airdone

Tanger Inc. (NYSE:SKT) is a well-managed open-air shopping center real estate investment trust with growth in rental spreads due to robust re-leasing activity and growth in its underlying funds from operations.

Tanger Factory slashed its dividend during the extremely unsettling Covid-19 pandemic, but the real estate investment trust started to pay a dividend again in 2021, and raised its dividend pay-out by 6% in the fourth quarter.

I think that Tanger Factory could see incremental FFO growth in 2024 due to new acquisitions which in turn should yield a higher base dividend.

My Rating History

I issued a bullish stock classification a year ago in my presentation Tanger Factory: Secure A 4.5% Yield For Tough Times, pointing to the real estate investment trust’s funds from operations growth, robust portfolio occupancy and safe dividend. For 2024, I think we could see a more aggressive acquisition posture of Tanger Factory.

With robust re-leasing/re-tenanting activity also providing investment support, I think SKT is a Buy for passive income investors that seek reliable and growing dividend income from a top REIT holding.

Well-Positioned For Growth, Acquisition Potential In 2024

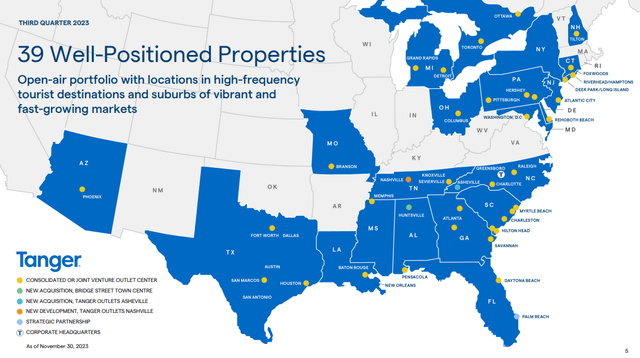

Tanger Factory is a leading owner and operator of outlet and open-air retail shopping destinations. The real estate investment trust presently owns 39 outlets and shopping centers in the United States and Canada, representing a total of 15.7 million square feet, and its properties are located in major metropolitan areas that have favorable population growth and household income trends. Key real estate locations are Houston, Atlanta, Columbus, Charlotte and Phoenix, to name a few.

Property Portfolio (Tanger Factory Outlet Centers)

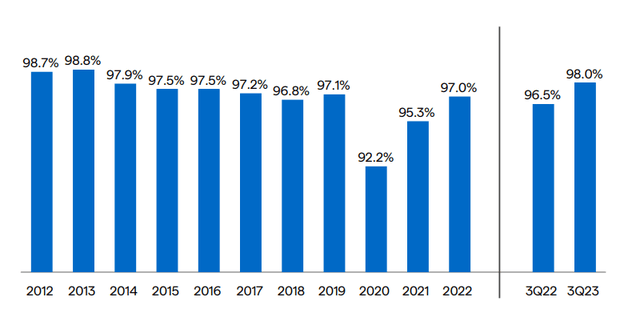

As was the case in the past, Tanger Factory is sporting first class occupancy rates and the real estate investment trust now has an occupancy that exceeds its portfolio occupancy before Covid-19. In 2020, Tanger Factory suffered a steep, short-lived, drop in its occupancy, but the trust has fully recovered and ended the third quarter with an occupancy of 98%.

Occupancy Rates (Tanger Factory Outlet Centers)

Re-Leasing Spreads Are Driving FFO Growth

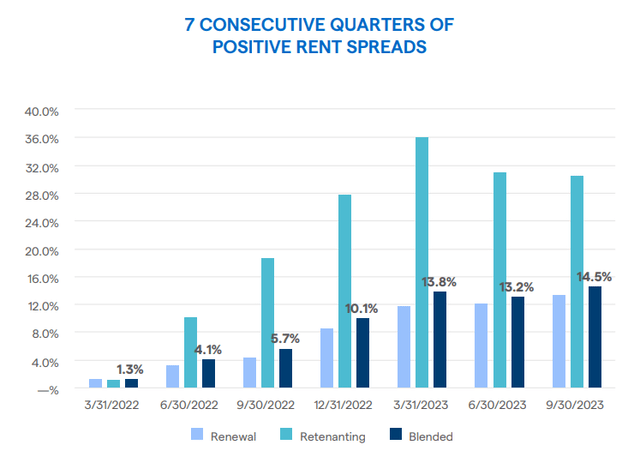

Tanger Factory profits from positive lease momentum in its shopping centers which is fueling the trust’s rental growth. REITs can grow their FFO through a number of actions, like redevelopments and acquisitions, but re-releasing existing properties is another solid way for Tanger Factory to unlock additional cash flow. In the third quarter, the re-leasing and re-tenanting of the trust’s properties resulted in a 14.5% increase in its rent spreads.

