Arseniy Rogov

Swisscom (OTCPK:SCMWY)(OTCPK:SWZCF), as we pointed out in our last article, had smaller CAPEX burdens. This has in turn allowed them to double their market share in Italy inorganically through the acquisition of Vodafone Italy, which was a major player along with Swisscom’s own Fastweb. The acquisition seems reasonable by every metric. The only issue is that Swisscom remains a bit expensive compared to peers, likely due to it being less complex from a CAPEX point of view. Since the absolute and relative valuations aren’t that compelling we pass.

Brief Earnings Comments

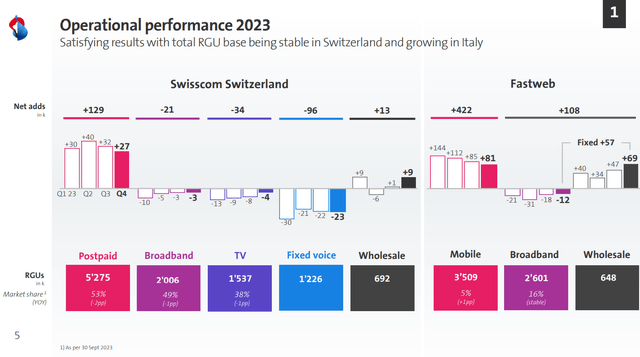

The story of the FY earnings are pretty straightforward. There was solid organic growth from net adds in postpaid, limited churn in broadband, similarly limited churn in TV and stable results in wholesale. The only really declining business is of course voice as people cut landlines.

Fastweb also did well in mobile, which is a newer limb in Fastweb’s internet provision strategy.

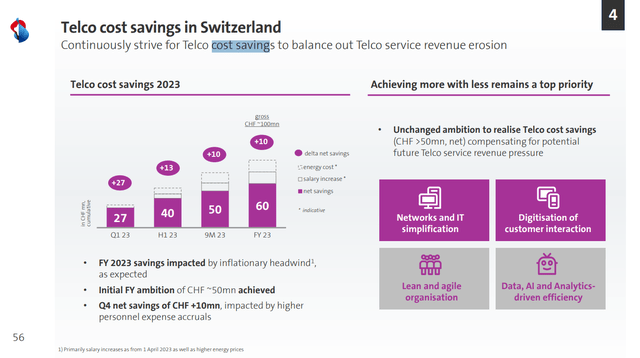

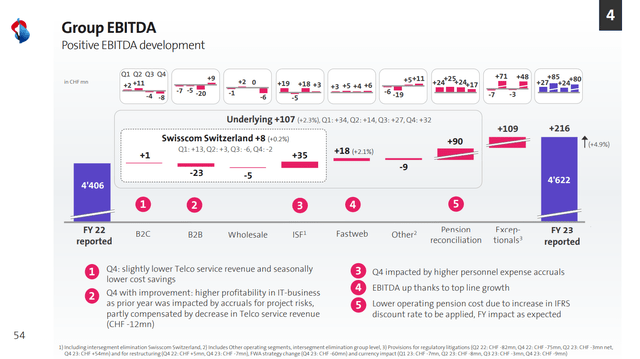

Cost savings were meaningful, and there was an additional benefit accounting for almost half the EBITDA growth from pension reconciliations associated to the ongoing lessened EBITDA burden from pensions which are now more easily financed by the higher interest rates.

There’s nothing especially untoward. The net adds keep coming, although there are ongoing competitive pressures limiting the overall EBITDA growth driven primarily on the revenue side, as the cost savings initiatives are working. The performance is more or less in line with peers and reflects the general competitiveness of the industry.

Vodafone Deal

The Vodafone (VOD) deal is now confirmed. Its Italian business was acquired by Swisscom for 8 billion EUR. Multiples paid are in line with Swisscom’s own EV/EBITDA and EBITDaL multiples, which is perfectly reasonable considering control premiums and that the infrastructure is not Vodafone’s concern, to our previous understanding, and that it comes down to Telecom Italia (OTCPK:TIIAY). There should be no special rollout CAPEX that they’d be on the hook for.

This also serves to double Fastweb’s market share which is planned to merge with Vodafone Italy, where it was almost tied with Vodafone and Wind Tre before. It is just behind TIM at this point. We don’t expect there to be any exceptional competitive value from having higher market share, besides the benefits of scale. The industry is still highly competitive, and it is working on TIM’s infrastructure regardless.

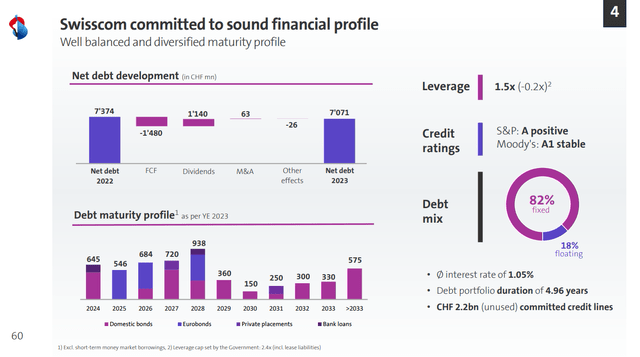

The deal is all in cash, and will be financed by debt on Swisscom’s side. They had around 2 billion EUR in committed but unused credit facilities which gets them somewhere without meaningfully changing the average rate profile, but the net debt burden is almost certainly going to be growing at this point from an already hefty 7 billion EUR to more than twice that. They should remain with a strong A credit rating thanks to their mostly fixed debt structure and very low existing rates, and pretty drawn out maturity profile, but the leverage is certainly growing, probably much closer to around 2.7-3x ND/EBITDA. EBT should be around 25% lower on account of that and the new debt, presuming a more modern 5% prevailing rate which would be consistent with European rates for a telco. Then there are some refinancings coming in in 2024.

Bottom Line

Swisscom definitely has capacity for the deal considering their current debt situation, which is highly sustainable. There really was no reason not to do it, as the valuation was perfectly fair. It won’t afford Swisscom any special advantages, and it’s not a reason to get excited, but it shows the value of not being heavily indebted and having staying power in a competitive market. If they had larger Swiss CAPEX burdens for a fibre rollout this would not be happening.

From a valuation point of view, Proximus (OTCPK:BGAOF) is at around a 5x multiple, and BT Group (OTCPK:BTGOF) is somewhere around 6x. Swisscom is quite a bit ahead of that at around 7.5x. After this deal, as the acquisition isn’t EBITDA accretive, that multiple goes up a little more. In other words, Swisscom is at a premium. Of course, it makes sense considering how much less complex they are, as they are not still on the hook for major fibre rollouts like BT Group and Proximus both are. So there isn’t a strong relative case, and we’d rather not buy its alternatives, except for maybe Proximus provided the IPO angle materialises.

In terms of absolute valuations, a 16x multiple and a 4.2% yield is pretty standard for what you’d expect from a telco historically. The dividend is well covered which can’t be said for alternative picks, and earnings yields aren’t too bad, and clearly a spread from risk-free rates. However, a 16x valuation is not that fantastic compared to some options you can still find on the market. Nothing too compelling here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.