PeopleImages/iStock via Getty Images

Introduction & Investment Thesis

I initiated a buy rating on Teladoc (NYSE:TDOC) on January 24, 2024. However, since then, the stock has declined by 28%. The company reported its Q4 FY23 earnings, where it saw its revenue grow 8% YoY to $2.6B and Adjusted EBITDA grow 33% YoY to $328M. While the company is expanding its profitability, the biggest concern investors have is the slowdown in revenue growth.

In Q4, the company saw a sequential decline in members across both its Integrated Care and BetterHelp segments, while revenue for the BetterHelp segment declined both sequentially and annually. While the company hired a new leader to accelerate revenue growth in its BetterHelp segment as well as drive targeted product innovation, its forward guidance of revenue to grow a meager 3% to approximately $2.68B squeezed out investor optimism.

After assessing both the “good” and the “bad,” I believe that the company’s stock is currently fairly valued. I also believe that if the management is able to turn around the growth trajectory for its BetterHelp segment, we can see significant upside ahead. However, at the moment, there is no clear evidence of a turnaround, and until then, I will stay on the sidelines and rate the stock a “Hold” at the moment.

A quick primer on Teladoc

Teladoc is a virtual healthcare services company that operates through two segments: 1) Integrated Care and 2) BetterHelp. It operates both in the US and internationally. The Integrated Care segment contributed 56% to Teladoc’s total revenue in Q4 FY23. The segment comprises virtual medical services and a chronic care suite of products, which are sold primarily to employers, health plans, and hospitals. Meanwhile, their BetterHelp segment offers counseling and therapy services and is sold directly to consumers. In FY23, the company generated 88% of its total revenue from access fees, which it derives from both its Integrated Care and BetterHelp segments.

The good: Improving profitability & continued strategic product innovations

Teladoc reported its Q4 FY23 earnings, which beat its earnings guidance. The company reported Adjusted EBITDA growth of 22% YoY in Q4 to $114M, while for the full year, earnings grew 33% YoY to $328M, with an Adjusted EBITDA margin of 12.6%. Meanwhile, total revenue grew 8% YoY to $2.6B in FY23.

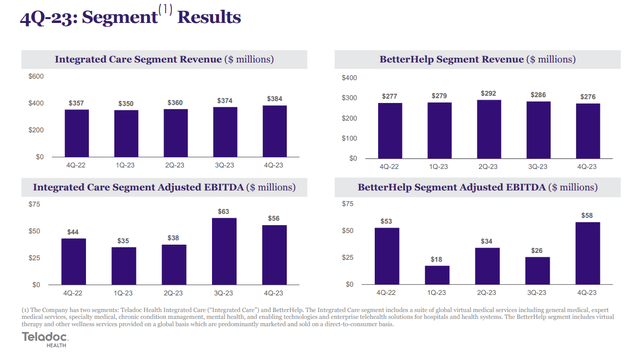

While there is a slowdown in revenue growth from previous levels, the management has prioritized improving profitability, with the Adjusted EBITDA of their Integrated segment growing 42% YoY to $191.8M in FY23 and margins improving by 323 basis points to 13.1%. Similarly, their BetterHelp Segment has also seen Adjusted EBITDA grow 19% YoY to $136M, while improving margins by 83 basis points to 12.0% in FY23. I would like to note, however, that although Teladoc posted double-digit Adjusted EBITDA growth at BetterHelp for Q4 and for the full year FY23, it was below management’s expectations, with lower yields on return on marketing spend.

Q4 FY23 Earnings Slides: Teladoc’s improving profitability

During the earnings call, Jason Gorevic, CEO of Teladoc, talked about the increasing scale that has enabled the company to continue to improve its bottom line, with 75% of its bookings being upsells or expansions with existing customers. I believe this showcases that Teladoc is continuing to see increased product penetration across its 90M virtual care members.

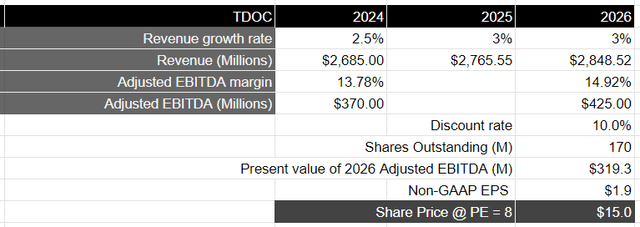

Looking forward to FY24, the company aims to continue to expand its profitability by increasing its margin from 12.6% to 13.78% to $370M. In fact, the management believes that Teladoc should be able to generate $425M in Adjusted EBITDA in 2025. That would mean that the company would need to grow its Adjusted EBITDA annually by 5% over the next 2 years. This should be achievable, as I believe there is a runway for continued cross-selling as part of its “land and expand” strategy among its 90 million members. Plus, the company is also looking to bring to market solutions in weight management and pediatrics in FY24. I believe that this indicates that the management is continuing to invest in targeted innovation to broaden its scope of solutions, as it sees revenues grow slowly, in order to reach its commitment for Adjusted EBITDA.

