Christopher Furlong/Getty Images News

My Thesis

You know, in my country, we don’t have Starbucks (NASDAQ:SBUX). Every time somebody returns from a vacation in the US or Europe, they mention that the coffee taste is different. But take notice of what I wrote here—they go to Starbucks and return there on the next vacation. Why is that? Well, it’s because Starbucks managed to create a super-strong brand power, a status symbol. I remember my sister wanted to buy Starbucks just for its cup; she doesn’t even like coffee.

Starbucks’ brand power is translating into numbers and creating a high-quality company, one that I have an interest in. It has high returns on capital, ones that are growing, solid top-line growth, and good solvency. It also pays a nice dividend, although I’d prefer it to buy more shares.

But the cherry on top is that it is also trading at a reasonable price. Let’s dive in.

Brand Moat

I believe Starbucks has a moat, even a wide one. I’ll use Morningstar Moats to demonstrate it.

Intangible Assets – Though not always easy to quantify, intangible assets may include brand recognition, patents, and regulatory licenses. They may prevent competitors from duplicating products or allow a company to charge premium pricing.

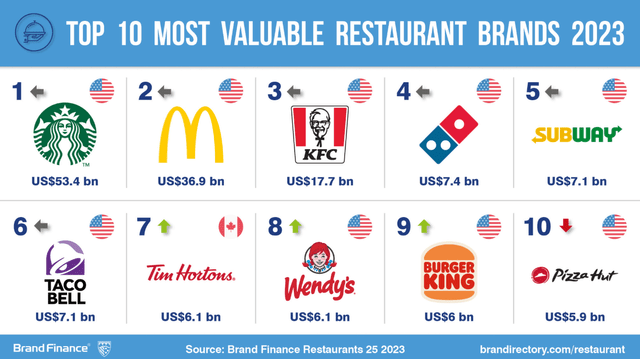

Starbucks has a very strong brand, arguably the strongest in the restaurant world. In my country, we love to explore brands that aren’t available here, and the first place people go to is Starbucks, mostly for the experience. According to Brand Finance, Starbucks is ranked as the number 1 brand in the industry by quite a margin. Building such brand power takes time, especially to become international. This brand power creates pricing power, and pricing power is crucial when valuing a business. This isn’t just my opinion; even Warren Buffett emphasizes the importance of pricing power in business valuation.

We can observe Starbucks’ brand power in 2023 when people had less money due to rising interest rates. Despite this, Starbucks’ comparable sales were strong at 8% year over year, and 9% year over year in North America. Here’s a way to gauge Starbucks’ brand power: if you walk the streets of Tel Aviv and show the Starbucks logo, everyone will recognize it, whereas if you show the Costa Coffee (KO) logo, only a few will know. Another indicator of strong brand power is the at-home coffee market and the ready-to-drink market.

This was driven largely by At-Home Coffee, while proudly holding the number one share position in the category at 16.1%, as well as the number one position in Ready to Drink, achieving our highest share in two years. Our fall launch, in conjunction with our North America Coffee Partnership, drove our performance, resulting in the segment performing better than the overall category.

Network Effect Moat

Network Effect – A network effect is present when the value of a product or service grows as its user base expands. Each additional customer increases the product’s or service’s value exponentially.

Well, Starbucks benefits from people seeing its logo on coffee mugs everywhere. Moreover, as a customer, you know what you’ll get whether it’s in New York or London — quality coffee. You can trust the brand, and with it in every major city, you return to buy there. There are also the benefits of the membership programs, with 33 million members in the US and an additional 21 million in China.

Our 90-day active Starbucks Rewards members reached a new record this quarter of nearly 33 million 90-day active members, and setting records in spend per member and total member spend. Customers remain loyal to a favorite four menu classics that have stood the test of time, including the Pumpkin Spice Latte, which celebrated its 20th anniversary.

Also, one could argue that Starbucks has a cost advantage moat due to its enormous scale and ability to negotiate prices. I don’t have a way to prove it right now, so we won’t focus on this aspect here.

Leaders

Laxman Narasimhan, the CEO, is very new to the job, so we can’t judge him thus far. However, we can look at his impressive resume, which includes experience in the retail space and various business areas, consulting at McKinsey.

