One of the most effective ways to build semi-passive income is to own your primary residence, live in it for several years, then rent it out and purchase a nicer property. If you’re aiming to retire early, over a 20-year career, you could easily build a rental property portfolio consisting of 3-5 units. This has been an integral part of my early retirement plan since 1999.

Not only does this strategy generate more semi-passive income, but it also allows you to climb the property ladder and live in a nicer home over time. However, it’s crucial to do so in a responsible way, as opposed to taking all the equity in your multiple rental properties and buying one premium place.

Throughout my transitions, moving from buying a new home to renting out my old one has consistently resulted in finding renters within one month. However, this time it took four months, attributed to bad timing, bad planning, and indifference.

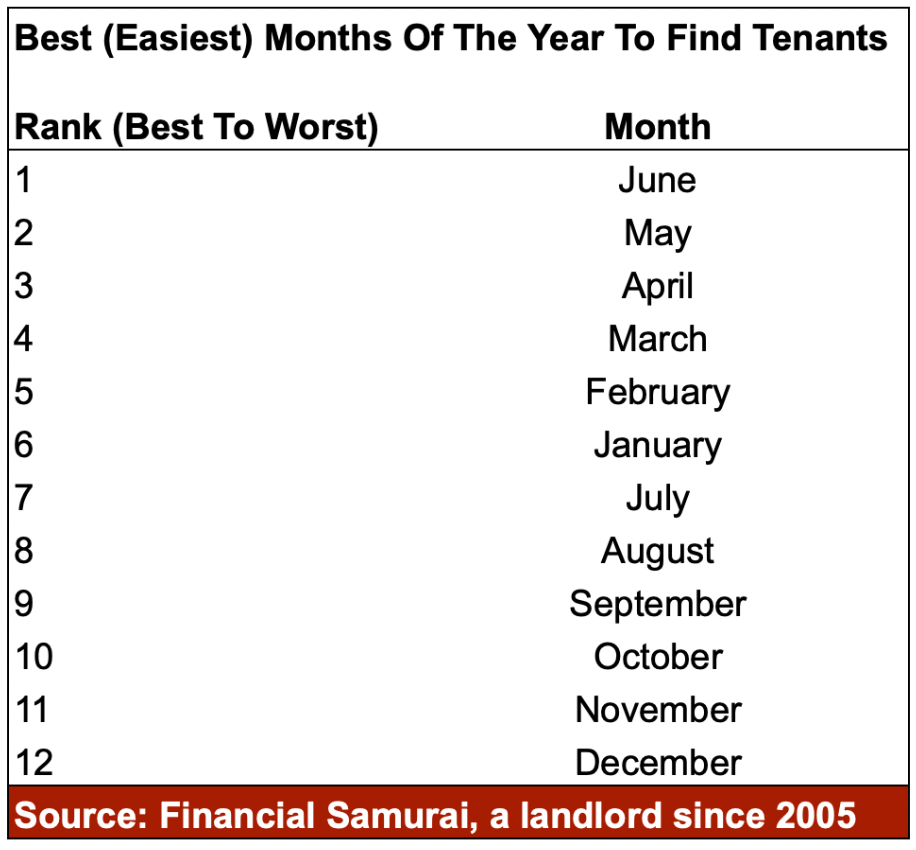

For those of you who want to own rental properties, let me share the best and worst times to find renters. I’ve been a landlord since 2005 and want to invest in more passive real estate investments as I get older.

The Worst Time Of The Year To Find Renters: October, November, December

The most challenging period to secure renters falls in the fourth quarter of the year: October, November, and December. This difficulty is amplified when attempting to rent out a single-family house to families with children.

The primary reason behind the daunting task of finding renters during these months is that the majority of people don’t want to move if they don’t have to. School typically commences in August or September, necessitating parents and students to secure housing well before these months.

Graduations for students commonly occur in May or June, with job offers typically materializing in July or August. Consequently, by the time the fourth quarter arrives, a significant portion of potential renters will have already found housing.

