The price of Bitcoin (BTC) dropped to the key support zone at $41,344, prompting market participants to shift their attention to Ethereum and other cryptocurrencies.

In my view, the approval of BTC Spot ETFs by the Securities and Exchange Commission (SEC) acted as a “sell the news” event, causing Bitcoin to incur a 15% loss after the announcement of these approvals.

One significant development last week was the SEC’s announcement on Tuesday that tweets about approving Bitcoin exchange-traded funds (ETFs) circulating on social media were untrue.

This revelation came after a false announcement was made on the SEC’s compromised Twitter account (SEC_X), resulting in substantial losses, with over $300 million vanishing from the Bitcoin market in moments.

Following this incident, the actual approval of Bitcoin ETFs by the SEC led to significant price swings, ranging between $48,500 and $41,000 within just two days. However, it appears that the anticipated Bitcoin explosion upon the decision did not materialize.

Ethereum prices surged by approximately 15% from their lows following the approval of Bitcoin ETFs, raising expectations that it could be the next cryptocurrency to receive ETF approvals, marking another significant development in the crypto world.

The trading volumes for ETFs surpassed $2.5 billion in the first few minutes of their launch. Despite this, Fox Business, the second-largest asset manager globally after BlackRock, prohibited its clients from buying the new Bitcoin ETFs, stating that these products “do not align with the company’s investment philosophy.” Just because the SEC allows their existence does not mean the private sector must accept them.

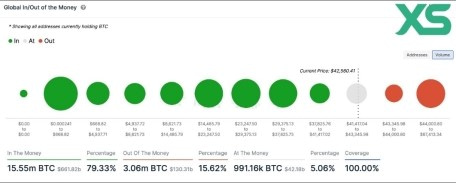

I believe that concerns in the crypto markets will continue to dominate Wall Street, weakening any rally in digital currency prices led by Bitcoin, justifying the recent price decline. At the current price, 79.33% of Bitcoin wallet addresses show reasonable profits according to data. The accumulation of assets by Bitcoin whales may stimulate cryptocurrency recovery by fueling demand.

At the current rate, BlackRock might end up owning more Bitcoin than MicroStrategy by February 1st. However, this could change if the current rates of holding the currency slow down or if Bitcoin prices rise. Demand for Bitcoin from ETF issuers may also stimulate a recovery in Bitcoin prices, as the downward trend for the asset seems to have reached support at $41,700.

From the above chart, we can observe that BTC is currently in the support zone of $41,417 to $43,345, where 2.93 million addresses hold 991,100 BTC, according to Into theBlock data. Therefore, the next target in the upward direction would be the $43,345 level.

From the above chart, we can observe that BTC is currently in the support zone of $41,417 to $43,345, where 2.93 million addresses hold 991,100 BTC, according to Into theBlock data. Therefore, the next target in the upward direction would be the $43,345 level.

In my opinion, factors likely contributing to the recent decline in Bitcoin include an increase in supply on exchanges and profit-taking by whales. Bitcoin supply on exchanges rose from its six-month low of 5.30% on January 7th to 5.39% yesterday. Typically, an increase in the supply of the asset on exchanges is bearish, as it may contribute to upward selling pressure. Sentiment data also shows how recent spikes in whale transactions valued at $100,000 or more coincide with similar movements in the network’s profit/loss metric. This indicates that large wallet addresses are already realizing profits, unlike retail traders and smaller portfolios, contributing to the downward pressure on BTC prices.

Finally, the Bitcoin Fear and Greed Index, which analyzes the current market sentiment of BTC holders, shows a shift from “extreme fear” to neutrality. This might be one of the reasons why the market did not respond strongly to the awaited approvals news, and the reaction was not as robust as expected.