da-kuk

Thesis

China has been a hard hit jurisdiction this year when it comes down to stock performance. The Chinese Communist Party (‘CCP’) has taken a number of actions this year to stem the rout in Chinese equities and stimulate the local economy. Among these measures one can find cutting required bank reserves, issuing long-dated bonds to inject liquidity, restricting equity short selling and allocating capital for industrial development. While the U.S. is in full restrictive monetary policy mode, China is stimulating its market both fiscally and monetarily.

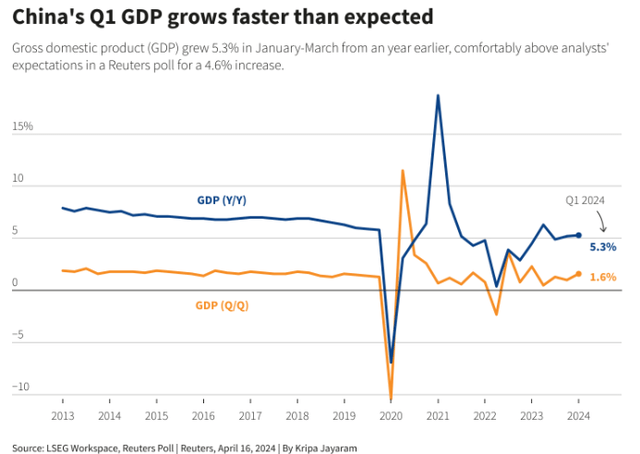

We think ultimately China will be successful in exiting its economic malaise, but it will be a slow recovery rather than a ‘V’-shaped one. We are already seeing positive signs, with the Q1 2024 GDP growth coming in higher than expected:

In our opinion, China is moving away from a real-estate driven economic growth model to an industrial and technology-based one. The current economic malaise is mainly driven by the real-estate crash, driven by a significant over-supply of apartments in speculation in the sector for over two decades. China’s CCP is also keenly aware of the need to provide jobs for its youth, with the party focused on tech development, while keeping companies’ policies within a tight framework.

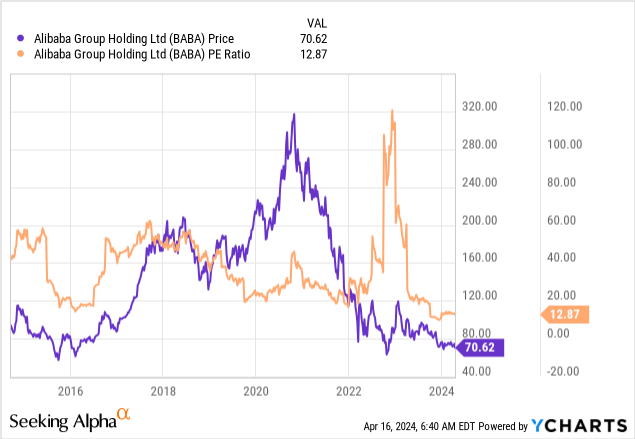

While U.S. mega-cap tech companies are having a field day, flirting with all-time highs, Chinese counterparts are at the opposite side of the spectrum, trading at all-time lows in terms of both price and P/E ratios. We need not look any further than Alibaba (BABA):

In the above graph, the teal line is the BABA price, while the orange line is the company’s P/E ratio. The stock price is hovering around multi-decade lows, all while its P/E ratio is at 12x versus close to 30x for its U.S. counterparts.

The Templeton Dragon Fund (NYSE:TDF) is a closed end fund that invests in Chinese equities. We covered this name two years ago, when we compared the CEF’s performance versus a simple vanilla ETF in the space, and lamented the lack of significant outperformance. The macro picture has changed dramatically since, with the CEF now exposing a historic discount to its NAV, providing retail investors with the beta advantages of investing via the CEF structure.

A large capitalization portfolio

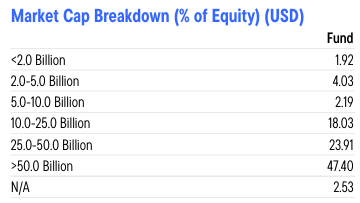

The CEF has a portfolio which is focused on large capitalization stocks:

Capitalization (Fund Fact Sheet)

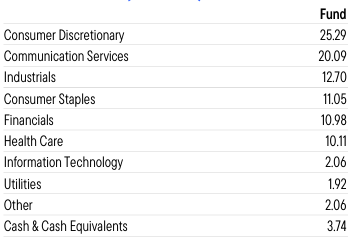

We can notice from the above table that most of the equities in the CEF have a market capitalization exceeding $10 billion, with the bulk of the holdings sitting in the ‘>50 Billion’ bucket. The fund is focused on Consumer Discretionary and Communication Services equities:

Sectors (Fund Website)

The above mentioned sectors represent over 45% of the CEF’s holdings, followed by industrials and consumer staples.

