The stock market may be struggling due to interest rates, but there are many opportunities developing in the bond market! Justin Paget/DigitalVision via Getty Images

Brian Dress, CFA — Director of Research, Investment Advisor

It’s no secret: since the beginning of August, the stock market has struggled to maintain value, amid a series of economic and world events.

Since we last connected with readers in September, things have become even more complicated for investors, with another war breaking out in the Middle East and with interest rates in the US (and elsewhere) continuing to breach levels unseen in many years.

We have heard plenty of worry coming from the investing public, wondering when the pressure we have seen in the stock market will dissipate. We continue looking for best-in-class stock investments, even in a difficult market environment. As we are learning in the current earnings season, many companies are delivering excellent results, in spite of many challenges.

Over the last year, we have spent a lot of time anticipating earnings season, for a key reason. It seems recently that when companies report earnings and give tangible data on which investors can base opinions, stocks tend to do well. On the other hand, between earnings release seasons, stocks tend to struggle, as investors focus on macroeconomics- factors like interest rates and global political uncertainty, which have led shareholders to sell.

We are roughly 1/3 of the way through 3rd quarter earnings release season and we are unfortunately seeing a new pattern emerge. Thus far, we have seen, on balance, negative initial stock price reactions, even when earnings releases appear positive. A couple that come directly to mind are Meta Platforms (META), which sold off after earnings and Microsoft (MSFT), which was strong post-earnings, but fell in the days following the release.

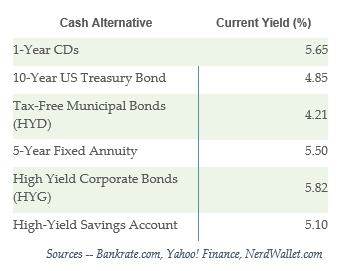

We think something has markedly changed in the psyche of investors that may account for the difference in earnings reactions and general sentiment surrounding the stock market. As you can see in the infographic below, the rates of return associated with fixed income instruments have risen to levels unseen in more than 2 decades, with the US 10-Year Treasury Bond now carrying a yield approaching 5%. Since other fixed income instruments price off of this benchmark rate, we see other fixed rates of return approaching 6%, 7%, 8% (or more) in certain cases. Couple this with the volatility we are seeing in the stock market, it is no wonder that investors are beginning to look beyond stocks for a place to park their money.

Bankrate.com, Yahoo Finance, NerdWallet

Our conclusion, and the conclusion of many others, is that stocks have a competition problem. With investors now empowered to achieve reasonable levels of return without taking direct stock market risk, we think it is possible that stocks will struggle to find footing in the short term.

For long-term investors, this presents an opportunity to add exposure that should prove to be an advantage over time – we remain optimistic for the course of the markets in a 3-5 year window from today. However, at the same time, we think it is worth considering for investors of all stripes to consider taking advantage of these generous rates of interest to add quality securities to the portfolio for long-term holds of 5, 10, 15, or even 20+ years. At Left Brain, we welcome the chance to lock in generous and predictable rates of interest for a long period of time. We think that when interest rates do ultimately fall (and they eventually will as these things move in cycles), those who purchase these fixed rate securities in this temporary period of high rates will be glad they did! In today’s newsletter, we are going to dedicate most of our “column inches” to examining opportunities for investors to “high grade” their portfolios with investment grade bond opportunities, limiting risk while locking in stock-like rates of return for long-term holding periods.

With that all being said, let’s get into it!

Quick Earnings Recap

Overall, earnings so far have been lukewarm, at best. However, we have seen some earnings reports that have been reasonably well received. Two of the reports over the last two weeks that have impressed for us have been from Netflix (NFLX) and Chubb (CB).

Netflix is well-known as the leader (by far) in the streaming world. The company is steadily growing market share, with nearly 40% of overall US screen time now on the Netflix platform, compared to 26% in May 2021 (thanks to Yuval Rotem on Seeking Alpha for his analysis on Netflix). Netflix was one of the rare companies that reported positive news and experienced an associated positive stock price reaction, gaining more than 15% after the earnings release on October 18. Fortunately, the stock has been able to hold its gains since, despite a choppy market.

