byakkaya

Introduction

Infrastructure plays are more and more part of the few key ideas I am building my portfolio. The property of key assets that are essential for an economy is a way to benefit from the overall economic activity of a certain area. Often, infrastructure businesses have a moat due to high barriers to entry and the regulatory environment. Moreover, they often benefit from long-term contracts, economies of scale and they often develop technological expertise hard to replicate. On the other hand, these businesses are capital-intensive carry high amounts of debt, and present an operating risk. These factors may impact the overall returns and may lead many investors to stay out of these plays.

In this article, I would like to go over one of the first pure-infrastructure plays that made their way into my portfolio: Terna (OTCPK:TERRF, OTCPK:TEZNY), the largest independent electricity transmission grid operator, managing almost 75,000 km (46,602 mi) of lines, with a main focus on Italy.

Why I seek infrastructure plays

There are several compelling reasons to take the plunge in infrastructure-related stocks. To be clear, I don’t think of infrastructure only as roads, bridges, railroads, or similar. Of course, this is a big part of infrastructure. But, as far as I see it, Amazon (AMZN) is an infrastructure play, as well as Visa (V) or Mastercard (MA) and Costco as well. Amazon has an impressive logistic network and runs the largest cloud business. This is infrastructure. Visa and Mastercard play a key role in transactions and they have an infrastructure to do so. Costco (COST) has built part of its success by the way it runs its logistics, its distribution centers, and its system of warehouses which are a true part of the supply chain infrastructure. Moreover, the ecosystem of the membership program is the evolution of an infrastructure. I will surely go more in-depth in future articles about this idea I have been developing. But for now, this is enough to explain my understanding of the topic and why I am targeting infrastructure plays for my portfolio.

The idea is that, even though we live in an ever more virtual and immaterial world, where services and software play a big role, the need for hardware won’t go away, just like we can’t live without a physical body. Therefore, playing infrastructure stocks helps me gain exposure to some particular funnels – some people call them “tollbooths” – through which many economic activities run.

Let’s take a look at Terna.

Terna: The Company

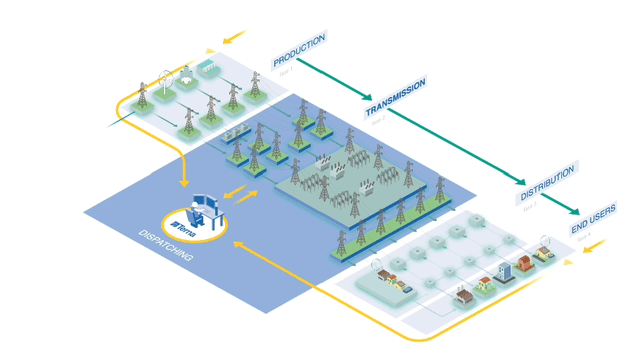

Terna plays a pivotal and monopolistic role in Italy’s power grid. It operates in the transmission of electrical energy, and, as such, it is involved in the transition to sustainable energy sources. Terna’s business revolves around two segments: regulated activities and non-regulated activities. The former makes up 84% of the company’s top line, with the remaining 16% coming from the latter. Regulated activities comprise transmission and dispatching. Transmission means Terna earns a fee for managing the high-voltage electricity grid, ensuring the flow of electricity from power plants to various distribution networks. Dispatching is the business of overseeing every activity connected with the optimization of energy flows: real-time monitoring, control, and coordination of demand and supply. Grid stability is quite important because it avoids disruptions. The picture below shows in green the electric flows and in yellow the data flow, to better help us grasp how Terna’s business developed.

Among its non-regulated activities, Terna provides engineering, procurement, and construction services. In addition, it offers maintenance services. It also has some international ventures that focus on interconnectors and grid development.

Terna plays a key role in Europe because Italy is becoming more and more a gateway and energy hub linking Europe with several energy suppliers in North Africa. For example, less than a year ago, Terna announced it signed a grant agreement with the European Commission to interconnect Italy (and Europe) and Tunisia, creating the first direct current electricity connection between Europe and Africa. The project deals with over 200 km of undersea direct current electricity cable with an output of 600 MW.

Terna’s Financials

With a company mainly operating in regulated businesses, we have to look at its financials properly. This means that, on one side, we can expect higher-than-usual leverage because regulated businesses offer more earnings stability thanks to long-term contracts. On the other side, we should not expect astronomical revenue growth.

We also need to be aware that Terna thinks these indicators are the most representative of its economic and financial performance: revenues, EBITDA, operating results, group net profit, net debt, and group net equity.

