Torsten Asmus

I’ve covered some of the more important trends impacting bonds and bond ETFs these past few years, as Federal Reserve hikes have led to wild swings in interest rates and broader bond market conditions. Last time I covered these issues for the Vanguard Total Bond Market Index Fund ETF (NASDAQ:BND), nominal rates were high, real rates were low, the yield curve was inverted, and credit spreads were slightly narrower than average. Some of these trends have reversed course, some remain broadly the same. Right now, the following stands out about bond market conditions.

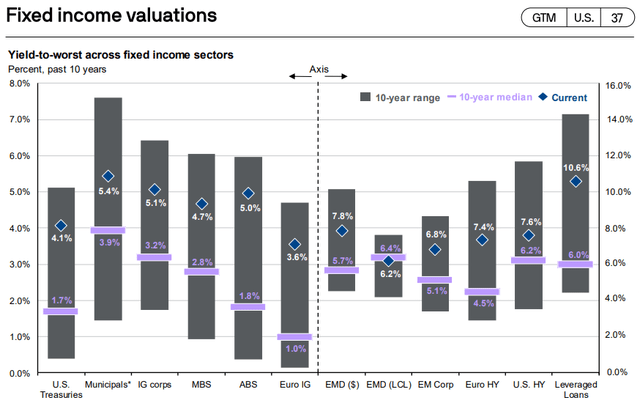

Rates are at their highest levels in decades, across bond sub-asset classes.

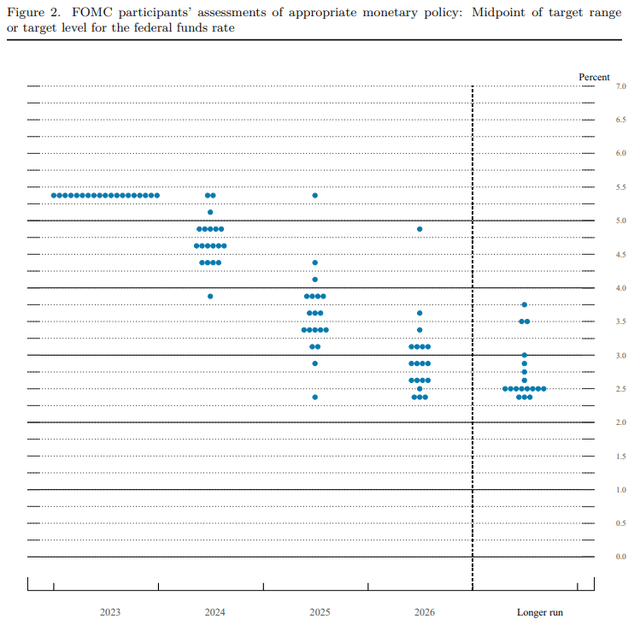

The Federal Reserve will likely cut rates in the coming months. Under current guidance, rates would remain at above-average levels for several years.

Longer-term bonds yield less than shorter-term securities as investors expect significant rate cuts in the coming months.

Credit spreads have narrowed even as default rates rise, although neither trend is significant. So far, at least.

In my opinion and considering the above, bonds remain a strong asset class, and a broad buy. Investment-grade bonds look more compelling than riskier high-yield bonds, due to narrow credit spreads and rising default rates. Shorter-term bonds also look more compelling, due to their higher yields and market expectations of rate cuts.

I’ll be focusing on BND for the remainder of this article, as a stand-in for the broader bond market. Still, everything here should apply to bonds as an asset class and to most bond funds in roughly equal measure.