Results were well beyond analysts’ expectations, as the company added nearly 9 million new subscribers in the third quarter, nearly double the expected value. Importantly, management expects similar subscriber growth in the next quarter, as well, which means that there is a possibility that 2023 could be a record year for subscriber growth, surpassing even the Covid year of 2020. Clearly, the company’s decision to crack down on password sharing has been a success in bringing new paying customers to the platform.

Additionally, we have seen improved profitability for the company driven by a new ad-supported model at the company. Operating margin came in at 22.4% for the quarter, compared to 19.3% in the prior year quarter. In a difficult business environment (writers/actors strikes) and market environment, Netflix continues to perform, which think augers well for future performance for this stock.

Chubb is the world’s largest publicly traded property and casualty (P&C) insurer and a company that we have followed closely for some time now. In the third quarter, Chubb delivered a record $4.95 in earnings per share, well in excess of consensus estimates coming into the report. Net P&C premiums written in the quarter increased 8.4% over last year, with net income of $2.04 billion for the quarter up more than 150% from the same quarter last year. Much of the additional profit was generated through higher insurance pricing, with pricing up 13.9% year-over-year in North America and 11.7% in the international vertical (thanks to Seeking Profits on Seeking Alpha for their analysis of the latest earnings).

Owning insurers like Chubb can be an excellent way to take advantage of a higher interest rate environment. That is because insurers like Chubb take advantage of what is called the “float”. The “float” describes how insurers collect premiums and deploy those funds in short-term debt markets to earn interest income. When short-term interest rates are high, this practices becomes all the more lucrative. In the third quarter, net investment income came in at $1.4 billion, more than $300 million more than the company generated in Q3 2022.

Put simply, a better operating environment for the insurance side of the business, coupled with additional investment income, driven by higher interest rates, were a boon for Chubb’s business. We like the relative predictability of a P&C insurer like Chubb and think this stock is potentially a great way to play the theme of higher interest rates. We also like Chubb for its largess – a large insurer like this is more diversified from a business perspective than are smaller competitors and, therefore, any large claims that it must pay out will have a relatively muted impact on the company’s overall bottom line.

Interestingly, along with the theme we mentioned in the introduction, Chubb shares have struggled to hold their post-earnings gains. This is similar to what we have seen with many other high quality companies that have reported solid results. Ultimately, for long-term investors, this represents an opportunity, if you can tolerate short-term share price fluctuations. Keep an eye on Chubb.

A Way You Can Take Advantage of Higher Rates

As investors and as consumers, we tend to think of higher interest rates only in a negative context. If we have to buy a house, we will have to pay more. If we have to buy a car, we will pay more. Existing bond positions we hold are likely well underwater. All of these concerns would be correct.

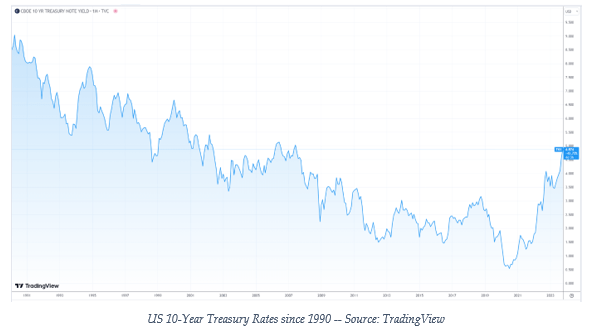

However, for investors with cash to put to work, there is a historical opportunity take advantage of the situation. Take a look at the chart of the US 10-Year Treasury rate since 1990. As you can see, we haven’t seen 10-Year Treasury notes with this high of a rate since the era of 2007-2008:

TradingView

I know the print on these charts can be small, but we are currently looking at a rate of roughly 4.85%. All fixed income instruments in the marketplace are priced based on where the 10-year Treasury rate trades. So, as we take a look at the landscape for fixed instruments, we see that there are investment grade corporate bonds with annual returns now sitting in excess of 7%!

Over the past decade, investors in search of income have had to dip into the high yield bond market to find yields that even eclipsed 5%. We happen to like high yield bonds, even today, but we also understand that there are many investors whose risk appetites dissuade them from owning high yield bonds. That’s just fine. But over the last 15 years, if you stuck in the investment grade side of things, you were looking at anemic yields of 2-4% — clearly not enough to keep up with the current rate of inflation or to sustain a retirement income planning strategy that keeps you from dipping into your principal.

