JHVEPhoto/iStock Editorial via Getty Images

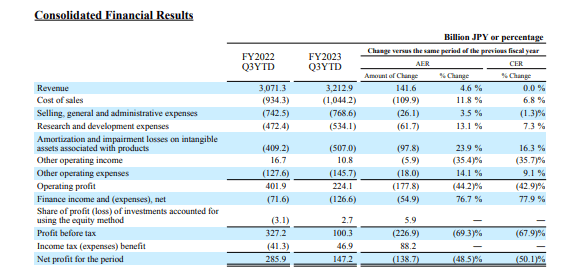

Multinational Japanese drug company, Takeda Pharmaceutical (NYSE:TAK) reported a 4.6% (YoY) growth in Q3 2023 revenue in the 9 months to December 31, 2023. Sales grew to JPY 3.2 billion from JPY 3.0 billion in the prior year driven by positive foreign exchange moves (forex) and pipeline advancements. The stock is trading 13.47% below its 52-week high and has lost 9.87% (YoY) owing to developmental pipeline challenges early in Q3 2023 including the “ discontinuation of its R&D on AAV-mediated gene therapy approaches.”

Thesis

Takeda Pharmaceutical announced that its novel product EOHILIA had been approved by the FDA in the USA paving the way for its launch and commercialization. This announcement follows the approval of FRUZAQLA and ADZYNMA in November 2023. The global drug maker is also advancing its R&D pharmaceutical transformation through innovative AI solutions with strategic partnerships to hasten drug discovery. Overall, the company has provided positive revenue guidance in 2024 and is committed to the growth of its shareholder return in the long-term including the advancement of its dividend policy.

The FY 2023 saw Takeda Pharmaceutical score big in terms of FDA approvals for its novel drugs. It has more than 50 drugs under distribution in the US alone with a market capitalization of $46.70 billion as of this writing. While Takeda’s medicinal background has been around for more than 240 years, it only began developing into an international pharmaceutical firm in 2000, indicating a rapid globalization process in the last 2 decades alone.

At least 5 drugs from Takeda Pharmaceutical were approved by the US FDA from November 2023 to the latest, Eohilia on February 12, 2024. At the moment, Eohilia is the only approved oral treatment for eosinophilic esophagitis (EoE) since Sanofi’s Dupixent was approved as an injectable drug for the disease’s treatment. Takeda has come a long way with the drug having been rejected by the FDA in 2021. EoE is stated to affect at least one in every 1700 people with the dominant patients being males. As of 2023, EoE’s market size stood at $140 billion and is forecast to reach $1.02 trillion in 2031, growing at a CAGR of 28.22% within the forecast period.

Research also shows that North America has the highest incidences of EoE at 5 to 20 new cases per every 100,000 people (annually). The prevalence rate of EoE in these two countries also stands at 9.5 to 58.9 adults per 100,000 with heritability of the disease also being cited as a potential growth risk.

Also approved in November 2023 was Adzynma, a treatment for an ultra-rare blood condition, “congenital thrombotic thrombocytopenic purpura (TTP). Another approved drug at that time was Fruzaqla for the treatment of “previously treated metastatic colorectal cancer (mCRC).” Clinical research has over the years indicated that CRC is the 3rd most common malignancy and the 2nd most deadly cancer globally.

Company with a focus

With these new advancements, it can be clearly understood why Takeda rapidly shifted from generics and targeted OTC drugs to an innovative pipeline fueled by robust research and development (R&D). We are now looking at a global pharmaceutical giant that focuses on six main “therapeutic areas: 1) neuroscience, 2) gastrointestinal/ inflammation, 3) rare diseases, 4) Plasma-derived therapies, 5) vaccines, and 6) Oncology.” Takeda has established this milestone in less than a decade, which according to me is due to transformational management.

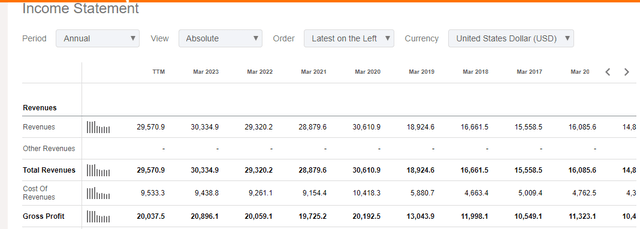

Firstly, Takeda appointed Mr. Christopher Weber as its CEO in 2015 after serving as the COO from April 2014. Since Weber’s appointment in 2015, Takeda’s annual revenue has more than doubled, from $14.82 billion as of March 2015 to $30.335 billion in the FY ending in March 2023.

Takeda’s overall approach in the last decade has been establishing patient-focused remedies in line with a sustainable business environment. Being a global pharmaceutical company with a workforce of at least 50,000, Takeda has consistently guided its innovative products based on its cultural and regional understanding. Early on while speaking about the intended tactic at Takeda, Mr. Weber stated, “The value-based approach can transform healthcare systems by putting patients at the center and allocating resources to the most valuable care.”

