rekemp/iStock via Getty Images

As we come to the end of January, having made fresh all-time highs in the S&P 500 last week, one is reminded again of the old trader’s saw that, “As January goes, so goes the year.”

Because of the way computers have made everything seem to move faster, some had tried to shorten it to “as the first week of January goes, so goes the year,” but I never bought into that shortcut.

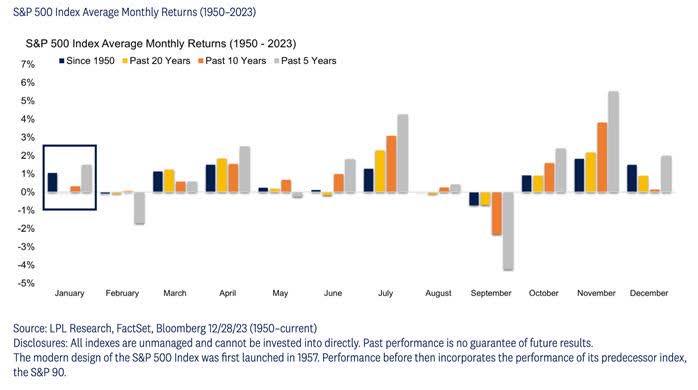

Still, looking at various periods of the year, seasonality can vary quite a bit, but one thing is certain: October through January tends to be the strongest time for the stock market, whereas February and September tend to be weak months over time.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

These seasonal charts are just a suggestion of what might happen, not a guarantee. I have seen strong Februarys and strong Septembers, but over time that is not the case.

To dig even deeper, last week I saw a chart from a famous investment bank that showed that the first two weeks of February – which starts this week – tend to be strong, while the last two weeks of February tend to be much weaker over time.

It had to be said that last year delivered some remarkable consistency when it comes to long-term seasonality patterns, and so I am wondering if this won’t play out in similar fashion this year – where we wobble out of the gate slowly but finish strongly after the presidential election is over.

Years where there is a presidential election tend to be strong for the stock market, but that is not a guarantee. If the January barometer holds true this year, it looks like 2024 will see another record high for U.S. stocks.

It helps that the Fed is expected to cut rates with falling inflation and a recession will likely be avoided. The wild card is the geopolitical situation, which seems to have worsened recently, with another war in the Middle East and Houthis in Yemen making the use of the Suez Canal nearly impossible.

The China Wild Card

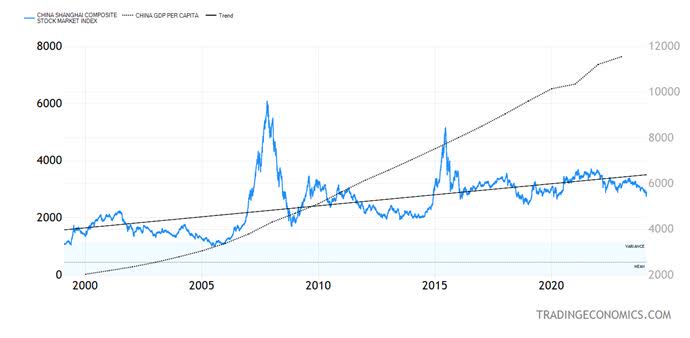

I am watching with great interest heavy selling in Chinese stocks markets, be they on the mainland or in Hong Kong – a trend that has garnered the attention of the Chinese government, which intends to give government entities around $280 billion to buy stocks and stabilize the market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The Chinese tried something similar when the mainland market crashed in the summer of 2015, which produced no results other than a feeble rally that ultimately made lower lows.

In the prior top in late 2007, the Chinese did not intervene in the stock market but there was a lot of forced lending in the economy that stabilized it after the Great Financial Crisis and caused their economy to avoid a recession.

If the Chinese economy is about to experience a recession in 2024 – which is long overdue in my opinion – then market intervention will not work.

The Chinese think that they have figured out a way to avoid economic cycles with their government’s grip on the financial system, but I am afraid that someday, and I cannot be sure that it will be this year, they will find out that recession cannot be avoided.

If the Chinese are headed for a recession, though, this event will be profoundly deflationary for the global economy and give the Fed more ammunition to lower interest rates, which could be good for U.S. stocks.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.