If you are in the process of searching for quality renters during the fourth quarter, you may either need to extend your waiting period or consider lowering your asking price. For renters seeking a place in the fourth quarter, there may be an opportunity to negotiate a better deal, but the available inventory of rental properties will likely be more limited.

For those looking to buy, the best time of the year to buy property is also during the fourth quarter. Sellers listing during this time are generally more motivated.

The Best Time Of The Year To Find Renters: April, May, June

The optimal period for securing tenants is during April, May, and June. The second quarter of the year witnesses heightened planning and movement as a result of the conclusion of the school year and the onset of summer vacation.

Families with children, particularly those aiming to minimize disruptions during the school year, prefer to locate a rental property and sign a lease that commences the month school concludes. This strategic timing allows families to utilize the summer for the relocation process, including moving, unpacking, furnishing, and decorating, before the commencement of the new school year in August or September.

In contrast, new college graduates seeking housing do not face the same level of urgency, but it’s still there. They may choose to reside with their parents for the summer before embarking on their work journey, delaying their search for rental properties until July or August.

Alternatively, they might opt for a final summer vacation to explore the world, akin to my experience with my 1999 trip to Japan and Taiwan before commencing my role at Goldman in August 1999.

The Second Best Time To Find Renters: January, February, March

The second-best time to find renters falls within January, February, and March, the first quarter of the year. The onset of the new year frequently triggers fresh beginnings for individuals, as some may aspire to secure new jobs, relocate to different cities, switch neighborhoods, save money, or undergo changes in their relationships.

While the winter holidays typically witness fewer people moving, the period following these holidays often sparks a renewed motivation to enhance one’s life. My new tenants were all residents of sleepy Santa Clara county, situated approximately one hour south of San Francisco. Seeking a more dynamic lifestyle in their twenties, they were eager to immerse themselves in the excitement of big city living.

Among the three months of the first quarter, March proves to be more conducive to finding tenants compared to February, with January being the most challenging of the three. The closer you get to the second quarter, the ideal time to find renters, the better.

The Challenge Rental Property Owners Face

Each month that a rental property remains unoccupied represents a loss of potential income. Even if the property is fully paid off, there are ongoing property taxes to cover. Consequently, it is in the landlord’s best interest to secure the most suitable tenants within the shortest timeframe.

Simultaneously, the ramifications of having a problematic tenant can far outweigh the costs associated with keeping a rental property vacant until an ideal tenant is found. It is crucial to meticulously screen each tenant, engage in discussions with their previous landlords, obtain evidence of employment and financial stability, and establish a robust rental lease agreement.

If you discover your tenants want to move out at the end of the third quarter or during the fourth quarter, the worst times to find new renters, there may be a strategic need to encourage them to stay until at least the new year. Incentivizing such an arrangement can be beneficial for both parties involved.

The Pleasure Of An Unoccupied Rental Property

While the search for suitable tenants proved challenging during October, November, and December, I found solace in having an empty rental house. This period allowed me to make necessary improvements, including touching up interior and exterior walls, and having my handyman replace some rotted deck planks.

October was an exceptionally busy month, as my family had just moved into our new house. Unpacking, setting up systems (wifi, solar, cable, ecology, etc.), buying furniture, and decorating consumed our time. Having the empty rental property provided the opportunity to enhance its condition at a relaxed pace while focusing on our new home.

I even transformed our old rental property into a wellness center for a day, offering a welcome respite to soothe the nerves and rejuvenate the mind after seven years of raising young children.

After three months of not renting out the property, a sense of economic urgency prompted me to reconsider its status. Although I had contemplated keeping the house vacant for personal retreats or accommodating extended family members, the cost was too much to bear.

I ultimately decided against selling given I anticipate another boom in San Francisco real estate prices due to the growth of artificial intelligence. Consequently, my best option was to rent it out.

This decision aligned with the formulation of my investment thesis, coinciding with the new year—a more opportune time to seek tenants.

