Upstart (UPST 20.31%) stock closed out Wednesday’s daily trading session with huge gains. The company’s share price ended the day’s trading up 20.3%, according to data from S&P Global Market Intelligence. Meanwhile, the S&P 500 index closed out the daily session up roughly 1.4%.

Stocks rallied on Wednesday following news that the Federal Reserve would keep interest rates at current levels rather than serve up another rate hike. That’s particularly good news for fintech companies, including Upstart, which have generally been battered by the central banking authorities’ program of rapid rate hikes.

Adding to the momentum for Upstart stock today, the company announced that a new partner had joined its platform. But even with today’s explosive rally, the fintech’s share price is still down 89% from its high.

A new partner and stabilizing macro conditions

Upstart aims to make loans available to a wider range of potential borrowers. Through its proprietary artificial-intelligence-powered system, the company aims to reduce the need for reliance on FICO scores and take a wider range of relevant criteria into account when assessing creditworthiness.

Today, Upstart announced that Mutual Security Credit Union would begin using the company’s platform to extend the accessibility of personal loans for its customers. Given the backdrop of macroeconomic uncertainty that has shaped much of this year’s trading, the addition of major new banking partners is undoubtedly a good sign.

Even better, signs suggest that the overall backdrop could be moving in directions that are more favorable for Upstart and its shareholders. Many analysts now expect that the Fed could pivot to a rate-cutting policy sometime next year.

If so, that could pave the way for Upstart stock’s rebound to continue. Lower interest rates would mean that it’s less risky to lend, and the company could accomplish a wider customer base through its network and banking partners. If overall economic conditions improve, that would also work to lower the risk of defaults.

Is Upstart stock a buy now?

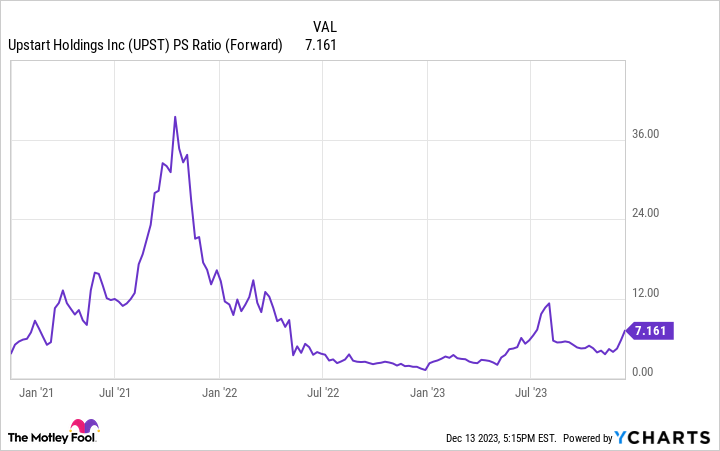

Upstart is now trading at roughly 7.2 times expected sales — a highly growth-dependent valuation. While the company’s sales growth can reasonably be expected to continue in the short term, its earnings trajectory could be much more uneven. On the other hand, it could be in the early stages of having disruptive impacts on the lending industry that pave the way for long-term shareholders to see stellar returns.

UPST PS Ratio (Forward) data by YCharts

For risk-tolerant investors, Upstart stock could be a worthwhile portfolio addition right now. While the company’s long-term outlook remains somewhat speculative, the potential for massive upside is still there even after today’s big pop.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Upstart. The Motley Fool has a disclosure policy.