Anadolu/Anadolu via Getty Images

Sunoco (NYSE:SUN) made headlines this week when it announced it was acquiring NuStar Energy (NYSE:NS) in a $7.3 billion deal. In my initial write-up on the stock in September, I said it was a solid option for income-oriented investors, but I did not like its incentive distribution rights (“IDRs”). More recently in November, I said I thought the stock looked fairly valued. With the NS deal looking like a transformational deal, let’s take a close look at SUN and deal. The stock has returned over 20% since my initial write-up and 2% since my last article.

Company Profile

As a reminder, SUN is a motor fuels distributor that services the East Coast, Midwest, South Central and Southeast, as well as Puerto Rico and Hawaii. 7-Eleven, with whom it has a long-term take-or-pay supply agreement, is its largest customer and only one above 10% of revenue.

SUN owns 42 refined product terminals with about 20 million barrels of storage capacity. It also operates four transmix facilities and has 76 company-operated fueling stations in New Jersey along the Turnpike, as well as in Hawaii. It also generates ratable lease income from real estate assets it controls.

NuStar Acquisition

On January 22nd, SUN agreed to acquire NS in a $7.3 million deal, including the assumption of debt. SUN will pay 0.4 common units of its stock for each NS unit. The deal was a 24% premium to NS’s 30-day volume weighted average price (“VWAP”). The deal is expected to close in Q2.

SUN will issue $3.1 billion in equity to NS unitholders, while $2.6 billion in NS senior debt and GoZone bonds will remain outstanding. It will refinance $1.6 billion of preferred equity, subordinated notes and its revolver.

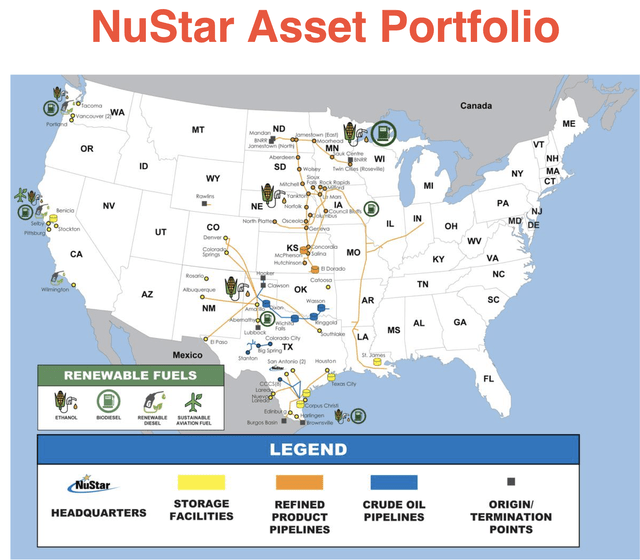

So what is SUN getting with the NS deal? NS is more diversified than SUN, with a network of refined product, crude, and ammonia pipelines and storage assets. It has about 5,400 miles of refined product pipelines, 2,100 miles of crude pipelines, and 2,000 millions of ammonia pipelines. It also has 49 refined product terminals and 14 crude terminals.

It also has renewable fuel assets on the west coast, including ethanol, SAF (sustainable aviation fuel), and bio-diesel blending, transport, and storage. In addition, it has a small fuel distribution segment.

Its assets are primarily located in the Midwest, running from Texas up north to North Dakota and Minnesota.

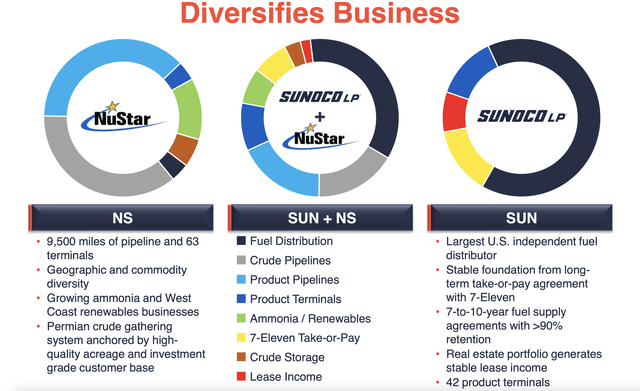

The overlaps between the two businesses is actually quite small. However, what the combination does do is create a much more vertically integrated company. NS’s largest operations are its crude and refined product pipelines, which SUN does not have. It also has important crude storage assets. This gives SUN assets across the value chain now, from crude gathering, to crude pipelines, to crude storage, to refined products, refined storage, and then fuel distribution and retail.

Combined SUN-NS (Company Presentation)

The rationale behind this vertical integration is that SUN’s fuel distribution business will help increase utilization of the terminal business. Higher utilization in turn will decrease fix costs per volume. In turn, the Midwest midstream assets it is getting also expands SUN’s geographical footprint, which should lead to more potential fuel distribution growth. And the NS assets will also increase its supply capacity as well.

SUN is expecting at least $150 million in run-rate synergies from the deal within three years. Much of this will come from cost and expense management. Additional synergies will come from the expected increased refined product terminal utilization and fuel distribution growth due to a larger geographic reach.

