Joe Raedle

Investment Thesis

In my opinion I view The Toronto-Dominion Bank (NYSE:TD) stock a buy. The bank’s net interest margin supported by a solid loan portfolio has proven to be stable and low risk surpassing many of its competitors. This stability is further reinforced by the bank’s management of credit risk as indicated by its low net charge off ratio. TD’s solid deposit base and disciplined loan to deposit ratio which is consistently below 100% indicates a resilient funding strategy. Additionally, the valuation analysis predicts a compound growth rate of 15.9% over the next five years driven by growth in book value, potential multiple expansion, and reliable dividend yields, hence making TD Bank a buy.

Headline Financial Analysis

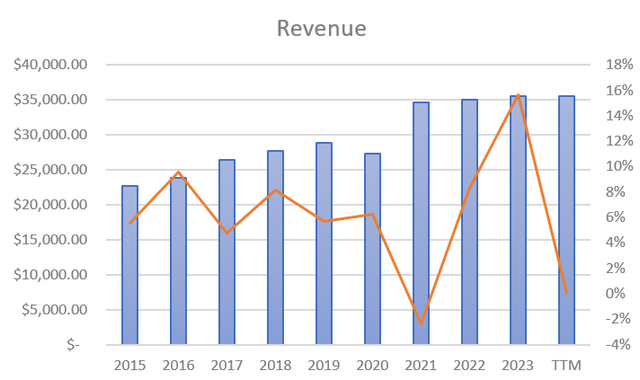

Over the decade TD Bank has demonstrated moderate revenue growth from $22,732.69 in 2015 to $35,479.10 in 2023, a compounded annual growth rate of approximately 4.6%. Given the present interest rate environment analysts expect revenue growth to modestly in the coming year with $38,148.98 in revenue expected.

Created by Author, Data from Tikr Terminal

Over the past decade I have observed that the earnings per share for this company have been cyclical. In 2015 the EPS stood at $3.22. It gradually increased to $6.95 by 2022 indicating an annual growth rate of around 11.6%. However, in 2023 there was a drop of 40% in EPS due to various factors such as higher non-interest expenses, increased provisions for credit losses challenging market conditions and specific setbacks in their U.S. Retail and wholesale banking segments. Fortunately, analysts predict that there will be a recovery in the coming twelve months with expected earnings per share to be $6.33 in 2024.

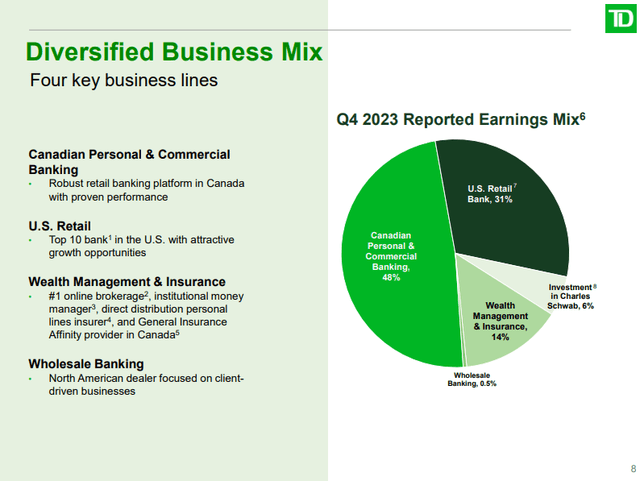

Net Interest Margin

Now let’s shift our attention to the interest margin (NIM). When evaluating this metric, it is crucial to examine the quality of loans held by the bank on its balance sheet. The Toronto Dominion Bank has a range of businesses with four areas of focus. The largest segment is Canadian Personal & Commercial Banking accounting for 48% of the business. This demonstrates their presence, in the market. U.S. Retail Banking makes up 31% of the business indicating their operations. Wealth Management & Insurance contributes 14% to their business showing their involvement in financial services.