How We Minimized Disruption For Our Kids With The Off-Cycle Move

Despite stating that October, November, and December are the least favorable months for finding renters, we decided to move in October, even with our kids already attending school. I tried to delay escrow for as long as possible to give us more time to prepare.

Here’s how we managed to minimize disruptions.

Our new house is merely 0.5 miles away from the old one, ensuring that the commute to school remains virtually the same.

We decided to move on a Friday morning after I dropped both kids to school. We then arranged the movers from 9 am – 4 pm. By the time I brought the kids home, our belongings were all transferred to the new house.

Crucially, our kids were familiar with the new house, having visited it at least 15 times over an 18-month period before we purchased it. We toured it as a family in May 2022 when it first hit the market, providing ample time for them to explore both the interior and exterior, accumulating at least ten hours of familiarity before the move.

In preparation for the move, we engaged the kids in discussions about where they would like to sleep and how they envisioned arranging the furniture. Additionally, my wife dedicated time to decorating their new rooms with their old wall decorations, making their rooms feel like home.

The 18-month duration it took for us to finalize the house purchase contributed significantly to our comfort level when we finally made the move. By then, it felt like owning the house was in our destiny as we were all mentally prepared.

A Natural Return To The Optimal Rental Cycle

While the worst months may pose challenges in finding tenants, there’s an opportunity to naturally revert to a cycle of securing good tenants during the better or best months.

For instance, if you faced difficulty finding tenants in October, November, December, and January but eventually succeeded in February, you’re now operating on a February-to-February cycle, given the typical one-year lease followed by a month-to-month arrangement. You likely no longer need to find tenants during the fourth quarter again.

The likelihood of your tenants moving out precisely a year later is also not guaranteed. In reality, they might choose to relocate in April, May, or June—the prime time for tenant searches, as it aligns with when most people tend to move. In essence, once you have tenants, you might naturally synchronize with the best cycle for finding new tenants.

Human behavior often follows patterns, akin to how people tend to commute between 8 am and 10 am, leading to intense rush hour traffic. Similarly, there’s a tendency for people to eat lunch between 12 noon and 1 pm, causing lengthy lines.

Adjusting these routines by just 30 minutes could save considerable time, but often, people are resistant to change even when it could enhance their situation.

Should Have Planned Better To Get Tenants

I didn’t anticipate that it would take four months for me to secure new renters. My timing to find new tenants, along with my overall sense of urgency, was off.

I was hesitant to introduce new tenants and potential new issues into my life after the new house purchase. During the beginning, maintaining stability was priority over cash flow.

Moreover, the more expensive a house is to rent out, the more challenging it can be to find tenants who can afford to pay six figures in rent. The “sales cycle” tends to be longer as a result.

As you age and, hopefully, accumulate wealth, there might be a tendency to become less proactive in finding new tenants. In my 30s, new tenants would often start the same week the old ones moved out. Today, not as much.

No More Physical Rental Properties After This

At this stage in my life, I had initially planned to focus on investing in private real estate funds with my incremental cash flow. However, I find myself managing yet another rental property because I couldn’t resist buying the nicest property within my means while my kids still lived at home.

But I promise you, I have purchased my last physical property for at least eight years.

While owning rental properties is one of the best paths to financial independence, being a successful landlord requires careful planning and effort. There may be fortunate stretches of not hearing from tenants, but these peaceful periods inevitably won’t last.

Best of luck in finding tenants for your rentals! I hope you learn from my experience and boost your semi-passive income over time.

Reader Questions And Recommendations

When do you think is the best time to find tenants? Have you purposefully forgone rental income before in hopes of finding better tenants? If so, how did you decide on when was the right time to take action?

If you’re looking to own rental properties without the hassle of being a landlord, check out Fundrise. Fundrise primarily invests in residential and industrial properties in the Sunbelt region where yields are higher and valuations are lower. Overall, its private funds manage over $3.5 billion in equity for over 500,000 investors.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.