VioletaStoimenova

One of the biggest pitfalls that value investors need to avoid is making a decision to buy a company solely off of that company’s historical financial performance and its current valuation. I would say that nine times out of 10, such a simple analysis can yield attractive results. But it can also result in missed opportunities and value traps, the former of which means that investors are missing out on a good opportunity, and the latter of which ends in some rather painful losses. One company that, from a valuation perspective only, looks rather pricey, is The Bancorp (NASDAQ:TBBK). But once you dig deeper and see what the company is cooking, the picture becomes a lot more interesting. Compared to other banks, shares are quite expensive. But when you factor in the rapid growth the company is experiencing and its growth prospects, the picture looks much more interesting.

A pricey bank worth considering

Just like any traditional bank, The Bancorp engages in a wide variety of services that you would expect. For instance, it accepts deposits, allowing customers to allocate said deposits into checking accounts, savings accounts, money market accounts, and other similar offerings. It also uses those deposits to engage in various investment activities. Examples include, but are not limited to, the origination of SBA loans, as well as other specialty financing activities like the issuance of securities backed lines of credit and insurance policy cash value backed lines of credit. The company also provides investment advisor financing specifically to investment advisors looking to either grow or establish their presence.

In recent years, management has also focused on other initiatives. As an example, the company has an entire arm of itself that’s dedicated to providing checking and savings accounts, as well as other banking services, to financial technology firms and similar enterprises. Some of the other services that it provides to these types of companies include fraud detection, anti-money laundering, consumer compliance, and more. It even provides ACH processing and credit card sponsoring services. Through the card issuing services division, the company issues debit and prepaid cards to both consumer and business accounts. It also handles payroll, corporate incentive, pre-tax medical spending benefit, and other related services.

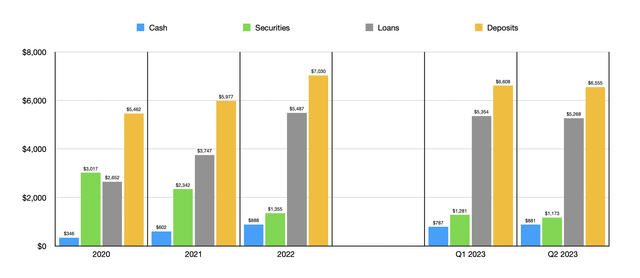

Author – SEC EDGAR Data

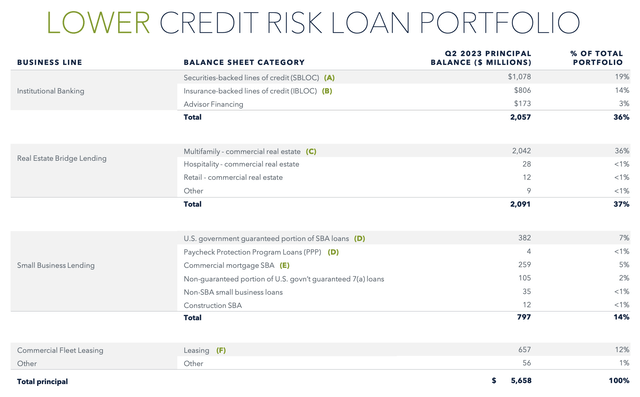

Over the past few years, management has achieved some rather meaningful growth for the bank. The value of loans on its books, for instance, more than doubled from $2.65 billion in 2020 to $5.49 billion in 2022. Loans have decreased modestly since then, dropping to $5.27 billion by the end of the second quarter of this year. Before I point you to the image below for some details regarding my own composition, I would like to point out that the image has a higher number for loans than what I just provided. This is because I included a portion of its loans into the securities that the company has since they are being classified as held for sale as opposed to held to maturity. They were even separated from the rest of the loans on the company’s balance sheet. But I digress. About 36% of the value of the company’s loans fall under its institutional banking line. This includes the aforementioned securities backed lines of credit and insurance backed lines of credit, as well as advisor financing. 37%, meanwhile, fall under real estate bridge lending activities, with multifamily commercial real estate comprising the overwhelming majority of that amount. 14% involves small business lending, with most of that involving SBA loans. The rest of the loans, totaling about 13% in all, fall under commercial fleet leasing activities or other miscellaneous activities.