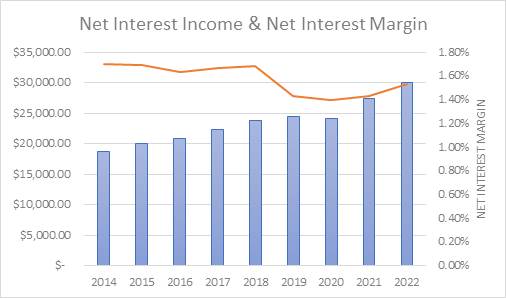

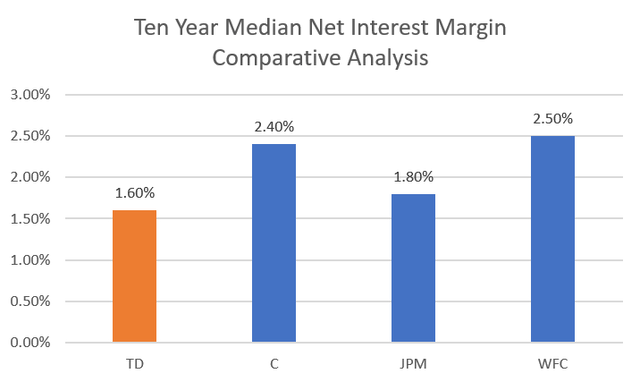

Usually banks, like TD Bank where real estate lending dominates their loan book, we often see this lead to a lower net interest margin. This is because these loans are considered less risky and hence demand lower interest rate spreads. However, TD bank does engage in higher risk lending such as credit cards, auto loans and other personal lines of credit but as a smaller percentage over the overall loan portfolio. These kinds of loans carry greater charge off risk. Over the decade TD Bank has achieved a net interest margin of 1.6%.

Created by Author, Data from Tikr Terminal

When comparing TD Banks interest margin over the ten years with its peers, it appears that Citigroup (C), JPMorgan (JPM) and Wells Fargo (WFC) have median net interest margins of 2.4%, 1.8% and 2.5% respectively. This gives TD Bank the lowest net interest margin over this period.

Created by Author, Data from Tikr Terminal

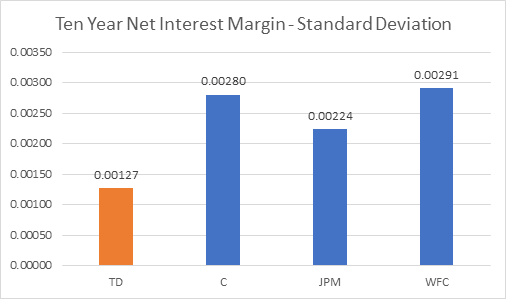

Another important factor to consider is the consistency of the net interest margin. A stable NIM often indicates higher quality loans while a volatile NIM suggests loan quality and makes it harder to predict the banks future performance, creating uncertainty. In the case of TD Bank, its standard deviation of NIM across the ten year period is 0.00127, which makes it have the lowest standard deviation, among its peer group by quite some margin. This implies that there is likely less risk associated with their loan portfolio and more consistency among their loan portfolio.

Created by Author, Data from Tikr Terminal

Net Charge-Off Ratio

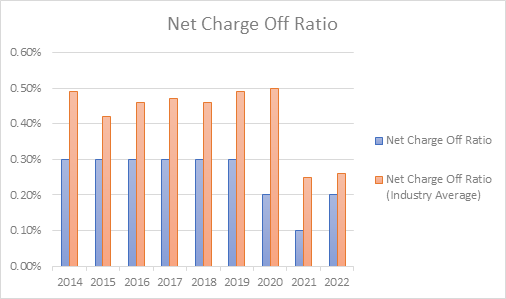

The net charge off ratio is another measure, for assessing the quality of the loan portfolio. TD’s net charge off ratio has ranged between 0.30% and 0.10% over the past ten years. When compared to the banking industry, TD Bank has consistently maintained a charge off ratio of 0.30% from 2015 through 2020 which indicates good credit risk management. The decline to 0.20% in 2021 and further decrease to 0.10% in 2022 demonstrate an improved credit performance during that period. However, there was an increase to 0.20%, in 2023. It has remained at that level until now. However, the overall ratio remains low which suggests that the bank’s loan portfolio is relatively healthy and that the bank is effectively managing credit risk.