In today’s letter, we are speaking directly to those investors that have been stuck with low-yielding bonds over the last two decades, struggling to keep their retirement nest eggs growing and to generate the income they need to maintain a comfortable retirement. We are also speaking to those investors who are in retirement or even within 10-15 years of retirement: the time is now to lock in predictable streams of income associated with high quality companies while rates remain elevated in a historical context (before you argue with me, I know where rates stood in the 70s and 80s, but that was an awfully long time ago and possibly a one-off!)

With rates elevated, we have a very special chance to “high grade” bond portfolios, owning higher-quality bonds, while locking in generous rates of return. Believe it or not, it is possible to build a portfolio of corporate bonds solely in the investment grade space with a gross return of 6-7%, a concept unheard-of over the past couple decades. What’s more, we can purchase bonds with maturity dates 10-25 years in the future, allowing investors to lock in these rates of interest for a very long time. In our view, if you are trying to develop a predictable income strategy for retirement, we think the time is now to build your bond portfolio!

Today we wanted to share with you a couple of bonds that are available in the marketplace to do just that. These are the types of bonds we are currently purchasing for clients to secure those income streams into the future:

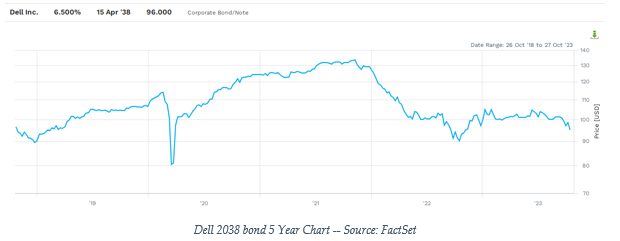

Dell Inc. 6.500% 2038 Bond

Dell is a well-known technology company that is the third largest personal computer vendor, as of January 2021. The company was privately held for some time, but became publicly-traded again in 2016. The company sells personal computers, as well as products used in enterprises, such as servers and other hardware.

Dell bonds carry a BBB rating, meaning that the company has an investment grade rating on its debt. As bond investors, we are looking for companies with steady or growing cash flows. Since the company began providing financial reporting again back in 2015, Dell has delivered positive Free Cash Flow each of those years, with an acceleration over the past year, delivering $7.14 billion in Free Cash Flow over the last 12 months from roughly $93 billion in revenue.

We also like the debt-to-equity ratio in evidence here, with just over $23 billion in debt compared to more than $47 billion in market capitalization. The debt was nearly $50 billion just three fiscal years ago, so the company is making great progress in paying down debt, which we also like as bond investors.

If you take a look at the chart below, you can see that the bonds have fallen sharply over the past two years, as overall interest rates have fallen. At today’s prices, investors are able to lock in nearly 7% annual return on Dell bonds for the next 15 years, loaning money to a very high-quality company that most of us know in Dell.

Should interest rates reverse course over the coming years, we expect these bonds to trade again to a higher price, so there is a great opportunity for investors to collect 6.5% in interest payments over the next 15 years, with the additional possibility of price appreciation of these bonds.

FactSet

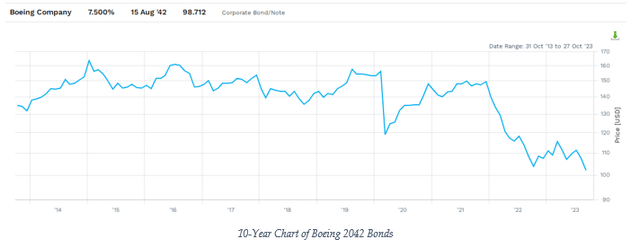

Boeing Company 7.500% 2042 Bond

Another household name with very attractive bonds is Boeing (BA). Here we are focusing on the 2042 bonds, which at current prices, offer investors an annual return of 7.6%.

Boeing is one of the world’s two behemoth aircraft manufacturers. The company has had some issues with the 737 MAX and some operational difficulties over the last decade, but its status as part of the world’s duopoly for aircraft manufacturing puts it in a dominant market position.