The Bancorp

I mentioned already the value of securities. Some of the increase in loans was driven by a voluntary transition from having some assets in securities to instead being in loans that the institution issues. From 2020 through 2022, securities values dropped from $3.02 billion to $1.36 billion. By the end of the second quarter of this year, they had fallen to $1.17 billion. Cash and cash equivalents, meanwhile, posted a nice increase over the past three years and, since then, has remained in a fairly narrow range. As of the end of the second quarter, cash totaled $880.5 million.

Author – SEC EDGAR Data

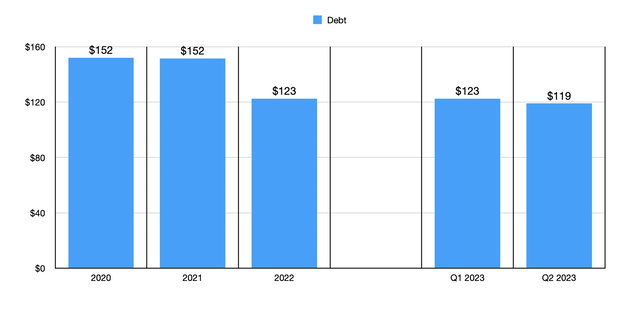

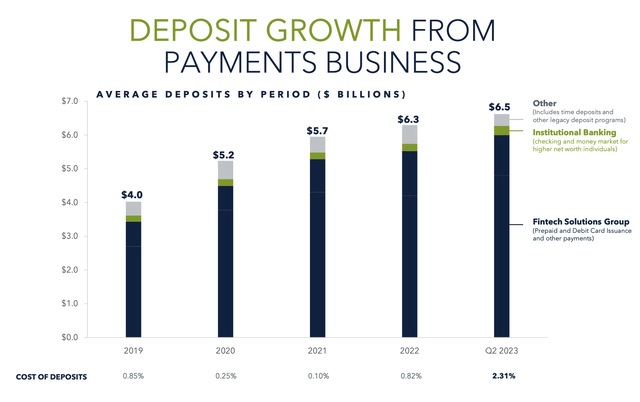

None of this would have been possible without a surge in deposits. The value of deposits jumped from $5.46 billion in 2020 to $7.03 billion in 2022. Likely because of the banking crisis that occurred earlier this year, deposits have pulled back slightly, dropping to $6.61 billion in the first quarter of this year before dipping further to $6.56 billion. While this is worrisome on its own, it is important to note that only 9% of the company’s loans are classified as uninsured. This is excellent in and of itself because it means that the risk of further declines in deposits is rather small. Add on top of this the fact that debt is only $119 million, which is a decrease over what the company had in prior years, and there is a lot to be bullish on from a stability perspective.

Author – SEC EDGAR Data

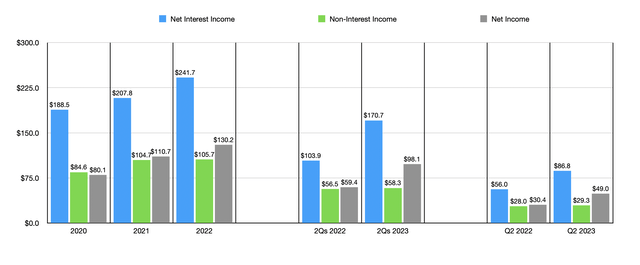

The overall growth for the bank has allowed it’s net interest income to grow from $188.5 million in 2020 to $241.7 million in 2022. Non-interest income also increased during this time, rising from $84.6 million to $105.7 million. And finally, net income for the bank jumped from $80.1 million to $130.2 million. For the current fiscal year, financial performance has continued to come in strong. Net interest income skyrocketed from $103.9 million in the first half of last year to $170.7 million the same time this year. We saw a small increase in non-interest income and a near doubling in net income from $59.4 million to $98.1 million.