Created by Author, Data from Tikr Terminal

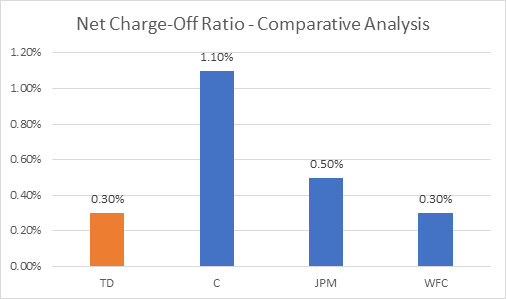

When comparing TDs ten year charge off ratio to its peers we can see that C, JPM and WFC each have a ten year median net charge off ratio of 1.10%, 0.50% and 0.30% respectively. As a result, TD ranks tied first in this evaluation. In my opinion because TD has reported a ten year median NCO ratio of 0.30%, I believe that TD is well positioned in term of risk in loan book, meaning that this gives them room is have higher leverage.

Created by Author, Data from Tikr Terminal

Leverage

Another tool I use to assess a bank’s balance sheet risk is leverage. Specifically, the assets to equity ratio plays a role in determining return on equity. As a rule, higher leverage is acceptable long as net charge offs are low. On the hand if banks engage in loans such, as personal credit, construction loans or auto loans I prefer to see lower leverage.

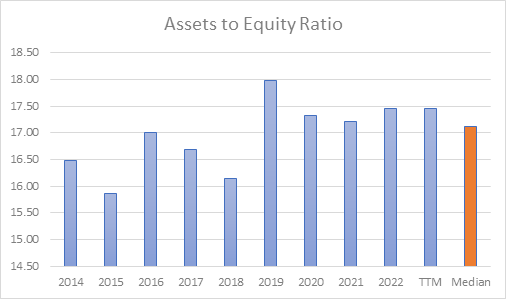

When considering TD Bank, it’s worth noting that their asset, to equity ratio has averaged 17.1 over the ten years and currently sits just below 17.50.

Created by Author, Data from Tikr Terminal

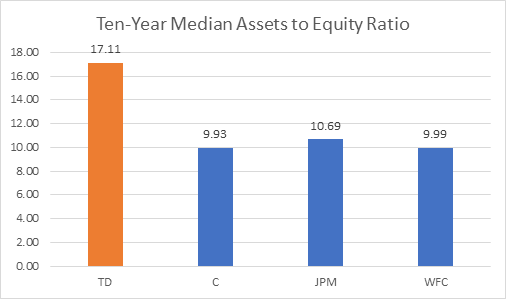

From my perspective, when compared to banks in its peer group, TD Bank has significantly higher leverage levels. While the leverage is high, it’s worth mentioning that they also maintain a low risk loan portfolio characterized by a low net charge off ratio and a consistent net interest margin, which indicates that their management team is using the higher level of leverage to drive book value growth given the low net interest margin, but high leverage. In this circumstance, the high amount of leverage is manageable but something to watch.

Created by Author, Data from Tikr Terminal

Efficiency Ratio

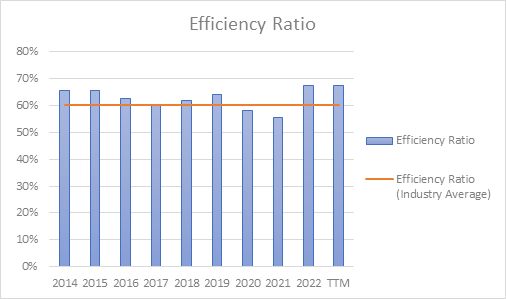

The efficiency ratio is a metric that indicates how well banks can control their operating expenses. Within the banking sector an efficiency ratio of below 60% is deemed an above average efficiency ratio. When we take a look at TD’s efficiency ratio, we can see that it has been lower than 60% for three out of the last ten years. From my point of view, this implies that the management team could have done a better job at reducing expenditure on overhead expenses within the business.

