Slaven Vlasic

Tesla, Inc. (NASDAQ:TSLA) investors head into one of its most important earnings conferences post-market on January 24, given the recent underperformance of TSLA. I upgraded TSLA stock in late October, following the weakness leading into Tesla’s third quarter earnings release. The upgrade was timely, as TSLA bottomed out in early November 2023, staging a recovery toward the $265 level in late December 2023. However, the buying momentum stalled and reversed before Tesla posted its full-year deliveries in January 2024. Since then, TSLA has gone on a decline for three consecutive weeks, falling to levels last seen in mid-November 2023.

As a result, I gleaned that it’s apt for me to provide a timely update to Tesla investors on whether the recent pullback should be capitalized to buy more or be more cautious.

Before we go into that, we need to take a step back and assess TSLA’s recovery over the past year. Despite the recent weakness, TSLA is still up nearly 80% over the past year, significantly outperforming the S&P 500 (SP500). Consequently, I’m not surprised that these astute dip buyers who pulled the Buy trigger when TSLA reached peak pessimism in late 2022/early 2023 (as I also emphasized) took profits (fully or partially) and rotated.

To be fair to CEO Elon Musk and his team, they slightly exceeded their full-year deliveries guidance for 2023 with 1.81M vehicles, achieving a deliveries/production ratio of 98%. Is that good? Of course, it is. It demonstrates Tesla’s ability to execute its direct-to-consumer model, which seems more complex than it looks. We don’t seem to give Tesla enough credit, as Fisker (FSR) discovered when it decided recently to “move away from its direct-to-consumer sales model to a traditional dealership model in the US.” The company highlighted that it realized the “direct sales approach is more costly and challenging than anticipated.” As a result, I believe Tesla’s ability to execute this model and post an incredibly high deliveries/production ratio is a testament to its execution prowess and strategy.

Therefore, investors shouldn’t be unduly concerned even as TSLA has underperformed the SPX since my October update, given its remarkable execution and recovery.

The question about TSLA’s high valuation has been a constant source of intense debates between Tesla Bulls and Bears. With a forward EBITDA multiple of nearly 35x against its peers’ median of 6.2x, let’s not deny the obvious that TSLA is expensive relative to peers. Seeking Alpha Quant’s “F” valuation grade corroborates my observation. Despite that, TSLA’s market outperformance over the past year suggests that investors believe valuation isn’t the most decisive factor in TSLA’s thesis. The EV market leader is still a solidly profitable leader against its legacy or smaller EV peers.

BYD Company’s (OTCPK:BYDDF) formidable challenge is undeniable. China’s NEV leader also surpassed its 3M vehicle target (including hybrids) in 2023, as BYD demonstrated its ability to scale quickly. Bolstered by its vertical integration advantages, BYD poses a significant challenge to Tesla in China. It’s also gaining traction in Europe. However, the silver lining is that BYD doesn’t seem to be in a hurry to target the U.S. market yet, allowing Tesla the opportunity to consolidate its dominance for now. The recently reduced investment cadence from the legacy makers highlighted that the EV CapEx has taken a toll amid a slower EV growth cadence. While Tesla isn’t immune, I assessed that the company’s ability to leverage pricing levers (supported by its “A+” profitability grade) to force its legacy peers and smaller rivals to change their game could be instrumental to maintaining its leadership.

Given Tesla’s expensive valuation, I believe it isn’t rocket science to CEO Musk that the market expects nothing short of impeccable execution on its deliveries growth cadence. However, Tesla’s recent price cuts in China and potentially more competitive dynamics could have led to weak investor sentiments. Investors could be concerned about Tesla’s FY24 deliveries target as we await the company’s Q4 earnings conference and guidance in less than two weeks.

Hence, considering recent developments, I assessed investors sitting on significant gains as they bought its lows and could have felt the need to reallocate some exposure. Despite that, let me help TSLA holders assess why TSLA’s price action suggests we should keep hanging on and consider buying further downside volatility.

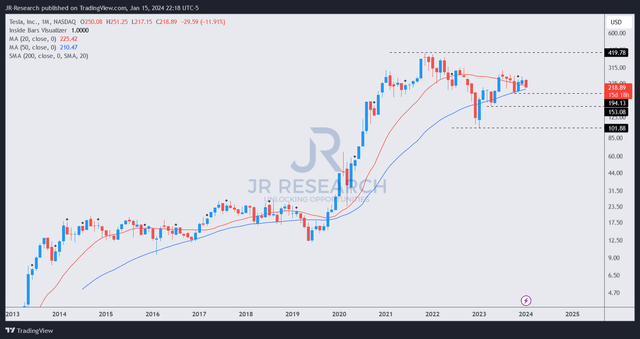

TSLA price chart (monthly, long-term) (TradingView)

TSLA’s price action suggests that its long-term uptrend bias has remained undefeated, notwithstanding the negative media sentiments. Investors who overstated its recent weakness and parlayed it into the market being bearish are missing the whole point.

As I highlighted earlier, TSLA has outperformed the SP500 over the past year. Therefore, some profit-taking and more cautious positioning as we head into its pivotal earnings release isn’t surprising.

I assess that TSLA dip buyers could return more aggressively between the $195 and low $200 zones to lift it from its recent weakness. With eight more days to go to Tesla’s earnings call, we might get there if market sentiments continue to favor Tesla Bears at the moment. However, the risk/reward on TSLA has improved markedly for buyers looking to capitalize on weakness.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.