This is what Jason Gorevic, CEO of Teladoc, said during the earnings call, which demonstrates how the management is thinking of profitability and unlocking operating leverage.

“We’ll speak to guidance in a moment, but our BetterHelp outlook assumes the lower yields experienced in certain channels in the second half of 2023 will persist and as a result will impact our year-over-year growth rates in the first half of 2024.”

“We also see significant opportunities for margin expansion in the Integrated Care segment from both operating leverage and productivity improvements, all while maintaining robust capacity for sustained strong investment and long-term innovation and growth. We expect this segment will drive the majority of consolidated margin growth over the next three years.”

The bad: Slowing revenue growth, especially in the BetterHelp segment

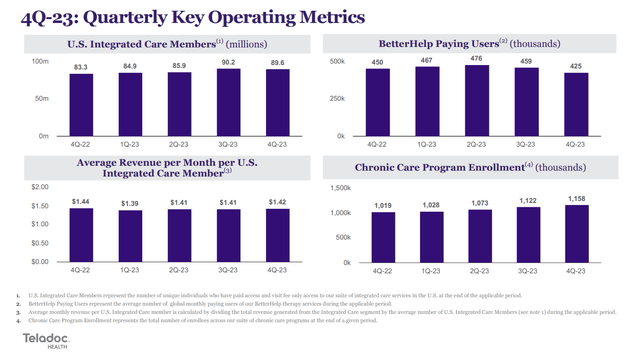

While revenue grew 8% YoY to $384M in Q4 in the Integrated Care segment, the growth rate in the BetterHelp segment was practically flat in Q4, which is a sign of concern. This could be explained by the growth rate in members across segments, where we saw a 7.5% YoY growth in Q4 in Integrated Care members, vs. a decline of 7.4% YoY for BetterHelp users. Looking forward to FY24, the company expects to generate approximately $2.685B in revenue, up 3% YoY.

Q3 FY23 Earnings Slides: Teladoc’s members across Integrated Care and BetterHelp segments

Although the Integrated Care segment is growing faster than the BetterHelp segment for Teladoc at the moment, in Q4 the management indicated that half of their Integrated segment revenue is derived from US-based virtual care business, which is a well-penetrated market. As a result, the management believes they will see growth in the low single digits moving forward.

Meanwhile, the remaining half of their Integrated segment is composed of their chronic care suite of products and their International virtual care business. One of the bright spots is that the company has been seeing a much faster rate of revenue growth in its International segment, at 19% YoY to $364M in FY23. In fact, their International business segment has contributed 14% to total revenue, up from 12% of total revenue a year ago, as the company expanded its presence in Canada.

While the growth in International revenue is a bright spot, the guidance undoubtedly marks a slowdown from previous levels. In my previous post, I discussed the competitive landscape of Teladoc, where it faces competition from legacy players such as Cigna (NYSE:CI), American Well Corporation (NYSE:AMWL), UnitedHealth Group (NYSE:UNH), Walgreens Boots (NASDAQ:WBA) and CVS (NYSE:CVS) as well as large technology companies such as Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT), who have developed their own virtual care solutions. While the company has said that it sees success in cross-selling and up-selling its solutions, the sequential decline in Integrated Care Members as well as an annual decline in Average Revenue per Integrated Care Member from $1.44 in Q4 FY22 to $1.42 in Q4 FY23 is definitely a concern.

As for its BetterHelp segment, which is struggling both sequentially and annually, when it comes to member growth, the management remains confident that it can drive steady growth as there are secular drivers such as the demand for mental health services, which continues to rise, as well as growing consumer preference for virtual mental health services. At the same time, Teladoc has hired a new leader to advance BetterHelp’s revenue growth, as the management believes that there is untapped potential outside the US. However, since the success of this segment is dependent on efficiently reaching new individuals and converting them into members by spending on marketing efforts, the return on marketing spend will be an important metric to track for the pace of profitability growth at Teladoc.

Tying it together: Teladoc is fairly priced

Assuming that Teladoc continues to grow in low single digits over the next 3 years until FY25, it should be able to generate approximately $2.8B in revenue. This is not an optimistic scenario; therefore, in this case, I am assuming that we will continue to see lackluster growth in both the Integrated and BetterHelp segments, despite hiring a new leader in the BetterHelp segment to accelerate revenue growth. Meanwhile, assuming that Teladoc is able to meet its Adjusted EBITDA expectation for FY25 to reach $425M, as it continues to drive product adoption and streamline operating expenses, that would translate to an Adjusted EBITDA margin of 15%, up from a projected 13.8% in FY24. This would translate to a present value of $319M in Adjusted EBITDA when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% annually over a 10-year period with a price-to-earnings multiple between 15-18, I believe that Teladoc should trade at 0.5x the multiple of the S&P 500. That would translate to a price target of 15, which is where the stock is currently trading.

Conclusions

I believe that Teladoc is fairly priced at the moment. In fact, I believe the company is also trying its best to revamp growth once again. But so far, its track record is against it. So, until I see a couple of quarters of sustained growth, especially in its BetterHelp segment, I am going to be staying on the sidelines and rating the stock a “Hold” at the moment.