During Covid, Boeing had negative cash flow, as it was unable to deliver aircraft to airlines who were watching their spending. However, over the past two years, cash flows have rebounded and the company has produced $4.6 billion in positive Free Cash Flow over the past 12 months, as the travel industry has rebounded significantly in the last two years. Long-term debt for the company ballooned to $63 billion in December 2020, but the company has successfully decreased that figure to $47 billion in the most recent quarter, so we think Boeing is on a good trajectory to improve its fiscal situation.

As you can see below, this bond traded at a significant premium (as high as 160 cents on the dollar) roughly 8 years ago, but again, due to higher interest rates in the US, the price has fallen back to a discount on its initial price. If interest rates drop, investors have a chance to see price appreciation here, while collecting 7.5% of interest income annually.

These are just two examples of large and steady companies that have bonds on offer that pay investors more than 7% annual return, mainly because interest rates have risen so far and so quickly, While you may not buy the absolute bottom price in securities like this, we think the current opportunity is very attractive, especially if you are looking for relatively low-risk ways to secure income for your portfolio over the next 20 years.

Takeaways

Interest rates have driven everything over the last few months in markets. We are now looking at a situation where stocks have to compete for portfolio share with high-yielding and relatively safe fixed rate investments.

We still see very impressive businesses deliver strong earnings like Netflix and Chubb did. We still think there is a place in portfolios for stalwart businesses like this, but we are dismayed by the overall muted reactions so far in this earnings season to quality earnings reports.

With that all being said, we think it is time for investors of all types to consider adding high-quality fixed rate securities to their portfolio. Not only do securities like this offer balance to those of you who are heavily invested in stocks, but also we really like the income potential – 6-8% annual return on investment grade corporate bonds was unheard of just 6 months ago!

If you are an investor looking to preserve wealth and secure a comfortable retirement, an income strategy locking in passive revenue streams is essential. Fortunately, now is the time to put the idea into practice, while we have the chance to lock in passive income for the next 10-25 years.

DISCLAIMER: This report contains views and opinions which, by their very nature, are subject to uncertainty and involve inherent risks. Predictions or forecasts, described or implied, may prove to be wrong and are subject to change without notice. All expressions of opinion included herein are subject to change without notice. Predictions or forecasts described or implied are forward-looking statements based on certain assumptions which may prove to be wrong and/or other events which were not taken into account may occur. Any predictions, forecasts, outlooks, opinions, or assumptions should not be construed to be indicative of the actual events which will occur. Investing involves risk, including the possible loss of principal. The opinions and data in this report have been obtained from sources believed to be reliable; neither Left Brain nor its affiliates warrant the accuracy or completeness of such and accept no liability for any direct or consequential losses arising from its use. In addition, please note that Left Brain, including its principals, employees, agents, affiliates, and advisory clients, may have positions in one or more of the securities discussed in this communication. Please note that Left Brain, including its principals, employees, agents, affiliates, and advisory clients may take positions or effect transactions contrary to the views expressed in this communication based upon individual or firm circumstances. Any decision to effect transactions in the securities discussed within this communication should be balanced against the potential conflict of interest that Left Brain, its principals, employees, agents, affiliates, and advisory clients has by virtue of its investment in one or more of these securities.

Past performance is not indicative of future performance. The price of securities can and will fluctuate, and any individual security may become worthless. A high or favorable rating, rating outlook, gauge, or similar opinion is not indicative of future performance, and no user should rely on any such rating, rating outlook, gauge, or similar opinion to predict performance or potential for return. Future performance may not equal projected or forecasted performance or potential for return. All ratings and related analysis, as well as data, statistics, analysis, and opinions contained herein are solely statements of opinion and are not statements of fact or recommendations to purchase, hold, or sell any security or make any other investment decisions.

This report may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will materialize. Reliance upon information herein is at the sole discretion of the reader.

THE REPORT IS PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS WITHOUT REPRESENTATION OR WARRANTY OF ANY KIND. Left brain Wealth Management DISCLAIMS ALL EXPRESS AND IMPLIED WARRANTIES WITH RESPECT TO THE REPORT, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

The Report is current only as of the date set forth herein. Left Brain Wealth Management has no obligation to update the Report, or any material or content set forth herein.