I’ve been wondering when I was going to see the analyst community start to get nervous about the other EV companies.

For the last month, we’ve watched the Wall Street analyst community back away from Tesla like it was an angry cat in the corner of the room. Dropping their buy/hold/sell recommendations on shares of Tesla (TSLA) and then the target prices.

There’s still more downgrade activity to come for Tesla, as headlines that Elon Musk is being dragged into the SEC’s Twitter probe is another distraction that could end poorly for Musk.

This morning, Rivian (RIVN)’s management team woke up to another downgrade of their stock.

Shares of Rivian are trading about 4% lower after Barklay’s downgraded the stock to a hold.

I know what you’re saying… “CJ, the analyst recommendations don’t mean a thing.” Wrong. Billions of investing dollars are persuaded to buy and sell stocks on this small group’s opinion. From the financial advisors that work for the firms the analysts represent to the Main Street investor.

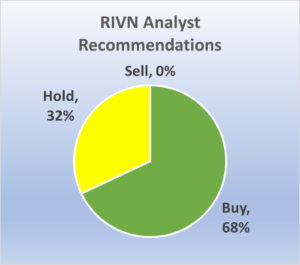

Here’s the kicker. The analyst community likes to act as a team, not individuals. When one breaks rank, they all eventually follow. This is why you need to beware of what’s to come with Rivian.

Here’ how it plays out…

Rivian shares just poked their head up above $15 last week. This is the critical “must hold” price in order for the shares to avoid a 20-30% decline. A move below $15 will get more analyst downgrades as well as an increase in panic selling.

Remember, the company’s earnings are approaching on the 21st, and the earnings trend has not been friendly for the stock.

Bottom Line

Tesla is lowering prices on the “Y”, which tells you that there is more than smoke in the EV kitchen… it’s a fire. Rivian shares should be seen in the same light as hybrid cars make what appears to be a glorious comeback.

I’m targeting a move to $12 followed by $10 on Rivian as the analysts start to migrate away from this stock.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.