BND – Quick Overview

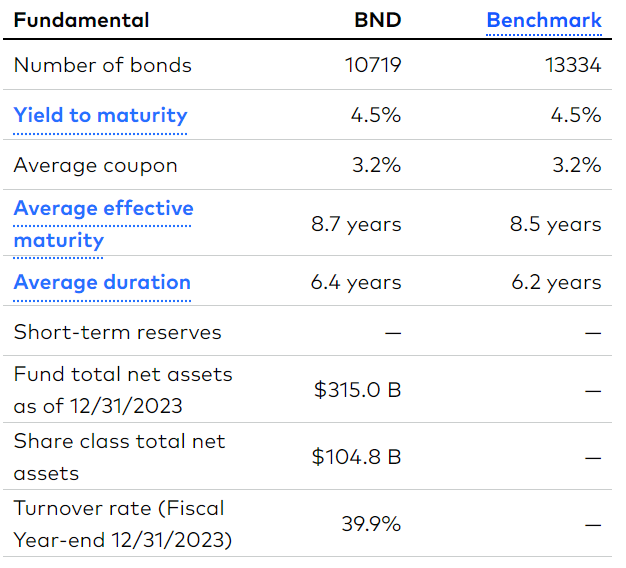

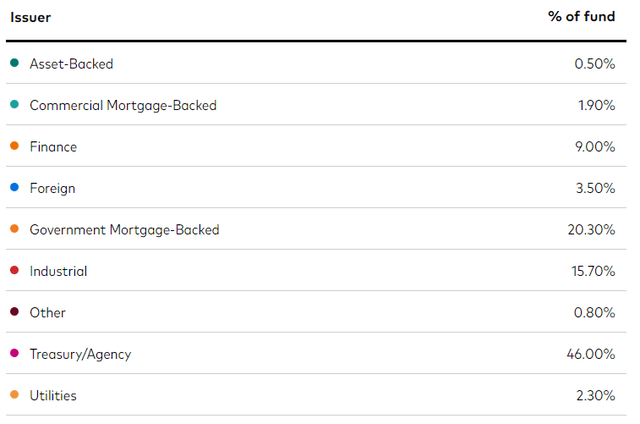

BND is a diversified bond index ETF, tracking the Bloomberg U.S. Aggregate Bond Index. It is a relatively simple, broad-based index, targeting the U.S. bond market, and including treasuries, investment-grade bonds, mortgage-backed securities (MBS), and other government-related securities. It excludes high-yield corporate bonds, with these accounting for around 8% of the U.S. bond market.

BND itself invests in over 10,000 securities from most relevant bond sub-asset classes. It is also the largest bond ETF in the market, with a whopping $315B in AUMs. Second largest is the iShares Core U.S. Aggregate Bond ETF (AGG) with $100B, tracking the same index as BND.

BND provides investors with broad-based exposure to U.S. bonds. Let’s have a look at some recent developments impacting these securities.

U.S. Bond Market – Recent Developments

Elevated Rates

Federal Reserve rates rose during most of 2022 and 2023, to combat inflation. Higher Fed rates caused market rates to spike across asset classes, with very few exceptions. Currently, rates are around 2.0% – 3.0% higher than average, depending on the asset class. Senior loans are the highest, at 10.6%.

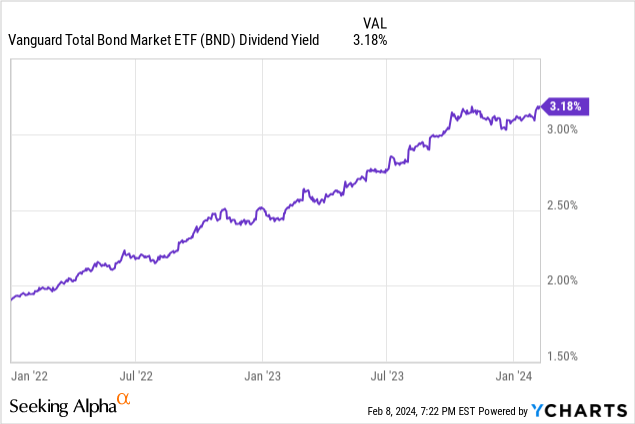

BND’s dividends have grown at a 12% CAGR since early 2022, with yields rising by around 1.3%. Under current conditions, the fund’s yield should rise another 1.2% in the coming years, as its older, lower-yielding bonds are replaced with newer, higher-yielding alternatives. Figures taken from fund data, and consistent with the graph above. Much will depend on future Fed policy, however.

Considering the above, I believe that bonds are a strong asset class, and a broad buy. Different investors might prefer different types of bonds, with risk-averse short-term investors sticking to treasuries, those looking for a bit more yield focusing on high-yield bonds or senior loans.

Likely Federal Reserve Cuts

The Federal Reserve is guiding for three rate cuts this year, several more in the next few years, and a 2.5% terminal rate.

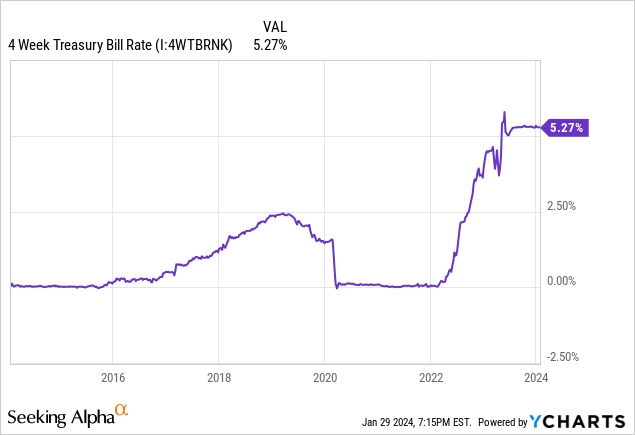

Lower Federal Reserve will almost certainly lead to lower interest rates on approximately all short-term and variable rate asset classes, including t-bills, CDs, floating rate treasuries, senior loans, CLO debt tranches, and others. Specifics vary, but most of these should continue to offer strong yields even after the Fed cuts rates.