Income Statement

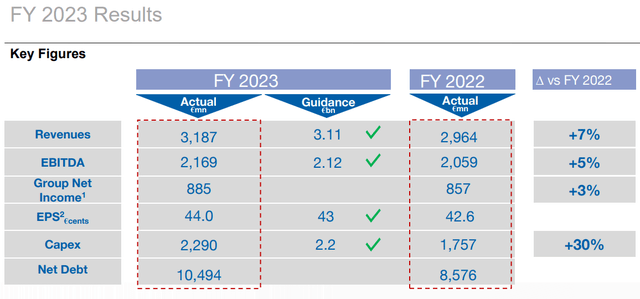

Terna reported €3.2 billion in revenues for FY2023, up 7.5% YoY.

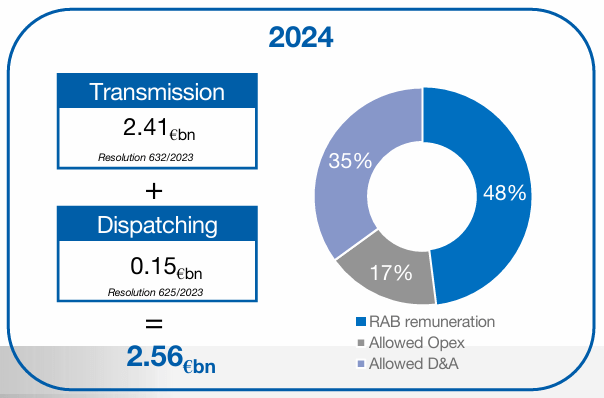

How does Terna make money? Its transmission and dispatching services are paid on the basis of a tariff system published by the national regulatory authority. Terna earns a fee and we see that this year it forecasts to earn €2.41 billion from transmission alone, with another €150 million coming from dispatching. This means €2.56 billion will come from these fees. Now, 48% of this is RAB (Regulatory Asset Base) remuneration, representing the net invested capital recognized to determine the expected and allowed return on investments.

Terna 2024 Capital Markets Day Presentation

Terna is compensated based on investments made and only when these investments are implemented. This is why we should look at Terna’s upcoming investment cycle with interest because it will translate into higher returns.

Back to the income statement.

Terna’s EBITDA was €2.2 billion, which is equal to a margin of 68%. D&A amounted to €806 million (25% of revenues) and pre-tax profits were €1.25 billion, a 39% margin. With a tax rate of 30%, net income came in at €880 million which is equal to a 27.6% margin. Quite good, as far as I see it.

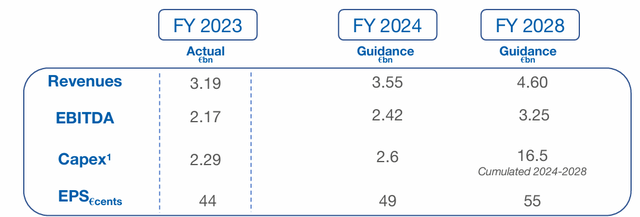

At the same time, while revenues grew 7.5% YoY, net income was up 3%. This is because capex grew by 30% since Terna just finished a big investment cycle and is getting ready to start a new one that will deploy from 2024 to 2028 around €16.5 billion.

Terna 2024 Capital Markets Day Presentation

Terna’s Balance Sheet

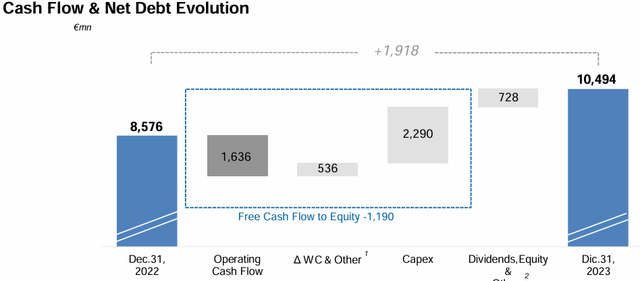

We can see from the key financial figures shown above that Terna’s debt increased by almost €2 billion in 2023. This is because the company generated €1.6 billion in operating cash flow, which was not enough to cover the €2.3 billion required for capex. The company also paid €728 million in dividends, while WC decreased by €536 million.

Terna 2024 Capital Markets Day Presentation

I think we will see a similar pattern in the next few years. Currently, the net debt/EBITDA ratio is 4.8x, but it could move up to around 5. While I usually steer away from ratios above 3, with the regulated business I can accept these ratios. Moreover, the company expects its EBITDA to grow above 8%, so the ratio should not spike up without control.

In any case, thanks to its strong operating cash flow, the company’s net equity increased by almost €200 million.

