Slaven Vlasic

Tesla: Worst Performer In S&P 500 In Q1

Tesla, Inc. (NASDAQ:TSLA) investors are likely disappointed about the performance of TSLA in Q1, as it finished as the worst-performing stock in the S&P 500 (SPX, SPY). Along the way, CEO Elon Musk also lost his coveted “gold medal” position as the world’s richest person to Amazon (AMZN) Chairman Jeff Bezos. Accordingly, TSLA fell to the $160 level, as TSLA bears threatened to re-test its April 2023 lows ($150 level). With TSLA recovering above the $175 level but still struggling for buying momentum, TSLA bulls must be prepared for more downside volatility as the leading EV maker releases its first-quarter deliveries and production report this week.

I’m also disappointed with TSLA’s performance, as I encouraged buyers to capitalize on TSLA’s pullback in January 2024. I had expected Tesla’s EV leadership to provide investors with confidence about a recovery in 2024, but the market hasn’t bought into my bullish thesis. Moreover, Tesla’s growth drivers from its mass-market vehicle and its Cybertruck platform might not be sufficient to rejuvenate the near-term weakness. Wall Street analysts have also downgraded Tesla’s Q1 deliveries estimates as the market prepares for disappointment over its upcoming report.

With TSLA down 30% YTD, has the market reflected sufficient pessimism in its valuation?

Can Bulls Still Justify TSLA’s Growth Valuation?

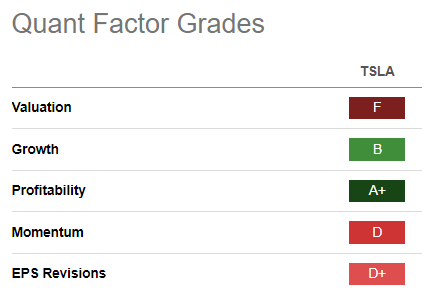

TSLA Quant Grades (Seeking Alpha)

Observant TSLA investors are likely aware Bulls would likely argue that we cannot rely on typical automotive valuation metrics to assess what TSLA should be worth. As seen above, TSLA’s “F” valuation grade suggests it is too expensive relative to its sector peers. When compared to its auto peers’ normalized EBITDA median multiple of 6.6x, TSLA’s 32.4x metric doesn’t seem to make much sense.

I believe the market has given Musk and his team the benefit of the doubt as it managed to deliver record growth over the past few years. However, with growth clearly slowing down, could 2024 be a year where Tesla delivers a YoY decline in its deliveries, as Tesla faces intense competition in domestic and global markets, particularly in China?

Revised analysts’ estimates suggest Tesla could report deliveries closer to the 425K zone, slightly above last year’s 423K. As a result, it could be a flat quarter as Tesla faces significant challenges in its key markets. Smartphone maker Xiaomi has also upped the ante as it looks to take on Tesla’s Model 3 with its newly launched EV. However, I urge Tesla investors not to be unduly concerned with new competition just because they believe they can take on Tesla. Unless they have the scale of Tesla or BYD Company (OTCPK:BYDDF), the onus is on Tesla’s competitors to prove that they can scale profitably. If they cannot scale effectively, Tesla still holds a substantial head start against these pretenders.

BYD is expected to mount a significant challenge against Tesla in China, as it looks for a 20% increase in deliveries in 2024 with 3.6M vehicles. However, it’s a markedly lower growth rate compared to 2023, as even BYD needs to manage its growth normalization phase. As a result, BYD could look toward the U.S. (with Mexico as a staging base) to penetrate the U.S. market, intensifying competition for Tesla. Therefore, Tesla must ramp up its efforts to make its mass-market platform a massive success and prove its doubters wrong, regaining investor confidence.

Accordingly, Tesla is reportedly looking to overhaul its manufacturing process with a next-gen framework that could reduce operational costs by up to 50%, based on a recent study. Could that provide a breakthrough in lifting Tesla’s profitability margins, which could stagnate for another year as Tesla looks to reset its growth cadence?

Wall Street analysts project Tesla to report an adjusted EBIT margin of 9.1% in 2024, slightly below last year’s 9.2% metric. With revenue growth expected to fall to just under 12%, Tesla is expected to face significant challenges in justifying its “F” valuation grade.

FSD Remains A Growth Optionality

Altimeter Capital CEO Bradley Gerstner highlighted his recent bullish sentiments on TSLA, arguing in favor of being “excited about companies like Tesla, especially when others are negative about them.” Gerstner underscored his belief that Tesla has a massive lead in autonomous driving, noting the Full Self-Drive, or FSD, v12 launch as a key driver.

As a result, I believe the market will likely want more clarity over Tesla’s FSD attach rates as a benchmark on adoption and potential revenue accretion from subscriptions. Despite that, I view FSD as a growth optionality that may not be sufficient to justify its expensive growth valuation. With automotive sales forming more than 90% of TSLA’s sum-of-the-parts valuation, Tesla is under significant pressure to deliver a faster vehicle growth cadence for the market to lift TSLA’s valuation higher from here.

Is TSLA Stock A Buy, Sell, Or Hold?

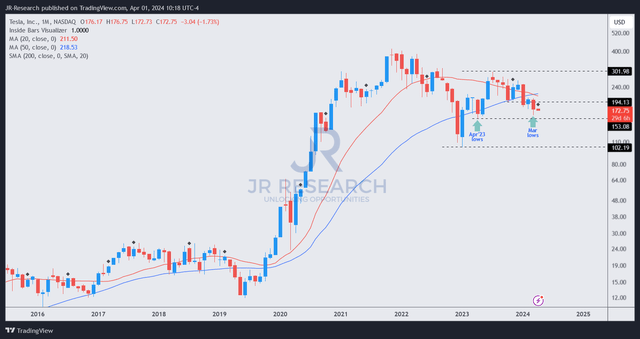

TSLA price chart (long-term, monthly) (TradingView)

TSLA buyers need to regain control over the $195 support zone to defend its uptrend bias. However, I assessed that a lower re-test of the $150 zone is looking increasingly likely. Tesla bulls could argue that a weaker deliveries report has been priced in, given TSLA’s significant underperformance over the past few months.

However, I believe Tesla, Inc. buyers must be careful and not throw caution to the wind, as buyers seem to have deserted the EV leader at crucial moments over the past few weeks. Therefore, with Tesla, Inc.’s bullish bias hanging in the balance, I believe it’s timely for me to turn more cautious as we await its Q1 report expected around April 19th.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.