imaginima

Servers: A Story of Ongoing Growth

AI, Networking, and the Hybrid Cloud

The server market sits at the tail end of the global semiconductor ecosystem. After fabless companies design chips and fabs manufacture them, it’s on server OEMs and ODMs to incorporate leading technology into marketable products.

Servers are the computers that power the cloud, telecom networks, and edge computing. Without high-powered servers, LLMs like ChatGPT and text-to-image generators like Adobe Firefly would be impossible. The largest customers of server providers are data center operators, mainly big cloud service providers (CSPs) Amazon, Microsoft, Google, and Alibaba. These CSPs, or hyperscalers, have built quite large data center networks to date and have numerous expansions planned.

Server market growth has a few key determinants. Data center expansion, the tendency toward industry standards, and consumer branding preferences are key growth drivers for this industry. Data centers are the leading customers of server OEMs, industry standards provide a lock-in effect and allow companies to build moats, and branding allows for price and component flexibility.

Datacenter Expansions

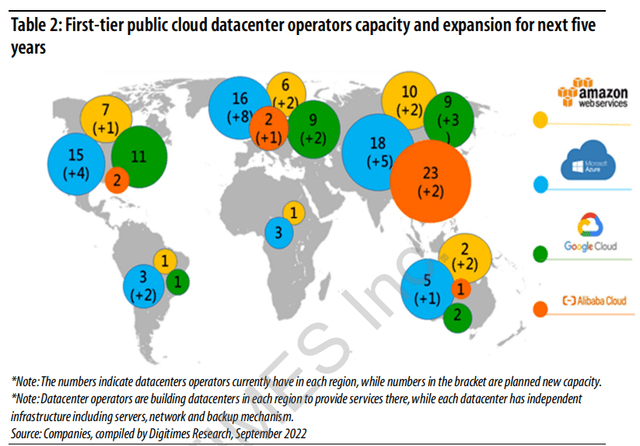

Data center expansion represents both short and long-term growth vectors for server companies. These expansions are therefore quite bullish for server providers. New machines are purchased today and the base of existing machines that will need servicing/hardware upgrades over time increases. Here’s a breakdown of current capacity and expansion plans, according to TechInsights:

Determinants of data center demand include artificial intelligence, the Internet of Things, autonomous driving, and generally the expansion of the digital world. The more embedded the physical world becomes in its digital counterpart, the more demand there will be for computing power.

Considering the pace of innovation in the semiconductor ecosystem, hardware obsolescence is a serious risk for data center operators. Hardware that’s even a few years old could be orders of magnitude less performant and/or efficient than newer hardware. There are strong incentives for data center operators to consistently upgrade full racks, networking interconnects, and cooling systems – especially as Nvidia shifts towards a bundling model with the DGX and HGX systems. Data center operators are facing increased complexity in floor planning, cooling, and networking requirements.

NVIDIA (NVDA), the golden child of AI, is using a bundling strategy to increase pricing power and become more entrenched in data center infrastructure. The new GH100 AI chip is not the tiny chip we typically envision, it’s a massive computing unit. Moving data around data centers is now a significant consideration for floor planning and design for operators. CPU and GPU racks have different networking and cooling requirements, so data center operators need to make decisions on the split between these racks.

Data centers have a number of key growth tailwinds. Companies are digitizing at scale and shifting toward a digital-native approach to business. The cloud is imperative to achieve this.

