Right now major automakers are battling to turn their electric vehicle (EV) lineups into a profitable segment. Ford Motor Company projects its EV unit will check in with a $4.5 billion loss for 2023 — a hefty chunk of change lost. And while General Motors plans to produce profitable EVs in 2025, a year ahead of Ford, Stellantis (STLA 0.22%) shocked everyone with an announcement about its EVs this week.

A big declaration

At a Goldman Sachs conference on Wednesday, Stellantis CEO Carlos Tavares declared that the company was “in the black” on EVs not only in Europe, but in the U.S. as well. The comment took many by surprise, especially considering that to spur a higher volume of sales the pricing has to stay affordable, making margins difficult to produce. In that equation, the only way to really produce profitable EVs at the moment is to be super strict on cost.

“Our margins on electrified vehicles are in the black. That’s a good thing. We are closing the gap against ICE faster in Europe than in U.S. because we started sooner, but we are achieving results and we see that all of this is going to be exciting,” Tavares said.

This is big news for an automaker often lurking in the shadows of crosstown rivals Ford and GM, and an important part of its broader story of aiming for 75 battery-electric vehicles (BEVs) globally by 2030, including more than 25 in the U.S. market.

The push for profitable BEVs also comes right as the Ram ProMaster van, Ram 1500 REV, and Jeep Recon are set to hit the stage. Tavares even acknowledged the upcoming Citroen e-C3, which sells at roughly $25,100, will be a profitable vehicle on its low-cost “smart car” platform.

But expect, there’s more

Stellantis also struck a deal with Chinese EV maker Leapmotor that will enable the automaker to deliver additional profitable electric vehicles to Europe. Stellantis said it would invest $1.5 billion for a 20% stake in Leapmotor in October. That’s a bigger deal when you recollect Stellantis CFO Natalie Knight said the automaker had overtaken Tesla as Europe’s No. 2 EV seller.

The reason for the advance is that the Leapmotor source will be 30% more cost competitive than anything in the Western world, according to Tavares. Stellantis’ announcement also came at a time a rival is adjusting its EV ambitions.

Ford recently said it is cutting some Mach-E production that likely won’t qualify for federal tax credits beginning in January, is temporarily cutting one of three shifts producing its F-150 Lightning pickup truck, and is postponing roughly $12 billion in EV investments including delaying its second battery plant in Kentucky.

Is Stellantis a buy?

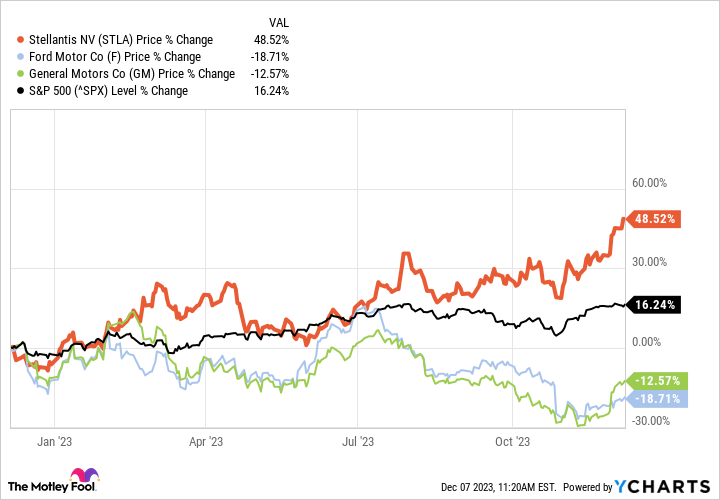

While Stellantis is often forgotten in favor of rivals Ford and GM, it’s quietly becoming a solid automotive investment. In fact, over the past year Stellantis stock has tripled the S&P 500 and far outperformed its two Detroit rivals.

advance, Stellantis trades at a paltry price-to-earnings ratio of 3.3 times earnings, and boasts a dividend yield of 6.58%. With the announcement that Stellantis is now in the black with its EVs in Europe and the U.S., it’s one more reason the automaker should at least make investors’ watch list. Ultimately, if automakers aren’t turning profits on EVs soon, it’s going to be a big, big problem for their stock price.

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and Stellantis and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.