The Bancorp

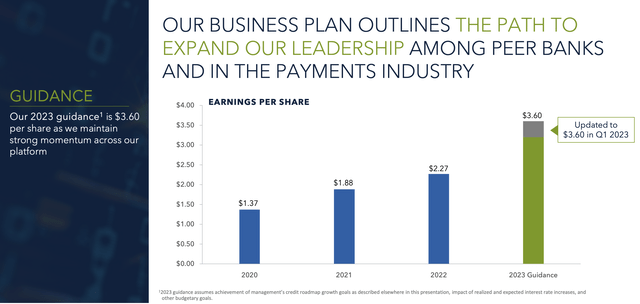

Purely from a valuation perspective, shares don’t look great. Using data from last year, the bank is trading at a price to earnings multiple of 14.4. The average in the space is roughly 10.4 and I have analyzed many banks with multiples ranging between 6 and 10. Some have even come in below that range. Similarly, the company is trading at 2.6 times its book value per share. Banks these days tend to trade somewhere between a decent discount to their book value and a decent premium, but almost never at a level that’s high. But this is where the picture starts to get more interesting. You see, management is forecasting earnings per share this year of $3.60. That would imply net profits of $196.4 million. That would bring the price to earnings multiple for the bank down considerably to 9.6. This doesn’t change the price to book value, but it should also decrease some so long as continued profit generation translates to a rise in the book value of equity for the bank.

The Bancorp

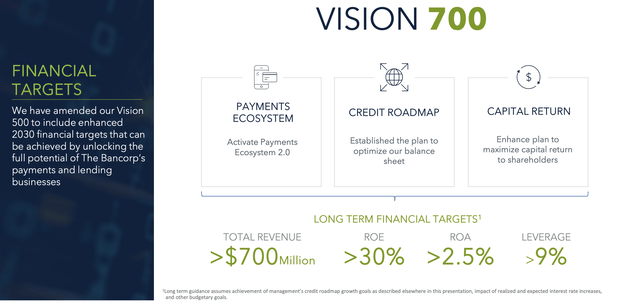

This growth seems to be only the start of the plans that management has. You see, in its latest investor presentation, the company discussed what it calls Vision 700. This is a plan for the company to unlock the ‘full potential’ of its payments and lending business. This includes activating its payments ecosystem 2.0, utilizing the growth it receives from this to optimize its balance sheet, and working to return capital to shareholders along the way. By 2030, management hopes for this part of the company to grow revenue to more than $700 million per year. By working directly with financial technology companies through the sponsorship of credit and debit cards, as well as by facilitating other payment activities, the company hopes to not only generate revenue from its payment ecosystem, but also to bring in additional deposits that it can use to lend out even more.

The Bancorp

Already, 22% of the revenue generated by the bank comes from its financial technology solutions. And deposit growth from its payments business has been impressive. Back in 2019, for instance, $4 billion worth of deposits were attributable to this part of the enterprise. By the end of the most recent quarter, this number had grown to $6.5 billion. When you then combine this with a strategy of focusing on the aforementioned specialized lending activities to the bank already engages in, activities that, it should be mentioned, have a low loss history, the upside potential for investors can be meaningful.

Takeaway

Based on the data provided, The Bancorp looks, at first, to be a rather expensive prospect. But when you look under the hood and see what management is working on, that picture changes rather rapidly. The company is growing nicely and the long-term trajectory for it should be positive. Absent anything unexpected coming out of the woodwork, I would make the case that further upside probably exists from here. And because of that, I have decided to rate the business a ‘buy’ at this time.