The CEF has fairly concentrated positions in its top holdings, with many of the names exceeding 3.5% of the portfolio:

Top Holdings (Fund Website)

Its top 10 holdings account for roughly 40% of the portfolio, but given their large market capitalization and representation of ‘focus’ industries for the CCP, in our view they represent a good macro take on the jurisdiction.

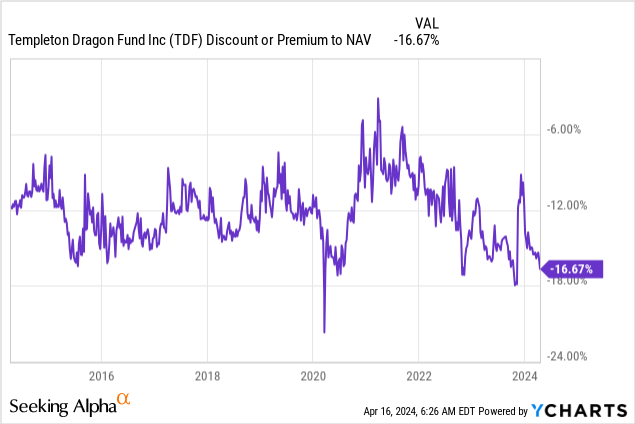

Historic discount to NAV

What is appealing for some CEFs is their propensity to have ‘wrong way risk’ embedded in the structure. When the underlying holdings underperform, the structure goes down in price even more on the back of a widening in the discount to NAV. This is exactly what is currently happening for TDF:

The fund has seen its discount to NAV widen out close to historic levels as the underlying holdings have lagged. In a ‘normal’ market environment the fund trades with discounts between -6% to -12%, while in full on risk-on modes the CEF is close to flat to NAV. We expect a +8% gain from the narrowing of the discount here once market participants potentially start assigning value to Chinese equities again.

This CEF is best bought for capital appreciation

Unlike ‘traditional’ CEFs, TDF is not an instrument to be bought for yield. In fact, the CEF has capital appreciation as its goal:

The fund seeks long-term capital appreciation by investing at least 45% of its total assets in the equity securities of “China companies,” as defined in the fund’s prospectus.

The CEF wrapper is used in this case for access to the management team for the fund, rather than the traditional yield generation capabilities of CEFs. You are getting NAV stability here, given there is no distribution if the fund fails to perform. In fact, the CEF did not have any dividends in 2022, and might not have any in 2024 either if the portfolio does not outperform.

TDF is a long-term play on China and its stock market, obtained via the acumen of the CEF’s portfolio managers. Investors buying into TDF are getting long term capital appreciation, rather than a high dividend yield. This set-up is the correct one for today’s market where underlying equities are underperforming, and return of capital would have been used for yield generation. As a reminder, a high ROC utilization results in an ever decreasing NAV all else equal.

The difference between TDF and a plain vanilla ETF in today’s market is represented by the acumen of the portfolio managers. While ETFs follow indices and thus represent a passive allocation in most instances, TDF has an active approach to its portfolio, approach which tends to favor undervalued names such as BABA.

Risks to outlook

The main risk for a China equities investment is geopolitical. As we have seen with the Russian invasion in Ukraine, a country that undertakes such an action can see its capital markets obliterated. A theoretical invasion of Taiwan by China could trigger a significant loss of value in Chinese equities and the start of many sanctions. Sanctions could further put pressure on the underlying TDF equities via outright banning of new listing or prohibition around providing equity capital to the jurisdiction.

We think the main thing here is the current economic condition in China, which does not allow it to undertake such an action currently. China has proven itself to be a very patient and savvy player on the world stage, and it likely fully understands that it could only undertake action in Taiwan from a position of strength and with modelled outcomes, in our view. While it exists, we think the geopolitical risk will not manifest itself in the next five years in our base case.

Conclusion

TDF is an equity closed end fund. The vehicle is focused on Chinese equities and has been pummeled in the past year as the jurisdiction has suffered a large drawdown. China has suffered a real estate contraction, with the CCP now focused on revitalizing the industrial complex and injecting liquidity in the markets by both fiscal and monetary stimulus. With Q1 2024 GDP figures coming in better than expected, progress is starting to show. However, do not expect a ‘V’ shaped recovery here, but a protracted return to normal. TDF is set to benefit as the jurisdiction comes back on its growth track via its actively managed portfolio of Chinese large caps. With the CEF trading close to a historic wide discount to NAV, we believe investors will be well served to capitalize on the move.