Innovative AI solutions

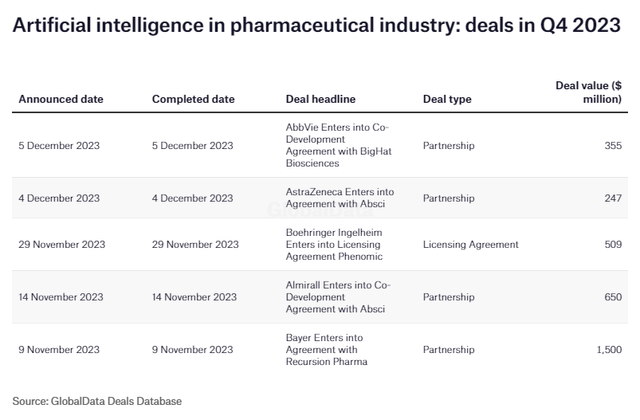

Over the years, Takeda has reiterated its commitment to enhancing innovation by incorporating digital solutions in its R&D. In particular, it announced the “use of cutting-edge AI systems that help discover new medicines, better understand fundamental biology, optimize treatments, or enhance the experience of patients, HCPs, and others.”

Against this backdrop, Takeda is partnering with “AI Self-driving labs tech” producer Atinary to not only harness its AI technology but advance its R&D proficiency. We can also consider other areas such as the optimization of its supply chain and other manufacturing operations that will benefit from this digital transformation. Targeted R&D investments will be made in Takeda’s six main focus areas to help in the establishment of effective treatment options for patients.

The pharmaceutical industry has witnessed a shift in the use of artificial intelligence in acquiring staff, making patient filings, and growing markets. There has also been a global increase in related deals worth millions of dollars that have shifted the dynamics of biopharmaceutical operations.

In the use of generative AI especially in content creation, Takeda’s sales team will understand the best options for individual providers of healthcare rather than just analyzing them based on market share. The latter can easily misrepresent the needs of the physician groups.

In a report by McKinsey & Company, the use of technology in pharmaceuticals is forecast to generate an annual revenue of between $60 billion to $110 billion. With Takeda, the use of AI will also be applicable in marketing and grow the approval of other drugs under development.

Other aspects to consider

Takeda is in talks with Indian regulators to allow for the launch of a dengue vaccine in the country. The company hopes to commence clinical trials after the approval and also grow the vaccine’s manufacture through a partnership with India’s Biological E. In 2017, India recorded about 12.9 million primary dengue infections. Currently, there exists a “US-Indian vaccine action Programme” that has licensed Indian companies with the partnership of the US National Institutes of Health (NIH) to develop the dengue vaccine. Remarkably, the Phase 3 trials of this vaccine are expected to begin in 2024, just when Takeda made the announcement.

At the moment, there only exists one vaccine approved by the FDA- Dengvaxia (by Sanofi). It is used by patients aged 6 through 16 and is only recommended for those who tested positive for the infection or are living in endemic areas. This condition has necessitated other companies to produce the dengue vaccine expanding the patient population. Dengvaxia’s injectable powder is estimated to cost $119.02. Takeda plans to “produce 100 million doses per year within the decade” while Biological E will grow the production to “50 million doses per year.” If also approved in the US, the dengue vaccine may rake in at least $10 billion per year for Takeda.

Risk and valuation

Pipeline influx

Takeda currently has up to 50 clinical-stage products in its pipeline spread across its six focus areas. I believe the company is still rebuilding and is yet to pick out clear winners since most of its drugs come from patent production. While it has grown its revenue over the decade, it will be vital to grow particular brands to ensure growth in market presence. Bringing all of them to the market is expected to be expensive. This can be seen by the fact that Takeda’s net profit in the 9 months ending in December 2023 stood at JPY 147.2 million despite recording a revenue of JPY3.2 billion (in the same period).

Takeda Pharmaceutical

Takeda’s dividend yield (TTM) stands at 4.32% against an annual payout of $0.63 (per share). The five-year growth rate is -17.07% indicating no positive change.

Valuation

Takeda’s forward PE ratio is X36.53 against the industry average of 33.46. It represents a 9.19% percentage difference indicating a slight overvaluation. We may see a potential downside to the stock as it prepares for pipeline readouts at the end of FY 2023.

Bottom Line

Takeda’s advancement in the last decade points to its experience in clinical product development with 50 treatments in its pipeline. The latest approval of Eohilia, Adzynma, and Fruzaqla is a testament to the company’s strength in R&D and product development. Further, the inclusion of digital transformation coupled with strategic partnership is seen as another pillar in Takeda’s success. Still, I feel the company needs to grow its net profit as it is incurring more expenses in its clinical trials due to the huge pipeline. For these reasons, I propose a hold rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.