Terna’s Cash Flow Statement

What matters more is whether Terna can generate free cash flow or not. In 2023, the company’s FCF was negative (Operating cash of €1.6 billion – capex of €2.3 billion= -0.7 billion in FCF). However, thanks to its good debt rating, the company was able to borrow the money it needed to fund its operations, mostly at a fixed rate.

Terna’s Outlook

Terna has announced a big investment cycle. This may concern some investors, but, as explained, part of Terna’s returns and linked to its capex.

Thanks to these investments, Terna’s revenues are expected to grow at an 8% CAGR from 3.19 billion to 4.6 billion. As said, EBITDA should grow above 8% per year and should move up from 2.17 billion to 3.25 billion.

Terna 2024 Capital Markets Day Presentation

Now, considering we are talking about a grid operator, 8% growth is quite good. There are many non-regulated businesses in the world that operate in different sectors and don’t achieve such a steady and good growth rate.

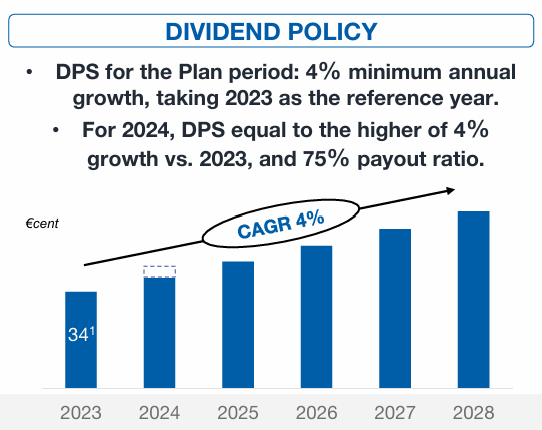

This leads us to what makes many investors buy Terna: its growth and, in particular, its dividend growth rate.

Terna’s Dividend

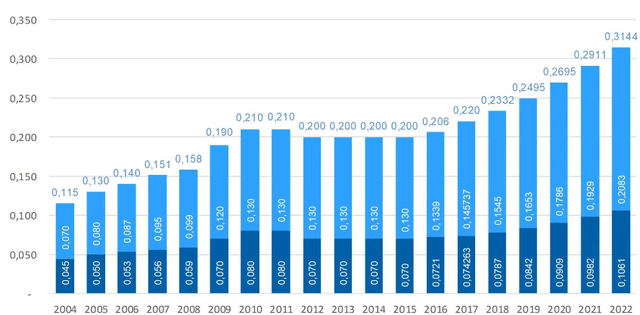

Terna’s dividend history is shown below and shows overall growth, which has not left investors disappointed. Currently, the company trades at a 4.1% dividend yield. But thanks to its steady growth, the yield on cost can increase at a fast pace. For example, my yield on cost is now already above 5%.

Now, Terna’s new 2024-2028 Industrial Plan anticipates that the dividend per share will experience an annual minimum growth of 4%, taking 2023 as the reference year. The DPS for 2024 will be the higher of either 4% growth compared to 2023, or a payout of 75%. Any increase to the dividend beyond this amount issued in 2024 will not have an impact on dividends in the subsequent years.

Terna 2024 Capital Markets Day Presentation

Risks

Terna carries some risks. For example, like many utilities, it carries some debt and may have liquidity issues in case of extreme events. It also has operational risks, due to the highly technological assets it operates.

For non-Italy-based investors, Terna may also be an illiquid stock, unless purchased on Euronext Milan. Moreover, dividend investors outside of Italy may face double taxation (Italy’s dividend tax is 26%). These risks, however, are part of many similar investments. What matters more for me is the steady and promising growth the company can offer over the long term.

Valuation

Terna’s shares trade at a 16.8 PE, which is quite high for such a company. This shows how much investors are willing to pay a premium, with the average PE ratio in Milan being 8.29. Its P/FCF is also high for a utility, standing now at 6.7. The fwd EV/EBITDA is 10.3. Overall, these multiples show, on one side, Terna’s quality, but, on the other, they are a bit demanding for a business whose growth is stable and foreseeable, but surely not astronomical. This makes me consider Terna fairly priced. In fact, while we should see 8% top-line growth and EBITDA growth above 8%, the impact of capex will lead to lower EPS and, most importantly, some yearly reports where FCF might be negative. This will create downward pressure on the stock.

I bought it around an 11 PE and investors should wait for a similar multiple before jumping in with a margin of safety. At the same time, if the stock trades up to an earnings multiple close to 20, it may be time to take some gains. As a result, I rate the stock as a hold, though I invite investors to put it on their watchlist because, in case of sudden dips, it may be highly rewarding.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.