Share prices of semiconductor giant Broadcom (AVGO 5.88%) gained a remarkable 91% in the past year, which may seem a tad surprising at first if we put the company’s relatively slower growth in perspective.

After all, Broadcom’s revenue in its fiscal 2023 (which ended on Oct. 29, 2023) increased only 8% to $35.8 billion. Its earnings, on the other hand, increased 12% to $42.25 per share. However, Broadcom’s recently completed $69 billion acquisition of cloud computing and virtualization company VMware and its potential in the artificial intelligence (AI) chip market seem to have fueled the stock’s run-up in the past year.

But after that red-hot rally, Broadcom shares are now priced at just over $1,100, close to the top of their 52-week range. This could give rise to a scenario in which Broadcom management could consider a stock split.

Why Broadcom may consider a stock split

A stock split is a cosmetic move, one that simply multiplies the number of outstanding shares of a company while its market capitalization remains the same and the share price is reduced proportionally. While such moves don’t have any impact on a company’s business, operations, or fundamentals, the lower stock price makes the shares of a company more affordable to smaller investors.

Investors who were unable to afford a high-priced stock could start buying it following a split, thereby increasing the demand for the company’s shares and potentially pushing up its stock price. So, the effect of a stock split can be considered to be more of a psychological one than a financial one, especially considering that many brokers now allow investors to buy fractional shares.

Given that Broadcom stock’s terrific rally has brought its share price to $1,100-plus levels, it wouldn’t be surprising to see management taking the stock-split route. For example, if management decides to go for a 10-for-1 stock split, Broadcom shares would trade at around $110 after the split goes into effect (based on their current pricing).

Such a move might or might not give Broadcom a boost in the short run, but investors considering adding it to their portfolios would do better to focus on the company’s long-term prospects, which seem solid enough to help the stock sustain its impressive rally.

The semiconductor giant could win big from some lucrative catalysts

Broadcom management forecasts fiscal 2024 revenue will land at $50 billion, including a $12 billion contribution from VMware. That would translate into year-over-year growth of almost 40%. Excluding the VMware contribution, a top line of $38 billion would equate to an increase of around 6%.

The integration of that acquisition is expected to accelerate Broadcom’s revenue growth: Analysts forecast a 10% jump in revenue in its fiscal 2025 to $55 billion. It is worth noting that Broadcom will have owned VMware for almost a year by the time fiscal 2024 ends. So the fiscal 2025 revenue forecast provides a true picture of how the acquisition is going to have a positive impact on the company’s growth.

That anticipated revenue growth acceleration isn’t surprising. VMware is the leader in the virtualization software market, which is expected to generate $149 billion in total revenue in 2029 as compared to this year’s estimate of $95 billion, according to a forecast by Mordor Intelligence. Meanwhile, Broadcom’s business is also getting a lift from AI chip sales.

CEO Hock Tan said on the company’s earnings conference call last month that its AI chip revenue came in at $1.5 billion, which was 20% of its semiconductor solutions revenue of $7.3 billion. It is worth noting that AI chip sales accounted for 16% of Broadcom’s total quarterly revenue of $9.3 billion. In its fiscal 2024, Broadcom expects generative AI-related sales to account for more than 25% of its semiconductor revenue.

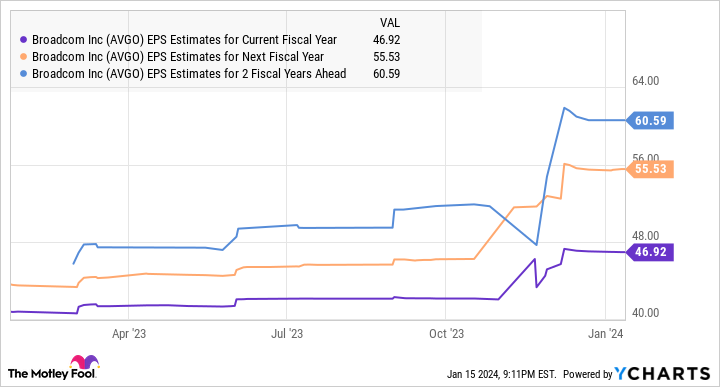

With the market for AI chips expected to grow at an annualized rate of 29% through 2030, it won’t be surprising to see solid long-term growth in Broadcom’s AI-related revenue. This explains why analysts are forecasting an acceleration in Broadcom’s earnings growth following this year’s estimated jump of 11% to $46.92 per share.

AVGO EPS Estimates for Current Fiscal Year data by YCharts.

Broadcom currently trades at just 20 times forward earnings. That’s way cheaper than the Nasdaq-100‘s forward earnings multiple of 28. Assuming Broadcom does hit $60 per share in earnings in fiscal 2026, as the chart above suggests, and that it trades at 25 times forward earnings, its stock price could jump to $1,500. That would be 36% above current levels.

However, Broadcom could deliver more upside if the market decides to reward its accelerating growth with a higher earnings multiple. That’s why savvy investors should consider buying this semiconductor stock while it is still cheap and not wait for a stock split, as its solid prospects could send it higher in the long run.