Created by Author, Data from Tikr Terminal

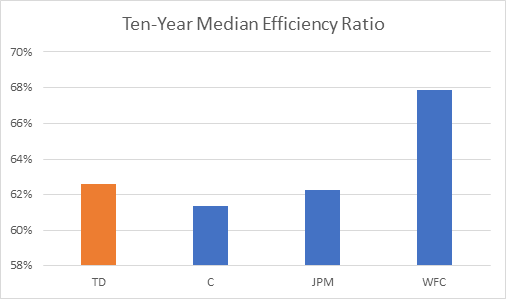

When comparing TD’s efficiency ratio to its competitors over the past ten years, we see that C had a median net charge off ratios of 61%, while JPM and WFC had median net charge off ratios of 62% and 68%, respectively. Therefore, this puts TD has the third highest efficiency ratio amongst its peers.

Created by Author, Data from Tikr Terminal

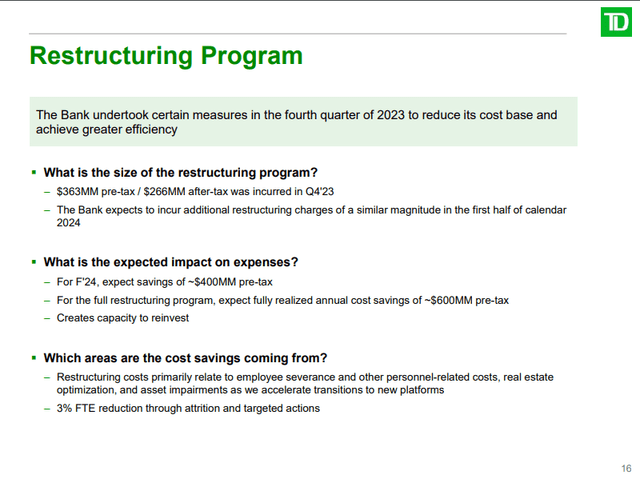

Moving forward, the company will aim to complete a restructuring program to reduce some of their expenses. This will include cost saving initiatives such as personnel cuts, property utilization optimization and shift to online based banking platforms. The program also plans to reduce the number of full-time employees by 3%. Once these initiatives have been implemented, it is expected that the company will save about $600 million per annum before tax. This should then lead to an increase in the efficiency ratio over the next two years.

Deposits and Funding Sources

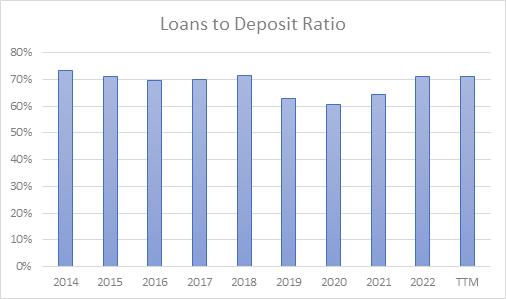

One crucial factor that I choose to look at is the loan to deposit ratio. I believe that a bank should have a loan to deposit ratio below 100%, as this indicates that the bank does not heavily rely on outside funding methods. When we examine TD’s performance over the past decade, we can see that they consistently maintained a loan to deposit ratio below of 100% across all ten years. This demonstrates that the bank’s deposit side is strong, meaning that they access to more than enough low-cost funding sources such as bank accounts and certificates of deposits.

Created by Author, Data from Tikr Terminal

In the past year, non-interest bearing deposits accounted for 11% of TDs total deposits. While I don’t view 11% as a high ratio, I believe non-interest bearing deposits are less reliable due to their short term nature and vulnerability to customer withdrawals. On the other hand, interest bearing deposits make up the majority of TDs deposits serving as a moderately more expensive but dependable funding source for the bank. Since 2021, TD has seen a decline of 17.7% in interest bearing loans. This decline aligns with a trend in the banking sector caused by rising interest rates and reduced liquidity. Considering the trends in the industry and TD Banks strong loan to deposit ratio I have confidence that the banks deposit and funding sources are reliable.

