Supertruper

REITs have made a comeback in recent weeks, as fears around a ‘higher for longer’ interest rate environment have subsided. It pays, however, to remain cautious, as the recovery may still be too early to tell. Perhaps that’s why higher risk segments admire hotels and office properties remain priced well below where they were just a year ago.

This brings me to Summit Hotel Properties (NYSE:INN), which I last covered here in December of 2020, in what seems admire a completely different time. Back then, Summit was climbing out of the depths of the pandemic and interest rates were historically low.

Hindsight is 20/20, and it appears that exuberance was overrated as higher interest rates have pressured the stock, with it now trading 30.5% below where it was since my last piece. In this article, I revisit the stock and converse whether if it’s a buy or hold at this time, so let’s get started!

Why INN?

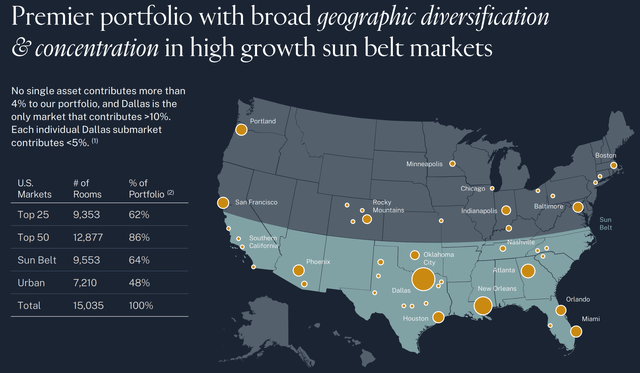

Summit Hotel Properties is a self-managed REIT that owns premium-branded lodging properties with efficient operating models. It has a presence in 43 markets consisting of 101 hotel assets, 57 of which are wholly owned with the rest being owned as part of joint ventures. As shown below, the majority (86%) of INN’s properties are in the Top 50 markets in the U.S.

Investor Presentation

INN is focused on select-service, upscale hotels with efficient operating models, with Marriot, Hyatt, and Hilton branded hotels comprising 95% of its room count. This translates to better margins than industry average. This is reflected by INN’s TTM Hotel EBITDA margin of 36%, sitting above the 34% among select service peers and 30% for all peers.

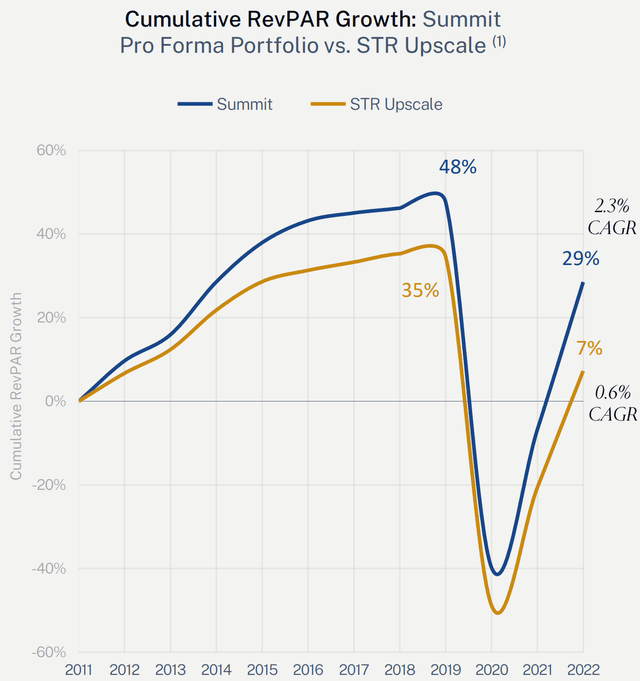

This has enabled INN to quickly climb out of the depths of the early pandemic, during which travel essentially came to a halt. As shown below, INN saw encouraging RevPAR (revenue per available room) in the pre-pandemic timeframe, and has since made a strong recovery, with performance sitting ahead of the STR Upscale chain benchmark over the entire timeframe.

Investor Presentation

Meanwhile, INN continued to produce stable and growing top-line trends, with same store RevPAR growing by 2.4% YoY to $117.85 and same store occupancy rising by 230 basis points YoY to 73.7% during the third quarter, signaling strong demand from consumer and business travel. Encouragingly, top-line growth is being converted to bottom line profitability for INN’s hotels, despite wage inflation, as same store Hotel EBITDA grew by 2.8% YoY to $61.4 million during Q3.

It’s worth noting, however, that INN’s recovery has slowed, compared to same store RevPAR growth of 7.7% YoY for the first nine months of the year. I’m not too concerned around the slowdown, however, as this was due to a tough comparable to 2022, when revenge travel was solidly taking hold. In addition, a strong U.S. dollar has made overseas travel more attractive, where the U.S. dollar strengthened, particularly against the Japanese Yen as an example, as shown below.