On the debt side, SUN expects to see about $50 million in interest expenses savings from refinancing NS’s high-cost floating debt. It anticipated getting to 4.0x leverage within the next 12-18 months. Notably, SUN has had a strong track record of deleveraging in the past.

SUN also sees the ability for implementing more growth projects with the combined company. This will come from both increased cash flow and a bigger opportunity set from the combined business footprint.

Overall, SUN expects the deal to be immediately accretive. Based on synergy estimates, expect about $37.5-50 million in 2024 in EBITDA additional as well as interest expense savings of about $37.5 million in 2024. Meanwhile, it is looking for 10% or more distribution cash flow per unit by year three of the deal closing. It expects to grow its distribution while maintaining a strong coverage ratio as well. At about an 8.4x 2025 multiple after synergies, it looks like SUN is paying a pretty fair price for the business, similar to the current public multiples of similar companies.

When it comes to risks that NS adds, it does add some expose to Permian E&Ps. With the Permian Basin the main oil growth driver in the U.S. this isn’t a bad thing, but it did see this segment impacted in 2023 from producer-specific operational issues and delays in the first half. And as midstream investors are well aware, the Permian has had natural gas takeaway issues that have impacted crude volumes as well. More takeaway should be coming online, but there is still some risk in this area.

NS’s pipelines and storage are also subject to volume and contracting risk. Only about 30% of its pipeline revenue is take-or-pay, and 69% of its storage segment. The storage segment saw some weakness in 2023 due to the amendment and extension of a customer contract at its Corpus Christi North Beach terminal.

As for SUN standalone risks, they remain centered around driving and fuel consumption, as well as fuel margins. These often counterbalance out, where lower volumes equals higher margins and vice versa, but it is something to monitor. EV adoption is a risk longer term, but the company has no exposure to the West Coast, where adoption has been highest.

Earlier this month, the company sold 204 convenience stores to 7-Eleven for $1.0 billion. As part of the deal, it amended its earlier take-or-pay agreement with the company to include the new locations. Separately but in the same press release, the company said it will buy liquid fuels terminals in Amsterdam, Netherlands and Bantry Bay, Ireland from Zenith Energy. At the time, SUN maintained its 2024 guidance calling for EBITDA of between $975 million to $1 billion.

The two deals (7-Eleven and Zenith) look to be a wash in terms of EBITDA, but will expands its take-or-pay agreement with its largest customer 7-Eleven, while allowing it to help supply its East Coast business.

Valuation

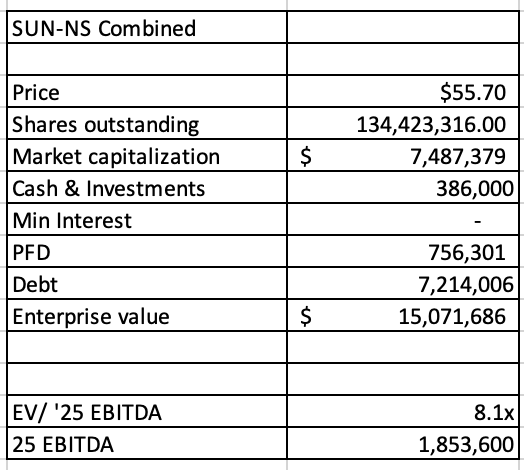

SUN-NS Valuation (Self, Filings, and FinBox)

The combined SUN-NS will trade at around 8.1x 2025 EBITDA. The estimate comes from a combination of SUN ($987.5 million) and NS analyst estimates ($766.1 million), as well as expected synergies of $100 million (estimate that 2/3 realized of $150 forecast realized by year 2. NS units are converted to SUN units on a 0.4x basis.

It trades similar to other crude and refined midstream names, outside of ONEOK (OKE), which trades at about 9.3x 2025 EBITDA. Plains All American (PAA) trades at 8.0x 2025 EBITDA, while Delek Logistics Partners (DKL) also trades at 8.0x.

Historically the SUN and NS businesses have traded between 8-11x EBITDA. Based on that, I’d value the combined company between $54-$95.

Conclusion

I think the SUN-NS merger makes a lot of sense, much more than the OKE-MMP combination. SUN’s fuel distribution business and NS’s refined and crude pipeline assets synergistically just go together nicely, while OKE-MMP was combining natural gas and refined pipeline systems and assets. I also like some of the emerging renewable fuel businesses that NS has started to build out, with a focus on the west coast. This is a geographic area that SUN does not have much of a presence.

SUN is ultimately part of the Energy Transfer (ET) family, and its parent has long proven to make very strategic and synergistic deals that make the combined assets better than the individual assets. I think this will prove true with this deal as well.

As for its upcoming earnings, expect seasonally lower fuel volumes but higher year over year, to go with typical fuel margins of around 13 cents per gallon, give or take a few cents. The company has already given and reiterated 2024 guidance, so don’t expect any changes until the NS deal closes.

While I still am not of fan of SUN’s IDRs, I like this deal, and as such will upgrade the stock on the merger announcement weakness. My new rating is “Buy” with a $67.50 target price, which is a 9x multiple on my 2025 combined estimates.