Monty Rakusen/DigitalVision via Getty Images

Since I wrote about China’s automotive services provider SunCar Technology (NASDAQ:SDA) last November, its price is up by over 16%. Even at that time, a 20-25% upside was evident for the stock in the short term, after it significantly overcorrected when a follow-on offering took place at a price lower than its initial listing price. This, coupled with competitive market multiples, indicated a price rise in the following months.

However, I was less certain about its medium-term prospects. Its recent drop in profits and the possibility for even lower valuations on any other follow-on offerings were risks. So it was better to have it on the investment watch list instead, prompting a Hold rating. Here, I look at the developments since to assess whether the story has changed for SunCar Technology.

Multiple business agreements

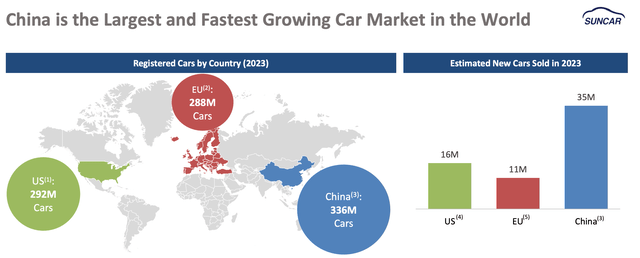

The company hasn’t released any updated financials since I last checked. But at that time, its revenue growth for the first half of 2023 (H1 2023) was strong at 28% year-on-year (YoY), which isn’t surprising that the company caters to a market is not just the biggest in the world, but is also the fastest growing (see chart below).

The multiple business agreements it has signed since further reflect that the fast-paced growth could have continued. The company has signed three different kinds of business agreements with financial services companies:

- Vehicle Services: The biggest agreements are with the Fujian and Sichuan branches of the leading commercial bank, China Construction Bank, for vehicle services like car washing. The expected cumulative revenue from the Fujian branch is RBM 25 million (USD 3.5 million) and RMB 23.4 million (USD 3.3 million) from the Sichuan branch. In total, these amount to 2.4% of the company’s total revenues in 2022, the last year for which the full-year revenues are available.

- Software solutions: It’s also developing a software solution for Li Auto Insurance’s brokerage operations for RMB 1.74 million (USD 0.24 million), which is expected to be completed in November this year. This follows the company’s affiliation with Li Auto (LI) late last year to develop online insurance services, so users can choose from the available options.

- Concierge services: SunCar has also signed agreements to provide concierge services for China CITIC Bank and Ant Fortune, the wealth management platform of the part Alibaba (BABA) owned Ant Financial.

Risks from a softer economy

However, it remains to be seen how much the company has grown in the last six months of 2023 and even in 2024, considering the Chinese economy’s recent trends.

First, let’s look at auto sales. Even though China’s car sales grew by 10.4% YoY in the first quarter of 2024, the monthly trends have been erratic. Sales declined by 19.9% in February before rising by 9.9% in March. At any other time, this gyration would be less concerning. However, it’s hard to ignore considering the recent softness in China’s consumer economy, as I pointed out in my recent article on China’s ANTA Sports Products (OTCPK:ANPDY).

It can, of course, be argued that SunCar’s market goes beyond just retail automotive, in that it’s also catering to the banking and financial services sector, which might not be as impacted. However, the consumer economy is a reflection of the overall economy too.

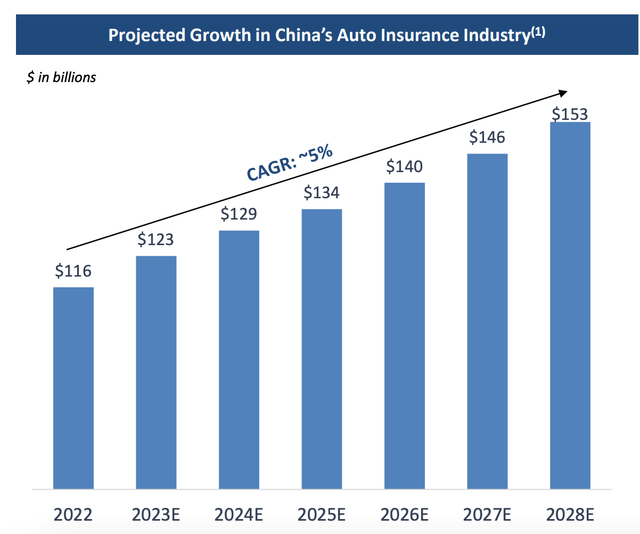

Forecasts for China’s economy also indicate softening ahead. Even though the economy grew by 5.3% in Q1 2024, leading banks predict an average growth of 4.6% this year. And financial services’ growth is closely linked with the broader economy. In any case, at least the auto insurance market isn’t expected to be the fastest growing (see chart below), which the company otherwise sees as a potential source of stable, predictable revenues. And this growth can slow down even further right now.

A slowing down in revenue growth can be challenging at a time when the company has already witnessed softer margins in H1 2023. The operating margin fell to just 1.1% (H1 2022: 6%) and the company also fell into a net loss.

The market multiples

Still, there’s something to be said for the stock’s trailing twelve months [TTM] price-to-sales (P/S) ratio. At 1.97x it’s a tad higher than the 1.67x level when I last checked, but it’s still lower than the 2.94x for its peer company Autohome (ATHM).

To estimate the forward P/S, I’ve reduced the company’s revenue forecast from last time. I had then assumed that the revenue growth for the full year 2023 would be at 34%, the company’s compounded annual growth rate [CAGR] from 2015 to 2022. But going by some softening in China’s demand, the growth is now assumed to be 28%, the same as that seen in H1 2023. However, the forward P/S doesn’t change significantly either. At 1.8x, it’s also just a bit higher than the 1.4x the last I estimated it. This, too, is lower than the corresponding ratio for Autohome at 2.9x.

The stock’s ratios are higher than that for the consumer discretionary sector, however. The sector’s TTM P/S is at 0.89x and the forward ratio is at 0.86x. Like the last time, here too, I’ve considered the average ratios of Autohome and the sector to assess what’s next for SunCar. The ratios are both at 1.9x, which doesn’t indicate any real upside to the stock now.

What next?

Essentially, the discussion indicates that SunCar’s rating remains unchanged. The market multiples now reflect fair valuation, based partly on the stock’s price rise and also risks to its growth due to a softening market. The company can still continue to grow at a fast clip, as evident from its recent business agreements. But whether it will grow as fast as it has in the past years remains to be seen.

A potential slowing down at a time when its profit margins have already declined only increases the risk to it further. It’s possible that things look different when it releases its full-year results, but that’s a wait-and-watch. I’m retaining a Hold rating on SDA.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.