manassanant pamai

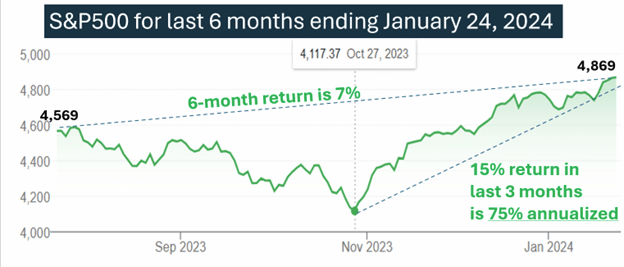

Today was the day that most believed the Fed would pivot, lowering interest rates by reinstating Quantitative Easing (QE). Recent stock market gains reflect this belief.

S&P

But few have considered the long-term consequences of the Fed’s actions and the predicament in which it finds itself. It’s not as easy as simply turning the interest rate dial. Here are 5 main concerns that the Fed needs to weigh. These are just 5 of the 22 concerns about the economy in general.

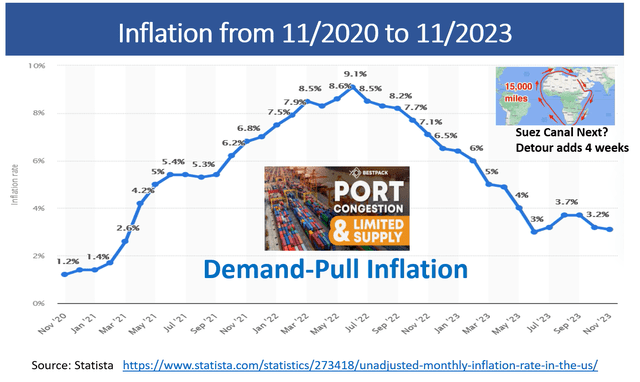

Concern 1: Inflation might not be under control. Recent “Demand-Pull” inflation was caused by COVID-created supply shortages that have subsided, but new turmoil in the Red Sea could re-inflate inflation caused by supply shortages.

CPI

Also, there is another form of inflation called “Cost-Push” which is the classical “too many dollars chasing too few goods.”

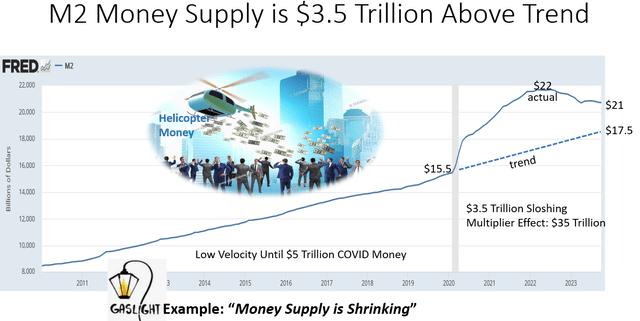

Concern 2: There could be too much money in the economy due to COVID spending, especially the helicopter money that was sent to most people. We estimate that there are 3.5 trillion excess dollars circulating in the economy.

Federal Reserve

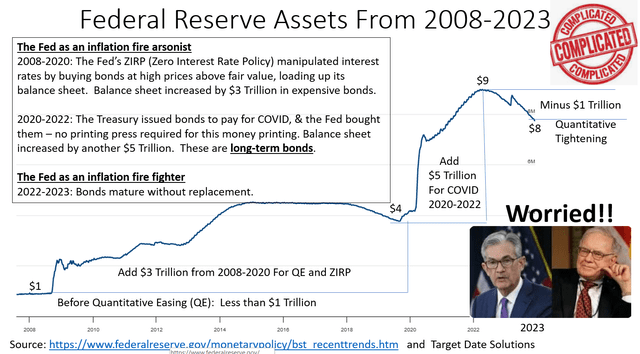

Concern #3: The Fed balance sheet has ballooned to 8 times its normal level. Unwinding the balance sheet with Quantitative Tightening (QT) has started. The Fed is allowing bonds to mature without replacing them.

Federal Reserve

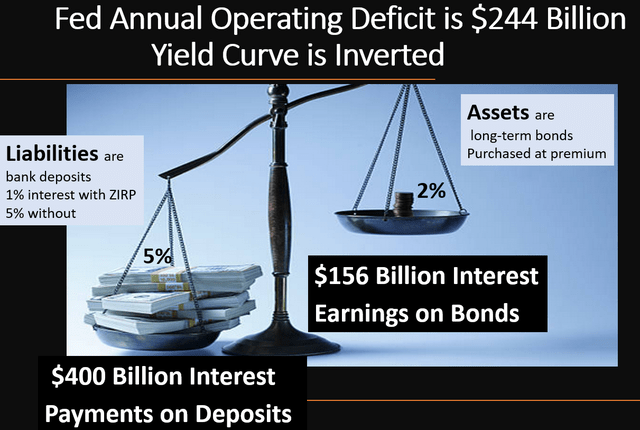

Concern #4: QT creates serious operating deficits where the Fed is losing more than $200 billion per year. It “pays” for this loss with a bookkeeping entry for “deferred assets” which is an IOU in itself.

Federal Reserve

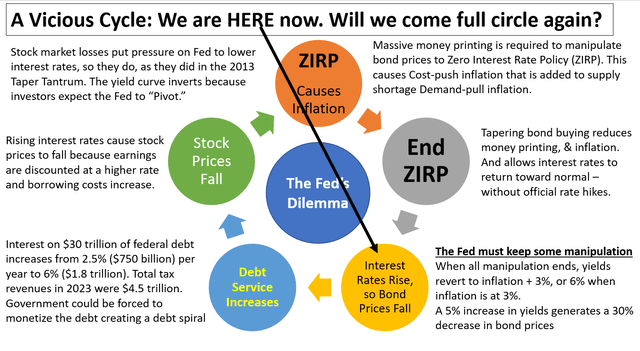

Concern #5: There is no way out. The Fed has a dilemma. It is caught in a cycle that is challenging to end. It’s like the roundabout in National Lampoon’s European Vacation.

Target Date Solutions

Conclusion

The Fed announced today that it is leaving interest rates unchanged. Was this the “right” decision? Is this what you expected? Apparently, the stock market was surprised since it’s lost value as of the time I write this.

What will they decide at the next meeting?