Win McNamee

The most important event during the past week probably wasn’t Nvidia (NVDA) and its earnings report. Yes, the stock did jump following better-than-expected results and guidance, helping to boost the Nasdaq 100 by roughly 3% and erasing the losses of the prior week. While the result captured the headline for the day, the magnitude of the jump may not have been all that surprising based on the options market positioning and the implied move.

The biggest news last week that is more likely to affect the longer term was probably the speech by Fed Governor Chris Waller, who, item by item, told investors the things he would be watching to know when and if the Fed would cut rates in 2024.

The speech was delivered on February 22nd, and in the speech, Waller noted that the economic data in January for GDP, jobs, and inflation were hotter than expected, which reinforced his: “view that we need to verify that the progress on inflation we saw in the last half of 2023 will continue and this means there is no rush to begin cutting interest rates to normalize monetary policy.”

Not only can the Fed take its time in cutting rates, but Waller went on to note: “The strength of output and employment growth means that there is no great urgency in easing policy, which I still expect we will do this year.”

He pointedly said, “Let me pause here and say that typically the FOMC considers easing policy only when there are fairly clear signs that the economy could be in or close to a recession.”

Data Points To a Strong Economy

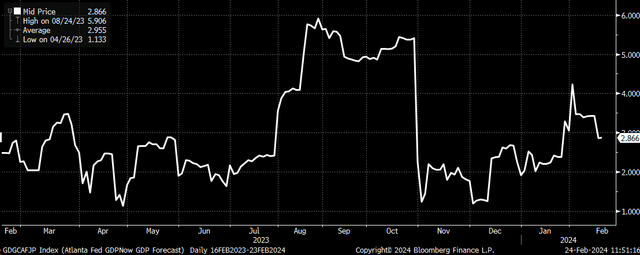

Based on the data, it seems very clear that the US is not heading towards or is anywhere close to a recession. The US seemed closer to a recession a year ago than it does today. With the economy re-accelerating in the second half of 2023, and as of February 16, the Atlanta Fed GDPNow model was forecasting first-quarter growth of 2.9%.

Waller still expects to cut rates at some point later this year, but to this point, the data suggest the Fed can still be very patient.

In the speech, Waller noted several key data points we will be getting over the next two weeks that will tell him if January was a fluke or if the disinflation progress made in the second half of 2023 is reversing.

Probably the most important data point will be this week’s PCE report, due on February 29; Waller noted that estimates for core PCE in January were 2.8%, down from 2.9% in December. Meanwhile, analysts estimate that core PCE is expected to rise by 0.4% m/m. Additionally, headline PCE is expected to rise by 0.3% m/m and 2.4% y/y.

Waller also made note of the ISM services and manufacturing purchasing managers indexes, which showed improvement in January. The ISM manufacturing report for February is expected to come out on Friday, March 1, and is forecast to show further improvement over January. Analysts estimate ISM manufacturing will rise to 49.5 from 49.1 in February, and ISM prices will rise to 54.5 from 52.9. Waller also went on to talk about wages and compensation as well as the Atlanta Fed wage tracker

However, Waller’s biggest point was the breakdown of inflation and how he looked at parts of inflation in different buckets. If market-based inflation expectations are correct, Waller will likely not be happy with the inflation data coming in February, March, and possibly April, based on market-based inflation swaps and expectations.

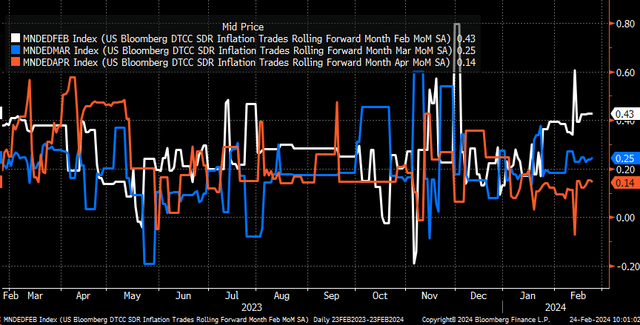

Inflation Swaps Price In Higher Inflation Rates

Inflation swaps are pricing in February CPI to rise by 0.43% m/m, which could round to either 0.4% or 0.5%. For March, swaps see CPI rising by 0.25%, which rounds to 0.3%. Then, in April, swaps expect CPI to fall back to 0.14% m/m, which can round to either 0.1% or 0.2%. In all three cases, the data between February and March will not be consistent with 2% inflation and will point more to the sign that the Fed will need to wait longer for the confirmation it needs to normalize policy.