Return on Assets and Return on Equity

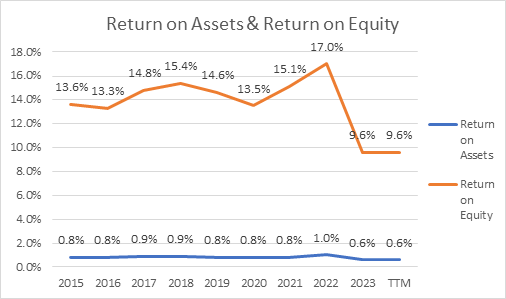

Let’s talk about Return on Assets and Return on Equity. TD Bank has consistently achieved a median ROA of 0.8% over the decade while maintaining a median ROE of 14.1%. We can see that the ROA increased from 0.80% in 2015 to 1.00% in 2022 before declining to 0.60% in 2023. The ROE showed an increase going from 13.60% in 2015 to a peak of 17.00% in 2022 followed by a decline to 9.60% in 2023. Based on these numbers, it is clear that TD Bank has been successful in generating profits from its assets and equity over the past decade. The recent declines in both metrics over the past year can be attributed to factors such as increased provisions for credit losses, rising expenses and lower revenue within the U.S Retail Banking sector. These challenges are a result of the challenging macro environment, elevated inflation, and heightened competition that TD is currently facing.

Created by Author, Data from Tikr Terminal

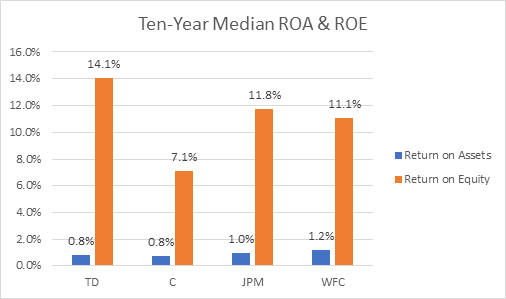

When comparing TD with its competitors over the decade we observe that TD is tied for having the lowest return on assets however they all have the highest return on equity. Considering the effective management of net charge offs and stable net interest margins which are aided by high amounts of leverage, I find the return on equity to be impressive.

Created by Author, Data from Tikr Terminal

Valuation

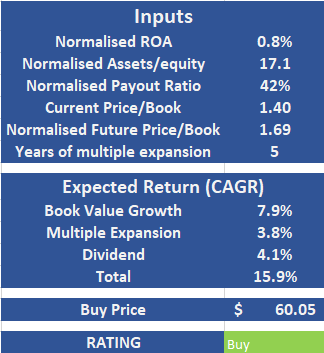

When assessing the valuation for TD Bank, I am going to apply the following criteria:

- A normalized return on assets of 0.8% which constitutes the ten-year median spanning various market conditions.

- A normalized assets to equity ratio of 17.1 constituting the ten-year median assets to equity ratio.

- A normalized ten-year median payout ratio of 42%.

- A current price to book ratio of 1.40 and an anticipated five-year price to book ratio of 1.69 which is based off the ten-year median.

Created by Author

Based on my analysis, I anticipate that TD Bank will provide a compounded growth rate of 15.9% to shareholders over the five years. This growth will come from a projected 7.9% increase in annual book value, a 3.8% in annual multiple expansion and an expected annual dividend yield of 4.1% calculated based on the payout ratio mentioned earlier. Consequently, I believe that TD Bank is currently worth considering as an investment given its share price of $60.05.

Risks

Investing in TD Bank stock comes with a risk, like any investment in the financial sector. The banks performance is influenced by factors such as inflation and fluctuations in interest rates. These factors can have an impact on the bank’s profitability and the quality of its loans. We should also consider credit risk as economic downturns may result in loan defaults and provisions for credit losses, which can affect the bank’s asset quality and earnings. Moreover competition, from both banks and emerging fintech companies could put pressure on margins and market share.

To be company specific, there is no guarantee of the success of the previously mentioned restructuring program. Unforeseen costs and challenges, in integrating may continue to exist which could cancel out the expected efficiencies and hinder improvements, in TD Banks efficiency ratio.

Conclusion

In conclusion TD Bank exhibits a profile with well-balanced characteristics making it an attractive option for potential investors. The banks diversified lending strategy is low risk and offers a low net charge off ratio, outperforming its competitors. Furthermore the bank takes pride in its deposits maintaining a loan to deposit ratio that consistently remains below 100%. When assessing valuation, I am of the opinion that the bank will experience a compounded growth rate of 15.9% over the next five years. Taking all these factors into consideration, I believe TD is worth investing in at its current share price of $59.61.