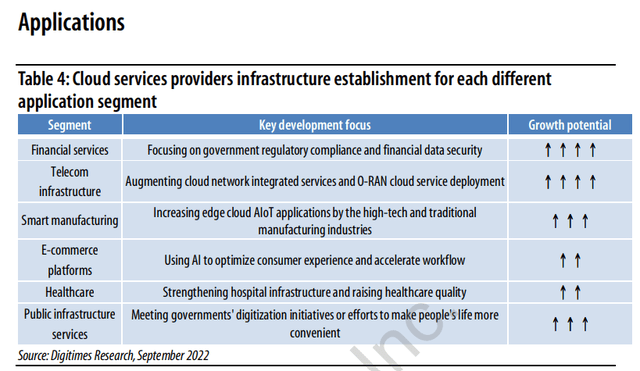

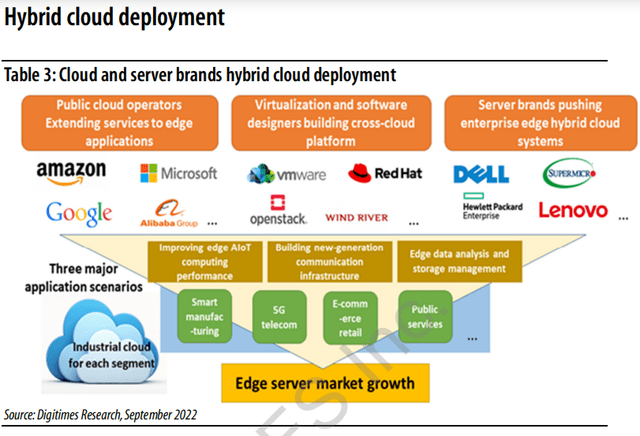

Hybrid Applications

Alongside cloud clusters, the hybrid cloud is another key trend in the server market. A hybrid cloud combines the use of public and private clouds. Hybrid clouds offer companies the opportunity to optimize their cloud infrastructure. Seasonality, variable requirements for data security, and cost considerations are key to hybrid cloud demand. For example, financial services companies, noted above as having high-growth potential, have a clear use case for the hybrid cloud. Financial services firms are required by regulation to maintain quite a substantial amount of customer data, which has differing levels of security requirements. This is a perfect example of why a hybrid cloud model is necessary. These firms will seek as much cheap storage as possible from the public cloud while hosting all PII (Personally Identifiable Information) and most other KYC (Know Your Customer) information on a private cloud to ensure sufficient security.

Industry Standards: O-RAN

The O-RAN standard will provide sustained growth in server demand. O-RAN, or Open Radio Access Network, is a new way of designing and building wireless networks. It’s based on the disaggregation of different components of a radio access network, such as the radio unit (“RU”), the distributed unit (“DU”), and the central unit (“CU”). These components communicate through open and standardized interfaces. This way, different vendors can specialize in different parts of the network, and operators can customize equipment according to their needs. O-RAN also leverages cloud-native principles and AI to enable more flexible and efficient network management and optimization.

DIGITIMES believes O-RAN will be a key growth driver:

“Dell, HPE, and Supermicro will also make additional efforts toward the Open RAN telecom equipment market and work with telecom carriers (including Vodafone, Dish, KDDI, and NTT Docomo) to introduce CU and DU servers or target opportunities in the private 5G network market.”

Dell, HPE, and SMCI are all key players in the wireless networking market. As the industry shifts to the O-RAN standard for wireless networks, data centers will continue to demand new networking equipment for existing and new data centers. AI & HPC and Networking are key growth vectors for the server market. Aside from O-RAN networking, networking equipment within data centers that connect servers is another SMCI proposition. Although NVLink is a clear competitor to this proposition, NVLink is prohibitively expensive for all but the richest of companies and even then represents substantial upfront commitment and lock-in to the Nvidia product stack. Big CSPs may naturally opt for unbranded, internally managed networking solutions provided by server companies.

To Brand or Not To Brand: White-box OEMs

The long-term growth potential in the cloud industry is clear, and the server industry benefits from that. According to DIGITIMES Research:

In the global server market, the cloud data center segment shows the strongest growth momentum, which drives the growth of white-box server shipments. White-box servers represented only 43% of the global server market in 2021. The share is expected to rise to nearly 55% by 2027, buoyed by the robust growth in large cloud data centers. White-box server shipments, which are mainly for large cloud data centers, are projected to grow at a CAGR of close to 10% from 2022 through 2027.

Server shipments to US-based server brands are projected to grow at a CAGR of only 3% from 2022 through 2027 and their market share will lower to nearly 25% by 2027 as their customers continue to feel pressure from cloud service providers. The share of shipments to US-based server brands will fall short of 29% in 2023 as their enterprise customers reduce their capital expenditures toward server purchases amid the weak global economy.

White-box servers are built using off-the-shelf components or generic products supplied by ODMs (original design manufacturers). White-box servers are cheaper and more customizable than branded servers. Branded servers are sold mostly by name-brand companies like Dell (DELL) and HP (HPE). These are pre-built and don’t offer as much flexibility as their unbranded counterparts. As cloud providers delve deeper into the cluster and hybrid models, the flexibility of white-box servers will provide sustained growth for white-box suppliers. The largest white-box server provider is Super Micro Computer (NASDAQ:SMCI), which is one of the leading server providers in the US. SMCI has experienced strong price appreciation in 2023 on the back of AI hype and high expectations. Both DIGITIMES Research and Reports and Data have forecasted that white-box servers will gain market share against branded servers. These servers are more customizable and better suited for hyperscalers to continue building AI and HPC capacity. Further to that SMCI offers rack scale plug-and-play, a highly customizable and easy-to-implement product, making them a clear beneficiary of the aforementioned market share trend.

The White Box Server Market is expected to outpace branded server growth:

The white box server market revenue growth is a result of the increased demand for cloud computing. White box servers are becoming more popular among cloud service providers due to their affordability and scalability, which allow them to optimize their data center architecture and save operating costs. Furthermore, the white box server market revenue growth is a result of the rising demand for Hyper-Converged Infrastructure (“HCI”) solutions. White box servers can provide the high level of customization and flexibility needed for HCI solutions.

In addition, the white box server market revenue growth is due to the rising need for High-Performance Computing (“HPC”) solutions in sectors including automotive, aerospace, and defense. High processing, memory, and storage capacity are needed for HPC systems, which can be provided by specialized white box servers. The demand for flexibility and customization in HPC solutions is accelerating the uptake of white box servers.

