JHVEPhoto

Dear readers/followers,

I’ve been a frequent analyst of Telenor (OTCPK:TELNY) here on Seeking Alpha. In fact, if you look at the two tickers, you’ll note that my articles are some of the most represented for both tickers. While I cannot claim that Telenor has been the best-performing investment in my portfolio since I staked out and increased a solid position, it’s nonetheless been an acceptable return.

More importantly, I’ve put myself in a position where I can see significant returns in an environment where Telcos would start to see a premium once again. I do not consider this to be likely for the near term, but then again I do not invest for the near term – I invest for the medium or long term.

Even if all my investments have trim targets, I’m perfectly fine with investments not reaching those trim targets for a long time. I recently covered Maersk (OTCPK:AMKBY), a good example of a company where I’m long, but I do not expect to recover materially in the near term. Telia (OTCPK:TLSNF) is another example, more relevant to this context of telco companies.

In this specific article, I’ll cover 3Q23 for Telenor try to see where we’re going from here, and supply an objective and impassionate update on this business.

Telenor – 3Q23 confirms what upside there is to the long-term

So what’s so great about the company hereafter 3Q23? Well, the company saw a substantial 4% enhance in top-line growth (sales revenue) and good EPS/profitability. To remind you, Telenor is a solid telco out of Norway with a secondary focus on growth markets in Asia.

Unlike its peers such as Telia, which has tried similar growth strategies and verticals, Telenor has actually succeeded in these, seeing an ongoing transformation of the company to even higher levels of profitability. (Source: Telenor 3Q23)

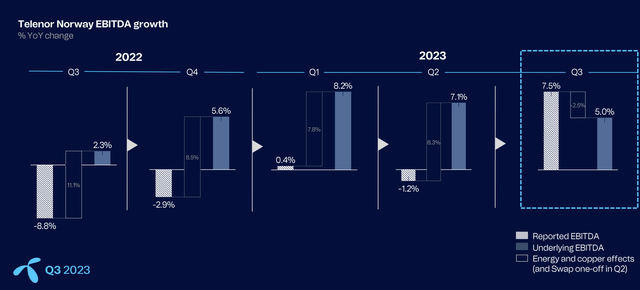

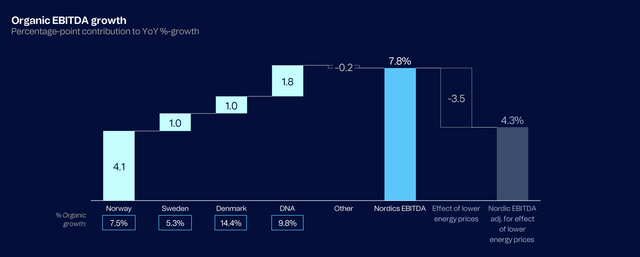

This profitability can be confirmed with a company-wide FCF of 4.3B NOK for the quarter, and this latest quarter marks the fourth consecutive quarter of 5%+ mobile service revenue growth, with an EBITDA growth of almost 8%. Norway specifically, as a segment for Telenor, has closed the gap to underlying EBITDA here.

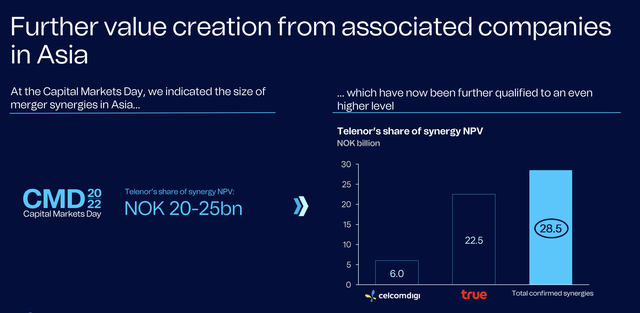

Telenor has Sweden as a segment too, of course, but I believe the focus here should be Asia. The company, as of 3Q23, is the no 1. telco in 3 out of 4 markets here. These various structures, including CelcomDigi, deliver substantial dividends and profits to Telenor, which enable among other things the continued high yield and has resulted in the company raising synergy targets even encourage. (Source: Telenor 3Q23).

For the company’s Asian segment, the company is planning a strategic review in the Pakistan segment and is working actively to drive dividends from both CelcomDigi (Successful) and True (ongoing), also driving continued growth in Bangladesh.

Turning to strictly financial targets and highlights, we’re seeing significant service revenue growth as mentioned, with a CapEx to sales percentage that at 13.3% is one of the lowest in the segment. Even lower than Orange (ORAN), and that company is a bit of a leader in this. This does not mean that the company does not see cost increases. OpEx is up 5.9% for the YoY period, driven across the board by salary cost increases, operational and maintenance expenses, sales and marketing costs, energy costs, and other costs. This comes to a total of over 350M NOK – but on a percentage basis or relational basis, this is not significantly more than any other telco in the sector (Source: GuruFocus).

Nordics saw a significant overall EBITDA enhance.

FCF was an overall highlight this year. FCF drivers here were improved EBITDA, improved net working capital, lower interest costs, licensing costs, tax payments, and other factors. The company leverage is back within the target range at 2.2x, compared to 2-2.5x. admire other Nordic companies, Telenor remains impacted by significant FX volatility and energy price volatility, with additional pressure from inflation and increasing interest rates.