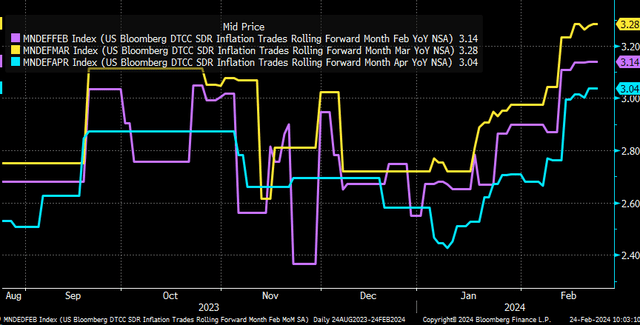

The swaps market is pricing in a year-over-year inflation rate of 3.14% in February, 3.28% in March, and 3.04% in April. This means inflation is expected to run north of 3% since June 2023.

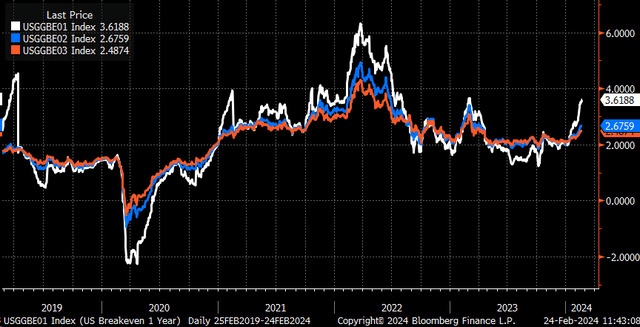

1-year breakeven inflation expectations are also rising rapidly and have moved back to their March 2023 levels that existed pre-SVB. At the same time, 2-year and 3-year breakeven inflation expectations are also beginning to move higher.

Reason For Higher Inflation Expectations

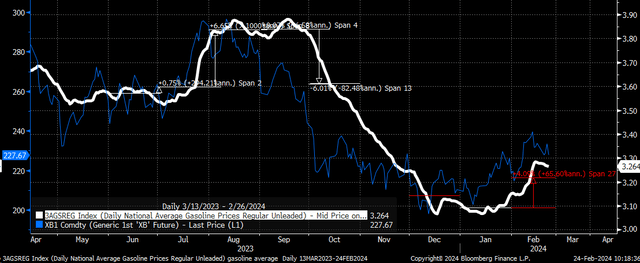

What is driving some of these higher inflation expectations could be rising gasoline and shipping rates. The daily average gasoline prices have risen by more than 4% in February versus the average in January.

Meanwhile, shipping rates out of Shanghai, China, have surged more than 80% on a year-over-year basis since the end of 2023, and changes in shipping rates over time have tended to lead to increases in the consumer price index.

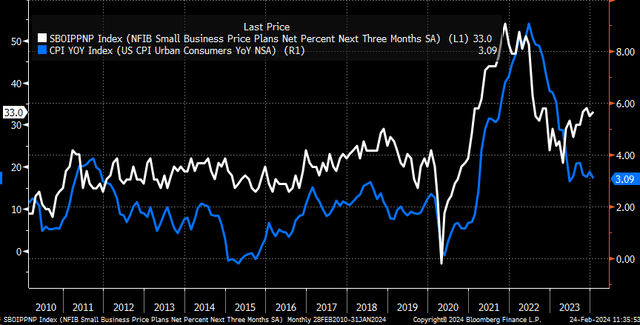

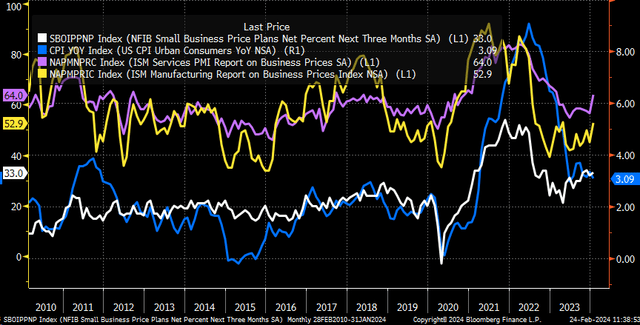

Meanwhile, small businesses have shown intentions of raising prices over the next three months, as measured by the NFIB. The measure has been steadily trending higher since bottoming in April 2023, and it is diverging from the year-over-year rate of change for the CPI. It could be a sign that CPI is due to turn higher.

Additionally, this week’s ISM manufacturing prices paid, if they come in as expected, would continue a trend of prices rising at a faster pace over the last several months, which could serve as further confirmation to the NFIB survey, which shows that businesses have the intention to raise prices in the future.

A Higher Neutral Rate

If you take the speech one step further and think about the implications, it starts to take the path for the possibility that there will be no rate cuts in 2024. The data won’t be consistently supportive enough to see rate cuts materialize, or perhaps fewer than the projected three rate cuts at the December FOMC meeting.

This means that when the March FOMC summary of economic projections comes out, there may no longer be 3 rate cuts expected in 2024, but fewer. If the market-based and survey data and the trend toward sticky inflation are correct, fewer rate cuts seem highly likely in 2024.

Of course, that brings us to the next discussion point: whether the policy is even tight enough currently because the longer inflation remains above target and growth remains above trend, the more it argues for a higher neutral rate in the economy. That policy just isn’t tight enough yet to finish the job.