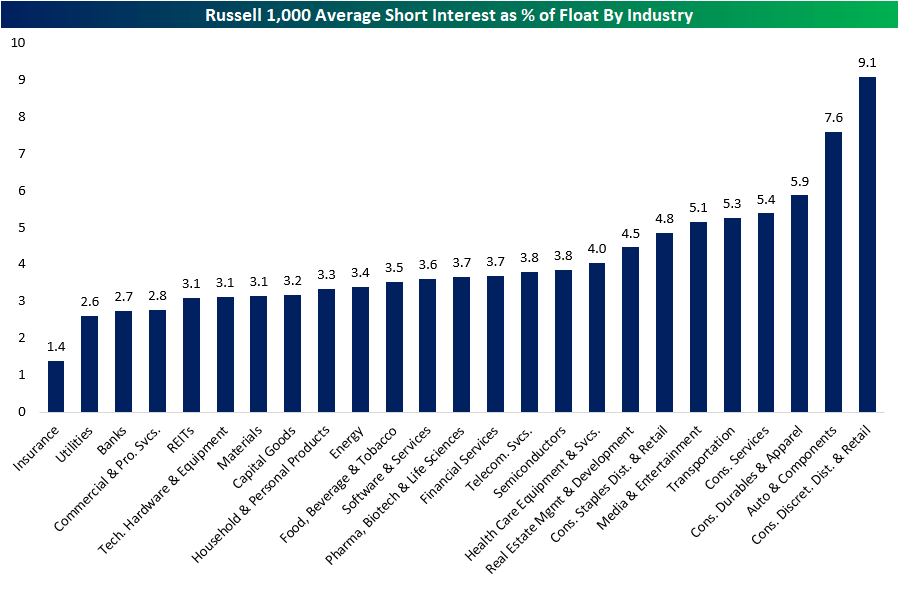

The most recent short interest data through the end of last year was released just last week. Below, we show the average reading for each industry in the Russell 1000.

Across the whole of the index, the average stock has 3.87% of float shorted. Readings are close to or more than double that for Discretionary Retail and Autos at 9.1% and 7.6%, respectively.

Media & Entertainment, Transportation, and Consumer Services are the only other sectors that average more than 5% of float shorted.

Meanwhile, Insurance, Utilities, Banks, and Commercial and Professional Services are some of the least shorted industries.

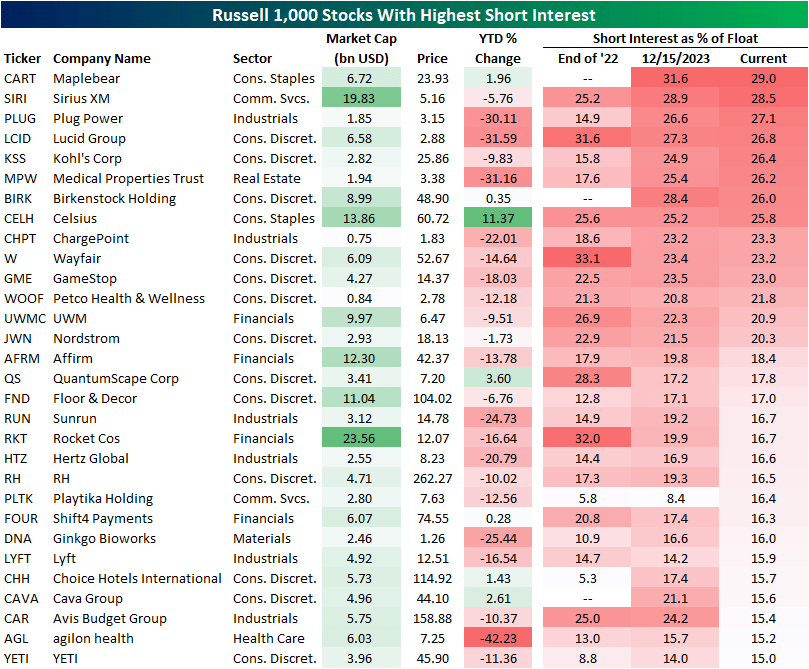

As previously mentioned, some of the worst-performing stocks this year have been those with the highest levels of short interest.

In the table below, we show the 30 Russell 1000 stocks that currently have the highest short interest as a percentage of float.

Recent IPO Maplebear, or Instacart (CART), tops the list with almost 29% short. That is actually down versus the mid-December reading though back then it was again higher than any other Russell 1000 member.

There are seven other names with more than a quarter of float shorted: Sirius XM (SIRI), Plug Power (PLUG), Lucid, Kohl’s (KSS), Medical Properties (MPW), Birkenstock (BIRK), and Celsius (CELH).

One thing that is notable is that while many of these highly shorted stocks are underperforming, some exceptions are those that have more recently IPO’d.

For example, CART, BIRK, and CAVA are some of the few from this list that are up on the year. Granted, their gains are not nearly as solid of Celsius which has completely distanced itself from the rest of the pack, rising 11.4%.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.