deepblue4you

Thesis

The Invesco Short Term Treasury ETF (NYSEARCA:TBLL) is a fixed income exchange traded fund. The vehicle is based on the ICE U.S. Treasury Short Bond Index and will invest at least 80% of its holdings in the index components. The fund is not a passive replication of said index but takes an active approach to pollinate the core duration profile. The index measures the performance of US Treasury obligations with a maximum remaining term to maturity of 12 months. Both the ETF and the index are rebalanced and reconstituted monthly. Given its composition, the fund runs duration risk only and can be construed as a cash parking vehicle, especially now that Fed hikes are behind us.

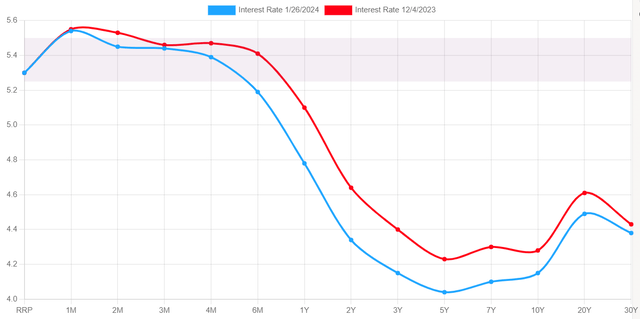

With the market starting to talk about rate cuts, investors should start focusing on the short dated funds with the longest duration possible. Why? Because it will capture the higher short rates for longer. Also to note that short dated funds will keep yielding the current high rates until the Fed starts cutting. While the long end of the curve has shifted lower given the market pricing of lower rates, the front end has not:

Yield Curve (UsTreasuryYieldCurve.com)

The red line represents the yield curve as of December 4th, 2023, while the blue line represents the curve as of January 26, 2024. The 4 months and out tenors exhibit a large differential, while the front end is almost identical. While the Fed can control the front end via monetary policy, the market usually decides yields above 1 year, based on expected rates. We can see a substantial shift in the long end of the curve during the past month.

When will the Fed actually cut?

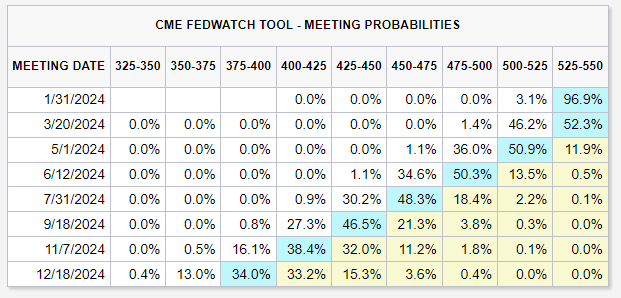

There are multiple opinions in this space, with the most aggressive coming from Goldman Sachs which is pricing in a first Fed cut in March. We subscribe to the JP Morgan view, which sees the first cut in June. The Fed Funds futures market has been aggressively reducing March Fed cuts:

CME Fed Funds Futures (CME)

The futures market is now pricing cuts beginning May 2024, just barely. As a reminder, this is an actively traded futures market, thus it gives us an idea of market expectations. The above matrix should be read as a probabilities matrix, with the blue squares representing the first probability above 50% from the respective sequence. For example, for May, the market is still pricing a 12% chance of Fed Funds to stay at current levels. If data comes in stronger than expected, we should see this number move up. The reality is that nobody knows when rates will move lower, not even the Fed. The Fed will remain very much data dependent, and in our opinion will err on the conservative side. Why? Because a resurgence of inflation will reflect very poorly on the Fed, while a very mild recession will not. After fumbling the ball in raising rates when needed, the Fed will ensure they do not repeat the mistake of cutting too soon.

Think about the Fed as an entity that gets very little credit, but a lot of the blame. If they cut too soon and prices start moving up again in an election year it would be a disaster for the current administration. A rampant, untamed inflation picture would give Joe Biden a poor chance to get re-elected.

Capturing the front end of the curve

TBLL will continue to capture the front end of the curve, with a delay:

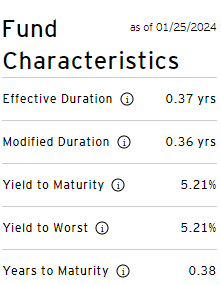

Duration (Fund Website)

The fund has 0.38 years weighted average maturity, meaning that it will take a bit over 4 months for the fund to fully turn its collateral. As soon as the Fed cuts the fund will start exhibiting a slightly lower yield, a yield that will only move fully lower after 4 months as the fund is forced to buy into lower-yielding bills.

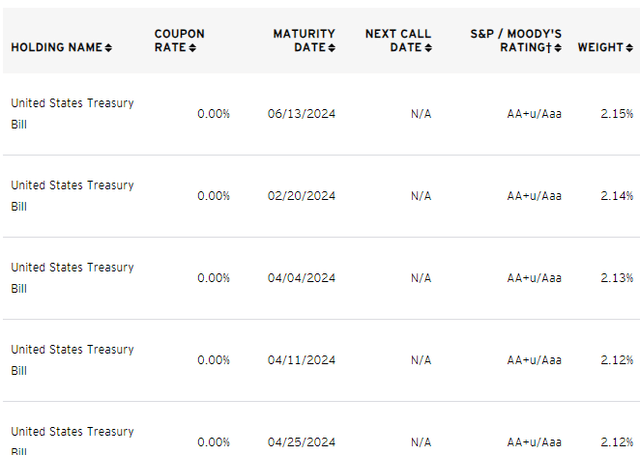

The fund contains a mix of T-Bills and Treasury notes, thus not having any credit risk:

TBLL versus short dated bond funds

The main difference between TBLL and short dated corporate bond funds is the composition. TBLL contains exclusively treasuries/T-bills, while short dated corporate bond funds have a credit risk profile. While short-term corporate bond funds tightly manage that risk factor via the low duration and high collateral rating, theoretically they can experience losses based on unusual defaults. Investment grade defaults, especially for those exhibiting a short duration are highly unusual, but they do occur. Think Lehman, think Signature Bank, think SVB. The trend is financials, and the reason is the high leverage embedded in a bank’s balance sheet. With the Bank Term Funding Program set to end in March, we might experience more trepidations in financials, although we do not expect further defaults.

TBLL is a safe choice at the current stage of the macro cycle, with the fund taking a bit more duration which is good, while taking no credit risk at all. Expect a slow upward accrual in terms of TBLL’s total return, with no drawdowns given rate hikes are in the past.

Conclusion

TBLL is a fixed income exchange-traded fund. The vehicle has a 0.37 years duration, which is a positive trait going into a monetary easing environment. The duration component translates into roughly 4 months for the fund to fully turn its collateral and start tracking the new rates exhibited by the front end of the curve. Until the Fed actually cuts, this fund is a Buy, with the ETF being able to match short rates until an actual decision is made on lowering Fed Funds. We believe the Fed is very data dependent at this stage and will err on the conservative side given the implications of a resurgence in inflation. Our ‘house view’ is for a June Fed cut, with short dated bond funds being an appealing choice until that date. A retail investor would also do well to start moving into higher duration short dated funds, thus being able to capture the positive side of duration in light of monetary easing.