As an example, current Fed guidance implies t-bill rates of 4.50% – 4.75% at years end, quite good on an absolute basis, and much higher than during most of the past decade.

Data by YCharts

As another example, senior loans currently yield 3.0% more than high-yield corporate bonds. Under current Fed guidance, senior loans would yield around 2.0% – 2.5% more than these bonds at years end, still a very healthy spread.

Significant rate cuts would lead to further declines in yields and dividends, however.

Lower Federal Reserve rates should also lead to lower rates on most medium and long-term bonds, including treasuries, investment-grade bonds, high-yield bonds, and municipals. Importantly, much will depend on the magnitude and timing of any future cuts. Significant, swift rate cuts would almost certainly result in lower market rates, less so for more smaller, slower cuts. This is because the market expects significant rate cuts already and is pricing bonds accordingly.

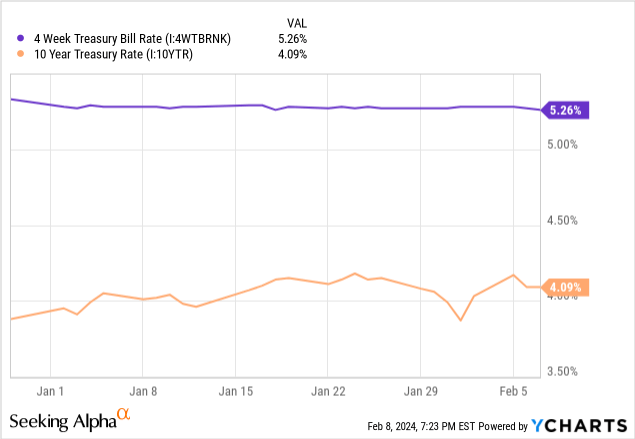

As an example, 10Y treasuries already yield less than t-bills, because investors expect rate cuts in the near future. Lower Fed rates might not necessarily lead to lower 10Y treasury rates because these already yield less than Fed rates.

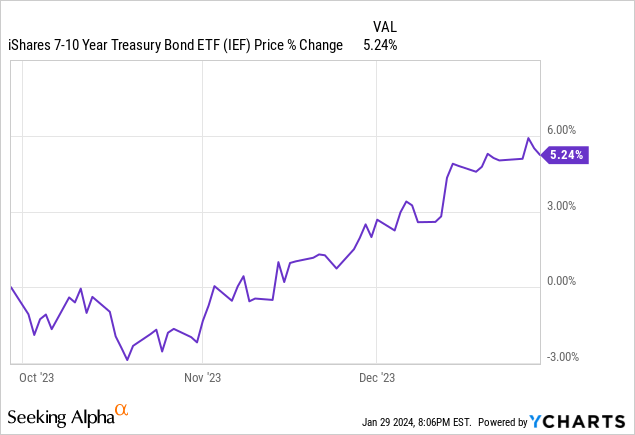

As another example, treasury prices rose 5.2% during 4Q2023, due to dovish Fed guidance. At least some gains have already occurred, so further gains are far from guaranteed.

Data by YCharts

As mentioned previously, the magnitude and timing of any future cuts matters. I would not expect 10Y treasury yields to decline if the Fed cuts rates by 0.25% per year for the next few years, but I would expect them to plummet if the Fed cuts rates to zero.

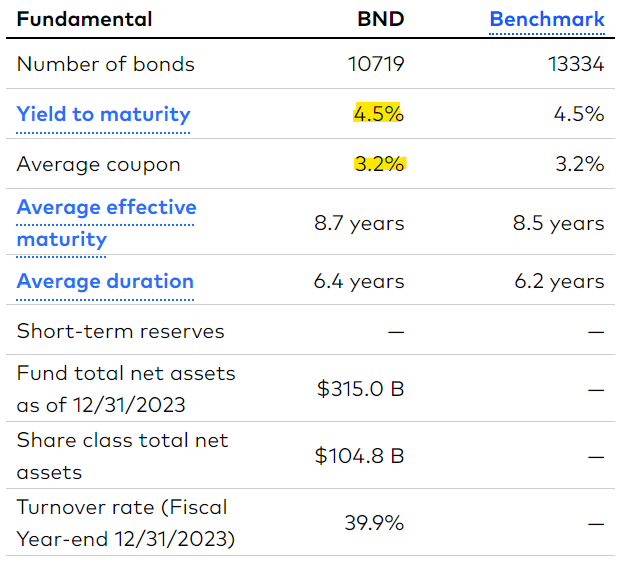

For BND itself the situation is a bit more complicated. Right now, assuming no changes to Fed or market rates, the fund should see its yield increase by around 1.3% in the coming years. This is because the fund still holds several old bonds from before the Fed hiked, with low coupon rates. Overall, the fund’s current portfolio has an average coupon rate of 3.2%, but a yield to maturity of 4.5%. As bonds mature that 3.2% should become a 4.5%. At least assuming no changes to market interest rates.