Positive Rent Spreads (Tanger Factory Outlet Centers)

In addition to new tenants taken over space in the trust’s properties, Tanger Factory might as well decide to throw more cash at acquisitions. In the fourth quarter, Tanger Factory acquired a 825,000‑square-foot open-air lifestyle center in Huntsville, Alabama and a 382,000-square-foot, open-air shopping center in Asheville, North Carolina.

New acquisitions in 2024, with a strong U.S. economy acting as support, could lead to incremental funds from operations growth for Tanger Factory.

FFO Growth And Dividend Pay-Out

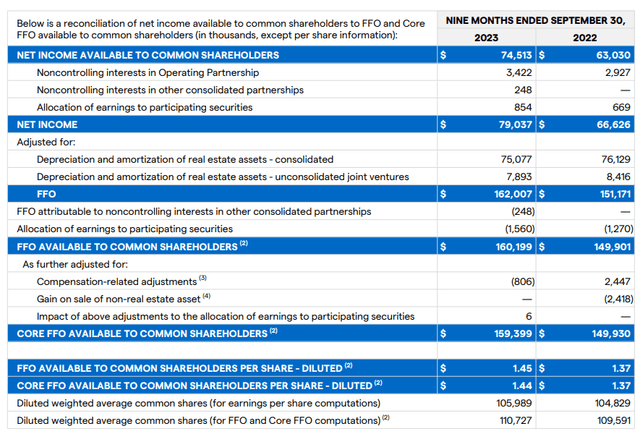

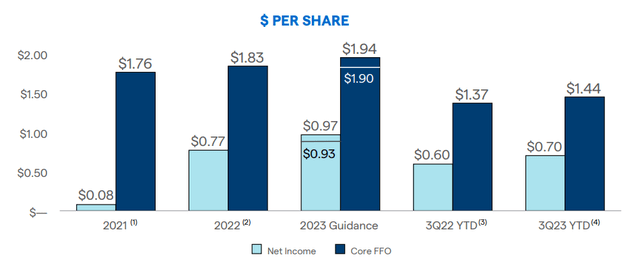

Tanger Factory reported $160.2 million in funds from operations between the first and the third quarter of 2023 which reflected a total FFO growth rate of 7% YoY. This growth is supported by a number of factors including a high occupancy rate for the real estate investment trust’s shopping center portfolio, but particularly, as I pointed out above, re-leasing/re-tenanting activity.

On a per share basis, Tanger Factory earned $1.45 in funds from operations until September 30, 2023 while paying out $0.71 per share in dividends to shareholders. This equates to a dividend pay-out ratio of 49% and the dividend pay-out ratio is even better than the one offered up by Kimco Realty Corp. (KIM).

Kimco Realty paid out 58% of its funds from operations in the last year and I consider the shopping center’s dividend to have a very high margin of safety.

Funds From Operations (Tanger Factory Outlet Centers)

2024 FFO Outlook And Multiple

As per Tanger Factory’s latest guidance, which was issued as part of its third quarter earnings, the shopping center real estate investment trust anticipates $1.90-1.94 per share in core funds from operations for this year.

Based on a stock price of $27.11, Tanger Factory is presently selling for a 14.1x (core) FFO multiple whereas Kimco Realty is priced at 13.1x core funds from operations.

The difference in valuation multiple is not that large and I think that both real estate investment trusts are attractive Buys for passive income investors, mostly because of their comfortably covered dividends.

In addition, Tanger Factory raised its dividend 6% in the fourth quarter, leading us to a present 3.6% dividend yield.

Core Funds From Operations (Tanger Factory Outlet Centers)

Recession Risk And Downside Potential

Tanger Factory is a well-managed shopping center real estate investment trust and a recession could damp the trust’s growth and acquisition potential.

During the last downturn, related to Covid-19, Tanger Factory experienced a large drop in its occupancy rate. A recession is something that I would not take lightly as the trust is dependent on the consumer economy remaining healthy. Any indication that consumers feel uneasy about spending money, in anticipation of a major recession, for instance, would be a major cause for concern.

My Conclusion

Tanger Factory’s funds from operations growth and re-leasing/re-tenanting activity are good reasons for passive income investors to own the real estate investment trust in a growth-focused portfolio.

More importantly, the trust is acquiring new shopping centers and could so again in 2024 which would fuel Tanger Factory’s FFO and dividend growth.

Tanger Factory increased its dividend 6% in 4Q-23 in 4Q-23 and the dividend is well-covered by funds from operations. Correspondingly, I consider Tanger Factory a Buy for passive income investors with a moderate risk tolerance.