The growing desire for servers that use less energy is another factor driving the white box server market revenue growth. White box servers use commercially available components that have been tuned for energy efficiency, so they are made to be as energy-efficient as possible. They are thus a desirable alternative for data centers seeking to cut back on their energy use and environmental impact.

In the same article, there’s a discussion of the rack and tower product category, which is the leading product in the white box server market.

“In terms of revenue, the rack and tower category dominated the worldwide white box server market in 2022. The versatility of their designs, characteristics that make them simple to install, and affordability are credited with the expansion of the rack and tower market.”

Supermicro offers a highly customizable, easy-to-operate rack scale product called plug-and-play. The customizability of this offering will drive demand from ‘GPU Poor’ and ‘GPU Rich’ companies alike. The plug-and-play product line will provide sustainable market-beating earnings growth for Supermicro.

Relative Investability

Dell, HPE, and SMCI

SMCI has experienced a material price appreciation throughout 2023 but is still a compelling growth opportunity. They recently ran up above the $350 price point, followed by a sizable drop to the current price below $250. This was driven mostly by forward expectations provided in their most recent earnings release. Despite still guiding for strong growth, the market saw that growth as insufficient for the multiple at $350, leading to a weeks-long drop in share prices. I covered this earnings release, indicating that I’m still fundamentally bullish on SMCI. The flat expectations are driven by demand outpacing supply, which is hampered by the complex advanced packaging process required for leading-edge chips. High bandwidth memory, or HBM, is a complicated, expensive, and timely process. However, enabling AI training and inference at scale absolutely requires HBM to bus enough data throughout a chip for effective and powerful models to operate.

The $250 price point leaves a forward earnings multiple of just over 14. Here’s a comparison between SMCI and the two leading branded server providers:

| Data as of October 27th | SMCI | HPE | Dell |

| Market Cap (at the time of writing) | $13.44B | $19.41B | $46.67B |

| Current Price (at the time of writing) | $243.39 | $15.31 | $65.39 |

| EPS (FWD) | $16.66 | $2.13 | $6.30 |

| FWD P/E | 14.37 | 7.09 | 10.24 |

| Cash on hand | $440.56M | $2.22B | $8.36B |

| Total debt | $309.46M | $13.51B | $28.01B |

| Yield | 0% | 3.17% | 2.23% |

| Gross Margin | 18.0% | 34.6% | 23.4% |

| Net Margin | 8.9% | 3.6% | 2.0% |

| Estimated market share | 4.80% | 16.80% | 17.20% |

Note: Market share data sourced from history-computer.com. All other data from Seeking Alpha.

While SMCI commands a higher forward multiple and doesn’t offer any yield, both Dell and HP are debt-laden monsters with significantly more debt than cash. Dell and HP also have cash distributions priced into their valuation, which leads them to potentially under-invest in critical future technologies for the sake of maintaining a dividend. Further, their debt-to-market cap ratios are significantly higher than SMCI’s.

SMCI is not subject to a debt constraint, with more cash than debt, which will allow it to continue building new and better products and bringing them to market quicker than competitors. Further, because SMCI incorporates new technology quicker than competitors, their products tend to offer better energy efficiency leading to a lower total cost of ownership. Customers get better products for relatively cheaper with low lead times. I covered this in more detail in a previous article, exploring SMCI’s business strategy and product ecosystem.

Although SMCI has a much tighter gross margin, this is mostly because of revenue breakdowns. 92% of SMCI’s revenue comes from their server & storage systems business line. This is equivalent to Dell’s ‘product’ business line, roughly 73% of revenue, which has a 17.5% gross margin. Meanwhile, Dell is generating a loss from its AI & HPC product line, the business line that most closely aligns with SMCI. So, while the gross margin profile looks dreary at first, peeling a layer back and evaluating SMCI with ceteris paribus conditions against Dell and HP, we find that SMCI has highly competitive margins for AI & HPC solutions. Further, SMCI touts a much better net margin, which should be a more important factor for investors.

Finally, Reuters recently reported that American companies operating in China may be at risk of Chinese retaliation during a potential conflict over Taiwan. While SMCI was plagued with accusations of Chinese spy chips throughout the 2010s, management made the difficult decision to diversify much of the supply chain. Today, few of SMCI’s products depend explicitly on China. Meanwhile, Dell and HPE are currently in the process of diversifying. Supply chain diversification is complicated and risky, which can lead to unforeseen price increases, efficiency losses, or margin compression. In the current geopolitical environment, it’s much safer to invest in businesses that have already diversified their operations and are operating relatively safer in the paradigm of potential East-West conflict.

Overall, the server market offers an attractive and safe investment opportunity. Leading server providers will continue to enjoy growth that outpaces that of the overall economy. White-box server companies look set to eat market share from their branded counterparts, and SMCI is the leading white-box server company available on the market today. While investors have lost the opportunity to invest in SMCI’s exceptional growth opportunity at an awe-inspiring valuation, long-term investors can still take part in this growth story. With a time horizon of around 10 years, I find that SMCI is an extremely high conviction bet on market-beating returns.