The company has, however, increased its overall outlook for the full year, now expecting above 3% organic service revenue growth, a 3-4% full-year YoY EBITDA growth on the organic side, and a full-year CapEx/sales of 17% – not the 13.3% for the quarter, not record-high, but as high as one might expect for a company that’s still in the midst of investment cycle. (Source: Telenor 3Q23)

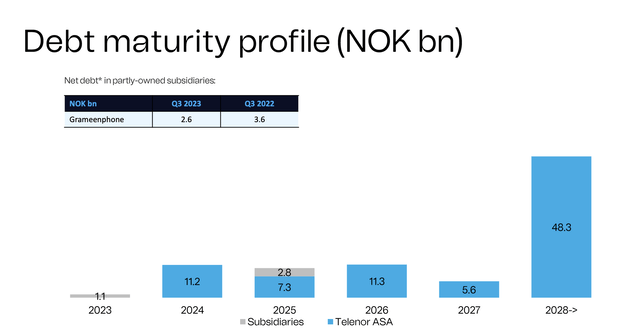

Debt maturities and other concerns on the fundamental side?

Those are extremely low overall. Most of the company’s debt isn’t maturing until late 2028 or beyond.

Other concerns or considerations here that go beyond what we’ve been through for Telenor in previous articles?

There’s some lack of clarity for these Asia dividends going forward. Because the company has a 5B NOK upstream FCF target, the question is if this is still possible with the Pakistan sale. The company says it is – but we’ll have to see. The company’s main argument here is that Pakistan was not the driver for that 5B NOK target, but this of course raises the bar for the company’s other Asia segments in terms of performance. While CelcomDigi dividends seem to be working well and on track to deliver good results even in the future, there’s always some risk here.

Secondly, regulatory issues. The regulator has said that it wants to break the national regulation of Telcos in Norway into regional regulations of 22 regions. In the past, Telenor was the only fixed operator that was regulated – this new structure means that in the future, other players will also become regulated, and this will result, in the end, in an additional 400,000 households for Telenor. This regulation isn’t as much a negative issue as something to keep an eye on for the future, and the current Telenor expectation is for it to go into play in the end of 2024E – but it could turn into 2025E as well.

Aside from this, there aren’t many new issues or concerns that have arisen over the past few months.

Risk & Upside for Telenor

As all investments I do have, Telenor has both an upside and a downside. We begin with the risks to the investment, as always. The risk to Telenor as an investment is that the market views the yield and return that Telenor offers at the current valuation to be too unfavorable, and the stock trades down. This has happened in the past. It’s not strange if the market offers 4-5% risk-free that a 7-8% yield isn’t as great or as highly valued, even if it’s safe, as it was a few years back. There are also the risks of issues in the Asian geographies, which are geopolitically more unstable than the company’s core areas.

The upside, however, is the opposite of this, and it happens to be the scenario I view as the more likely in the long term. That’s why I have significant investments in Telenor. I believe the combination of good yield, solid fundamentals, and a non-optional societal service (telecommunications), will result in a significant long-term upside of at least 10-15% CAGR.

Let’s look at the valuation for this company and what it offers at current levels.

Valuation for Telenor

This is going to be my last Telenor article for 2023, unless something very material happens. That means it’s likely that my next article on the company will coincide with the dividend decision, the impact of which could be material.

I am not changing my target for Telenor at this time, and while Telenor is in no way as attractive as it was in the double digits – when I added to my position – the company is still a good “BUY” here.

Why is it a good “BUY” after 3Q?

Because it’s slightly down from its 120 NOK level, and currently trades closer to 115 NOK, which even only to a normalized multiple of 17-18x P/E gives it an upside of 20% per year – and that includes essentially flat growth over the next few years. You might ask why a Telco might warrant an 18-19x P/E – that’s because that’s where the company has traded on a 5-year average. 20-year average P/E for this company is almost 17x – so this trading range is well-established, and this is the reason why I consider it to be “valid”.

This 20% annual upside is partly due to 7-8% from yield, and is based on the fundamentals that I’ve mentioned above – and also, reminding you, of the company’s less than 51% long-term debt to capital, and the fact that the company is A-rated from S&P Global, one of the very few telecommunications companies that manages this, thanks to extremely conservative debt metrics and handling.

So, the upside here is, as I see it, solid. I don’t view it likely that the reversal here is going to be quick, but I also don’t see it as all that likely that we’ll see significant downturns again to an 80-90 NOK level, at least not without some external catalyst or internal result. Given that interest rate increases seem mostly “done” for the time being in Scandinavia, and I don’t see the macro conditions for telcos in Scandinavia worsening significantly, I’m fairly positive about the company’s overall prospects here.

When valuing Telenor, 17 analysts follow the company as of the 29th of November 2023. They give the company a price target range starting at 92 NOK and going to 170 NOK, with an average of 128 NOK. Obviously, as you can see from my price target, I believe the company to be worth more than this for the long term. We’re likely to see some near-term earnings pressure from non-recurring items, but 2024E is expected to regularize net earnings and trends here. (Source: FactSet).

All in all, I believe the prospects for Telenor to still be good enough to warrant a solid, positive thesis here – and the fundamental variables and forecasts as well as the historical prospects imply to me that this company warrants a “BUY” here.

Thesis

My thesis for Telenor is as follows:

- I view Telenor as one of the best telcos in all of Europe, based on its fundamentals and markets. Safer than Orange, and safer than Tele2/Telia. Perhaps Deutsche Telekom (OTCQX:DTEGY) might be as safe, but less than half the current yield.

- Based on this safety and this yield as well as this upside, I’m marking this company as a “BUY” and considering it with a PT of 150 NOK/share. I am still not lowering my PT here as of November/December of 2023.

- I believe the right way to invest in the business is native shares only, not ADRs. The native share trades on the Oslo Share exchange under the symbol TEL, and I would not invest in any Norwegian company except by buying the native share.

recollect, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to regularize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

I call the company “cheap” here, and it fulfills every single one of my investment criteria.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.