What I like about Starbucks is that the board holds superstars, with Satya Nadella, who might not have experience in the restaurant world, but is a talented leader I appreciate. Richard Allison, the former CEO of Domino’s, brings more experience from another strong brand in the restaurant space.

CEO incentives are well-aligned with shareholders, as almost 80% of CEO compensation is based on equity, and more than 90% is at risk. Good incentives are very important in my view, especially where the business is not founder-led or family-owned, and insiders do not have significant ownership, especially after the legendary Howard Schultz left.

Q4, China & Guidance

Starbucks reported in November and is also set to report at the end of the month. Sales grew by 11% year over year in Q4, and when adjusting for currency to gauge the business’s intrinsic performance, we see an impressive 14% top-line growth. In my view, the more crucial numbers are the comp growth rates, boasting an 8% comp growth globally, and notably, a 5% comp growth in the challenging Chinese economy. Starbucks plans to have 9,000 stores in China by 2025, implying a 15% CAGR in store expansion. Additionally, there is a chance that the economy there will recover, leading to higher comp growth. The management expects strong long-term growth in China. We can observe that the brand power works well in China.

China now has over 21 million active loyalty members, representing 22% year-over-year growth, with many members skewing younger to build our next generation of customers…

The momentum against the backdrop of headwinds in China this past year give us optimism in our position and affirm our distinctive competitive advantages for our business…

We continue to see long-term growth in China with significant opportunities in daypart, digital offerings, and store format and, accordingly, continue to make investments for the future of our partners, stores and local community.

Also, when looking at China, the currency-adjusted growth looks much better and indicates the robustness of the business there.

Turning to China. We were pleased with our performance in the quarter, delivering revenue growth of 8% from the prior year, or up 15% when excluding approximately 6% impact of foreign currency translation. This is further supported by a comp of 5% squarely in line with our expectations. Full-year revenue grew to $3 billion, up 3% from the prior year, or up 11% excluding approximately 8% impact of foreign currency translation with comp of 2%.

Some may perceive China as a risk, and I completely understand their concerns. As tensions with the US rise, surprises from the Chinese government can come from anywhere.

The guidance was also strong, with comp sales expected in the 5-7% range, continuing the robust growth, and around 7% store count growth. Margin expansion is very important in my view, as it can boost Return on Capital figures, an important factor in long-term value creation.

For the upcoming results at the end of the month, unless the numbers are significantly off and the management guidance is far from reality, I’ll remain bullish. Additionally, Seeking Alpha data shows that most analysts have revised their earnings per share forecasts upward.

Numbers

What I’m looking for in a business is solid top-line growth with high Return on Capital figures, preferably growing ROC. This combination, in my view, is the strongest value creator of all. If you manage to catch the stock before multiple expansion, you’ve nailed it. Starbucks checks all the boxes. Analysts‘ top-line growth estimates are around 10% compound annual growth rate, similar to management guidance for 2024. Along with that, we get margin expansion, driven by price increases as well as operational efficiency. Management does expect margin expansion, and with the buybacks, this could lead to mid-teens growth in EPS. That’s the analysts’ consensus as well, even up from that.

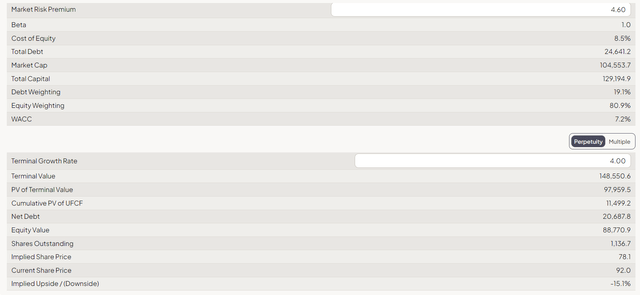

Margin expansion is important in my view because it grows the spread between the company’s Weighted Average Cost of Capital and its ROCE/ROIC figures. A recent study by Michael Mauboussin showed that companies with a high and growing spread between the WACC and the ROIC tend to perform well. ROIC is dependent upon how you calculate it; management noted at the earnings call that Starbucks reached a 25% ROIC. I prefer to use ROCE because it’s simpler and provides a similar outcome. ROCE for Starbucks grew to 28%, an outstanding number.

