Julia Nikhinson

The Fed’s dovish surprise

The Fed held interest rates at 5.25-5.50% at the December 2023 meeting, as widely expected. However, the Fed signaled a significant 0.75% easing in 2024, almost matching an exuberantly dovish market expectation before the meeting. This was a major dovish turnaround for the Fed.

Just two weeks ago, Fed Chair Powell stated: “It would be premature to deduce with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.”

Thus, even the doves were expecting at least some pushback from the Fed against the aggressive easing expectations. So, what happened? Why the major dovish turnaround?

Fed Chair Powell’s post-FOMC meeting press conference possibly revealed what’s going on with the Fed.

Recession warning

First, Powell gives a recession warning in his prepared statement:

Our actions have moved our policy rate well into restrictive territory, meaning that tight policy is putting downward pressure on economic activity and inflation, and the full effects of our tightening likely have not yet been felt.

In other words, the Fed feels it went too far “well into restrictive territory” with the interest rates, and the full effects of the recent monetary policy tightening are likely to be felt in 2024. This is a recession warning, but more importantly, the Fed is possibly panicking now and trying to reverse at least some of the tightening to hinder a recession – just before the election. Yes, there are likely political motivations behind the dovish turnaround.

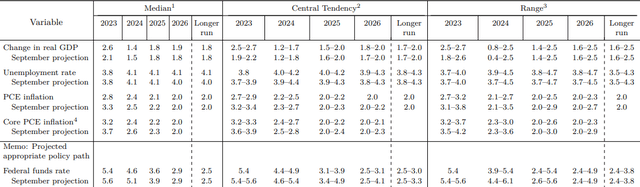

The bizarre dot plot implications

The Fed has been using the Summary of Economic Projections as the communication tool – this is where the FOMC signals the future path of monetary policy. So, the December dot plot puts the 2024 Federal Funds rate at 4.6% – which is about 75bpt lower than 5.33% right now, and it’s below the 5.1% level predicted in September. This is the signal that the Fed will cut in 2024

FOMC SEP December 2023

Powell also specifically mentions that the FOMC was discussing the timing of the cuts at the December meeting, despite saying that it was premature just two weeks ago.

But of course, the other question—the question of when will it become appropriate to begin dialing back the amount of policy restraint in place—that begins to come into view, and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today.

But when asked about those discussions, Powell reveled a bizarre process:

Everybody wrote down an SEP forecast. So many people mentioned what their—what their rate forecast was and there was no—there was no back and forth, no attempt to sort of achieve agreement, admire this is what I wrote down, this is what I think, that kind of thing, and preliminary kind of a discussion admire that. Not everybody did that, but many people did. And then—and I would say there’s a general expectation that this will be—this will be a topic for us looking ahead. That’s really what happened in today’s meeting. I can’t do the headcount for you in real time, but that’s generally what happened today.

So, essentially, each FOMC member just put down his/her number, without any academic discussion, evidence, data, etc, and these individual predictions were just complied into the SEP? And that’s supposed to be the monetary policy guide?

Just look at the range of forecasts, one FOMC member expects a 5.4% Federal Funds rate by the end of 2024 – so no cuts. Somebody else expects a 3.9% Federal Funds rate in 2024 or 5-6 cuts. I assume both of these FOMC members looked at the same data, both are educated, and yet the range is very extreme.

That tells me that these SEP projections are not credible. However, the fact is that the FOMC on average is very dovish – they really want to ease and avoid a recession in 2024. The question is whether the inflation data will allow them to ease. The other question is whether it is too late to attempt to cancel the recession, given the lagged effects of prior tightening.

Mission accomplished?

Here is what Powell said when asked how sticky is core inflation right now:

Well, that’s what we’re finding out. And we’ve—you know, we’ve seen real progress in core inflation. It has been sticky. And famously, the service sector is thought to be stickier. But we’ve actually seen reasonable progress in non-housing services, which was the area where you would expect to see less progress. We are seeing some progress there, though. And in fact, all three of the categories of core are now contributing—goods, housing services, non-housing services, they’re all contributing in different—at different levels, you know, meeting by meeting—or, rather, report by report. So, yeah.

Just to add context to this, core CPI just increased by 0.3% month over month, and stayed at 4% year over year in November. Both of these measures are double the Fed’s target.

Yes, Powell said that he’s not going to foresee for inflation to fall to 2% before starting to ease, as that would risk a recession. But, his statement above is likely his premature “mission accomplished” moment.

Wikipedia

Also, Powell completely disregarded the inflation “last mile” challenges.

But to say with certainty that the last mile’s going to be different, I’d be reluctant to—you know, to suggest that we have any certainty around that.

Powell also completely disregarded the inflationary challenges due to deglobalization. The Fed’s Jackson Hole 2023 Economic Policy Symposium was themed “Structural Shifts in the Global Economy,” with specific implications on inflation.

Yes, the facts are that the disinflationary process is still progressing, but taking the dovish turn at 4% core inflation, 3.7% unemployment, two active geopolitical situations that could push oil above $100 with a slight escalation, a trade war with China, reshoring, onshoring, climate change events, etc., seems premature.

Implications

The Fed seems to be terrified of a recession in 2024, right before the election. They seemed to be panicking and trying to reverse some of the forthcoming damage. They know what’s going on, the pandemic savings are likely gone, the consumer is facing student loan payments, and shopping with buy-now-pay-later plans. The delinquencies are rising, the housing market is frozen, and the vulnerable zombie companies are facing the interest rate refinancing wave. It seems the Fed would prefer 3-4% inflation, rather than a recession, at least leading into the election.

Obviously, this is not a situation to be short stocks, until the data starts verifying a recession, and the Fed’s cuts are unable to hinder it. We are obviously not there yet.

The stock market bubble could reinflate over the near term, but the understanding is that buying the S&P 500 (SP500) at this point is chasing the bubble, which requires timing the eventual blowoff top.

Long-term investors should stay out of this game completely, especially if it is close to retirement. Cash is still an attractive alternative at a 4.95% 12-month yield.