USD to JPY Exchange Rate (Google)

Looking ahead, INN should benefit from evolution of work, in which employees are increasingly in hybrid mode compared to pre-pandemic. This means period visits to their company’s regional headquarters, with smaller groups and shorter stays, for which INN is well suited.

Plus, while INN’s cost of equity and debt are currently unattractive due to a low share price and higher interest costs, portfolio recycling is a way for INN to create internal growth. This is reflected by a signed agreement to sell a Hyatt Place in Maryland for $8.25 million at an attractively low 4.6% cap rate, and the proceeds of which can be deployed to higher yielding properties. Since May of 2022, INN has disposed of 6 hotels totaling $111 million, inclusive of the above-mentioned Hyatt Place.

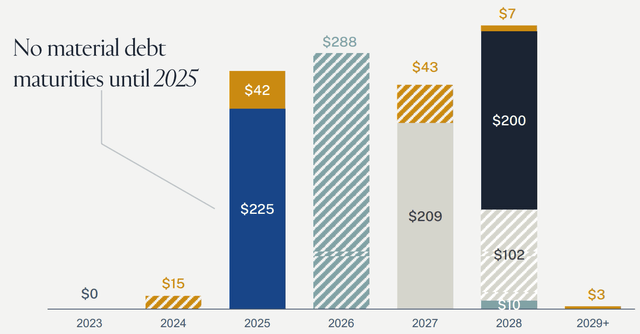

Importantly, INN is modestly leveraged with a net debt to enterprise value of 51%, a fixed charge coverage ratio of 2.5x, and no material debt maturities until 2025, as shown below.

INN Debt Maturities (Investor Presentation)

Risks to INN include the fact that Hotels are more vulnerable to an economic recession compared to other REIT asset classes such as net lease, industrial, and community shopping centers. As such, a potential hard landing in the economy could reverse some of the top and bottom line gains that INN has seen over the past year.

In addition, higher interest rates pose a headwind, as INN does have meaningful debt maturities starting in 2025, as shown above. However, while Hotel REITs are among the most economically vulnerable asset classes, they are also resilient when it comes to inflation due to their ability to reset rates almost instantaneously. As such, room rate growth due to inflation could offset some of the impact from higher interest rates, should inflation remain elevated.

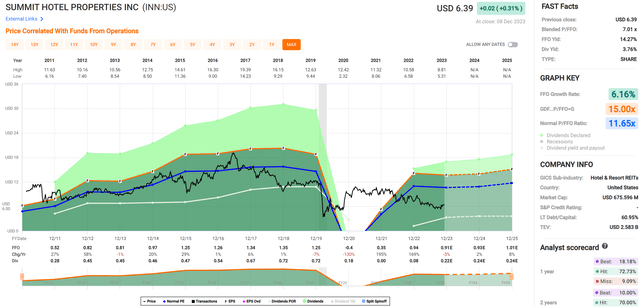

Meanwhile, INN currently pays a 3.8% dividend yield, which is well-covered by a 27% payout ratio, based on INN’s forward FFO/share of $0.89. This leaves INN with plenty of retained capital to either pay down debt or to follow accretive growth. I also see value in INN at the current price of $6.39 with a low forward P/FFO of just 7.2, sitting well under its normal P/FFO of 11.7. As such, it appears that the market has already priced in plenty of risks into the stock.

FAST Graphs

Conservative income investors ought to consider Summit’s Preferred Series E Stock (NYSE:INN.PR.E), which currently yields a high 8.4%. At the current price of $18.70, it trades at a material 25% discount to the $25 Par Value. This preferred issue is also cumulative, which means that missed payments must be made up so long as INN is solvent. While INN.PR.E currently trades post its call date of 11/13/2022, I don’t see it being redeemed anytime soon, considering that it has a face yield of 6.25% and was issued in November of 2017, at a time when interest rates were much lower.

Investor Takeaway

INN is a well-positioned hotel REIT with a strong focus on select-service, upscale properties in top markets. With high margins and impressive performance in recent years, INN has proven its resilience and potential for growth. Additionally, INN’s strategic portfolio recycling approach allows for internal growth opportunities and continued stability.

Meanwhile, the common stock trades well below its normal valuation while offering a well-covered near-4% dividend yield, leaving plenty of retained capital to bolster the balance sheet and/or follow growth opportunities. More conservative income investors may want to consider the Preferred Series E stock, which carries an 8.4% dividend yield and trades at a 25% discount to par value.