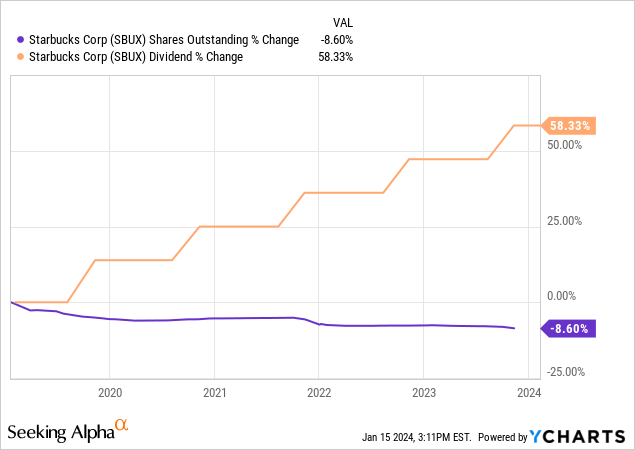

With the extra cash, Starbucks returns a lot to shareholders, with a dividend yield of 2.5%, growing at a 20% CAGR in the last 13 years—a classic dividend growth stock. Management is committed to a 50% payout ratio. I personally prefer buybacks, but cash is also a suitable option for me. The growth factor for EPS is the buybacks management undertakes, reducing the share count by around 1.7% a year.

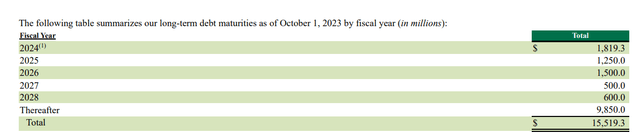

Some may scrutinize Starbucks’ balance sheet and be concerned about the high debt, but I don’t perceive any risk there. Almost $10 billion out of the $15 billion matures after 2028. Starbucks needs to return between $500 million to $1.8 billion each year, depending on the year — numbers that are easily covered by its free cash flow. I don’t see this as a risk.

Valuation

At 22 times NTM earnings, it’s cheap for a company growing in the mid-teens along with a 28% ROCE. In my view, it is very cheap. Companies with such growth potential are rarely found at these prices. Another positive factor is that Starbucks has room for multiple expansions. It is trading below its multiples averages, and the potential for both multiple expansion and EPS growth over time creates the multi-bagger we all strive for. A 22 forward PE divided by 16% EPS growth gives us a 1.37 PEG ratio, not bad for a wide-moat, growing company.

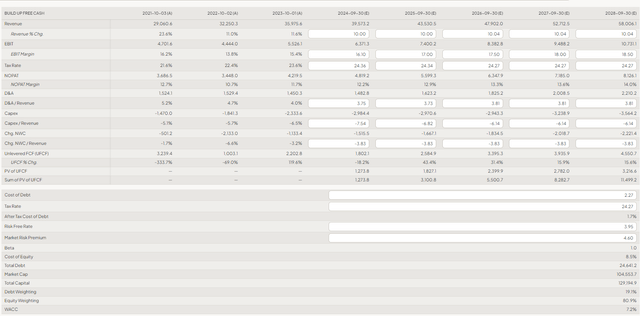

I’ll perform a DCF analysis, although I’m not a fan because most of the time it fails to capture the value of such companies. Many multi-baggers have been deemed too expensive by DCF models. Using a 7.2% WACC, 4% terminal rate, top-line growth of 10%, and a 0.5 basis point margin expansion per year, we get an overvalued stock by 17%. Well, I think the model is way off, and the company is pretty cheap.

Risks & Conclusions

Despite the quality of the company, I see several risks:

The first is the presence of a new CEO and the departure of Howard Schultz. While the new CEO has an impressive resume, a change in leadership always poses a challenge.

There are a few risks concerning China, including economic instability and rising tensions with the US. However, the reassuring factor is that comp sales are still growing there despite the economic slowdown.

Another risk is a recession in the US. Although people continue to buy Starbucks even during tough times, in a severe recession, it’s likely that people might reconsider spending $5 on drinks. It is certainly not a recession-proof business, I’d say.

Competition is less stressful for me, as it always has been, and Starbucks is still at the top.

Considering the risk/reward here, I believe SBUX is a STRONG BUY for long-term shareholders who will benefit from a high-quality, growing business, plus dividends. I look forward to your comments.