BND

Considering the above, for BND’s dividends to decline market interest rates would have to go down by more than 1.3%.

As BND invests in fixed-rate bonds, changes to market interest rates should have approximately zero impact on the yield of its current portfolio, or on short-term fund dividends. These would only start to change as the fund’s bonds start to mature, and get replaced by newer, lower-yielding ones. The process should start a few months after rates change but take several years to finalize. As an example, the Fed started to hike in early 2022, and the fund’s dividends have only grown by around half as much as expected.

Overall, I don’t expect BND’s dividends to significantly decline this year or the next. Too much dividend growth is expected to happen due to prior hikes, and it will take months / years for future cuts to impact the fund’s dividends. Same is true for most other medium and long-term bond funds. Much will depend on future Fed policy, however.

Credit Spreads and Default Rates

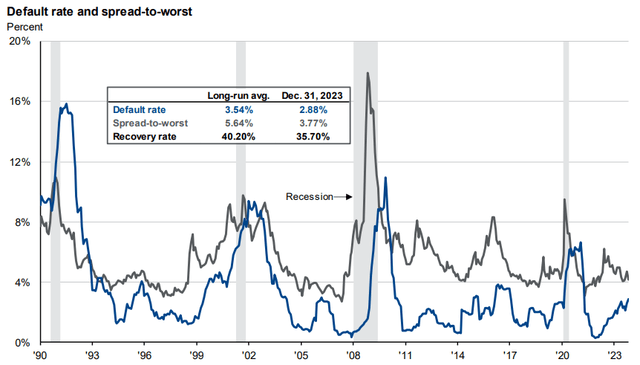

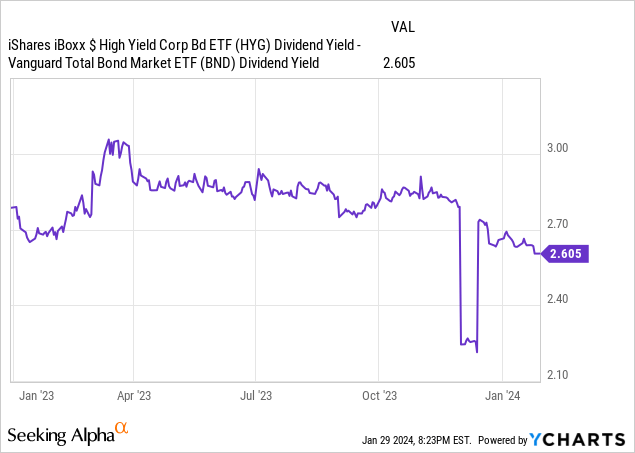

Credit spreads have narrowed since early 2023 and are currently at historically below-average levels. Spreads are around 1.0% narrower than the recent average, almost 2.0% than the long-term average.

Spreads between benchmark high-yield corporate bond ETFs and BND itself have also narrowed since early 2023, with some volatility.

Data by YCharts

Narrower credit spreads increase the relative value proposition of investment-grade bonds and bond funds, including BND, over riskier high-yield corporate bonds and bond funds.

Default rates have also risen, from close to zero in 2021, to 3.0% – 4.0%, as per J.P. Morgan and S&P data. Default rates are somewhat higher than in recent years, perhaps a bit lower than long-term historical averages.

Higher default rates also make investment-grade bonds stronger than high-yield bonds, at least relative to the past. Investment-grade bonds are less impacted by rising default rates, due to being issued by comparatively strong, resilient companies. BND itself almost exclusively invests in investment-grade bonds. High-yield bonds are issued by weaker, riskier companies, and more impacted by rising default rates.

The combination of narrower credit spreads and higher default rates make high-yield corporate bonds less attractive as an asset class over investment-grade bonds. I’m personally quite bullish on the economy so remain bullish on high-yield bonds, but these two trends do point in the opposite direction.

Conclusion

Several important trends and developments are impacting bonds and bond funds, including BND.

Rates are at their highest levels in decades, across asset classes.

The Federal Reserve will likely cut rates in the coming months. Market rates should decline as well, although much will depend on the magnitude and timing of future cuts.

Longer-term bonds yield less than shorter-term securities as investors expect significant rate cuts in the coming months.

Credit spreads have narrowed even as default rates rise, although neither trend is significant.

In my opinion, and considering the above, bonds remain a strong asset class, and are a broad buy.