BeritK/iStock via Getty Images

Like pointing gauges, AGNC’s (NASDAQ:AGNC) dividend coverage continues its status as a hot topic. Opinions abound including effects from refinancing hedges, particularly the expiring short end. Other questions abound such as, is the marketplace more stable and what does that mean? Consistent with our other articles on AGNC dividends and monitoring critical parameters, we move forward. What does the gauge read, green, yellow or red? As with most gauges, an accurate look requires a walk closer to the panel. So, let’s go.

The Quarter

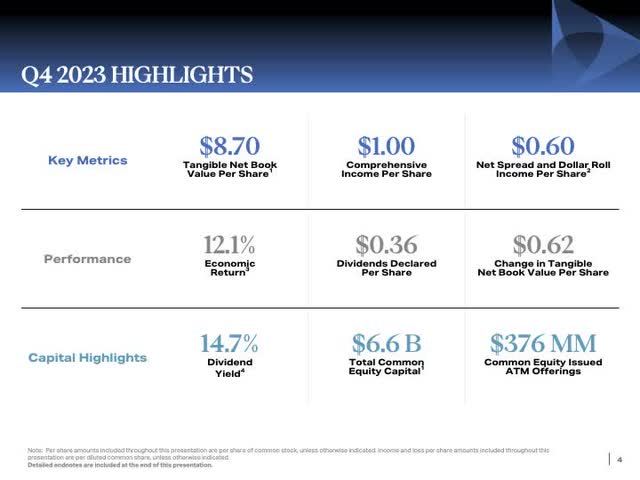

AGNC reported on the 22nd of January. The next slide summaries the results.

Of special importance for us, the Net Spread and Dollar Roll fell $0.05 quarter over quarter with this caveat, “due to a somewhat smaller asset base and a larger share count for the fourth quarter.” The company issued 43 million shares an increase of approximately 6%.

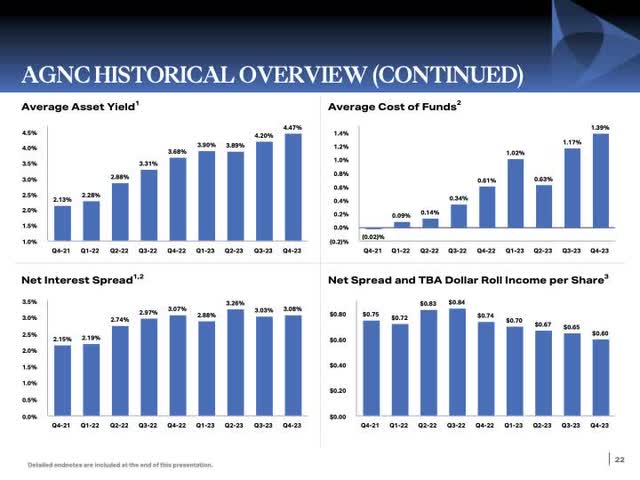

The next slide includes a several quarter performance history.

In our view of importance, the interest spread, lower left, remains constant while the cash earnings continue to drop reasoning noted above.

Also, discussed during the conference at quite length was the duration gap. A negative duration gap means that the market value of equity will increase when interest rates rise (this corresponds to a reinvestment position). At the end of December, AGNC reported a negative duration, but at the call, updated as being neutral.

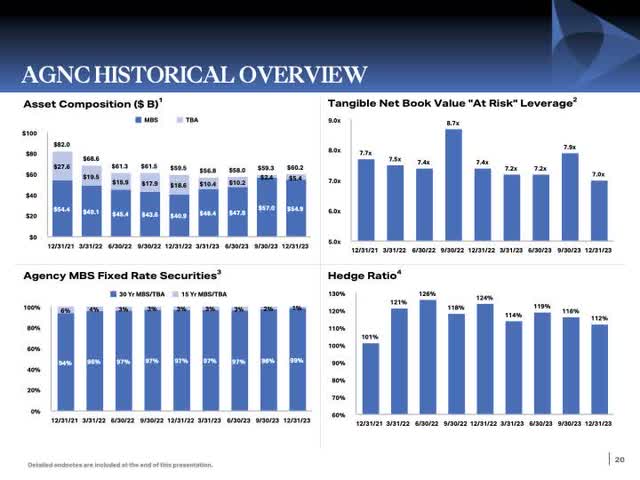

From the next slide, a conservative approach toward asset allocation dominates (upper left) coupled with continued unlevering.

Finally, management reported on several other factors:

- Strong liquidity at $5.2B.

- CPR average of 11.4% at quarter’s end.

- MBS with treasury-based hedges performed meaningfully better than swaps.

- Added a modest level of TBA “comprised of Ginnie Mae.” (Better roll performance than MBS.)

The Company’s Design

AGNC buys, in general, two types of instruments, MBA and TBA, levers by selling lower interest instruments and then hedges these investments for protection from interest rate changes. Management noted that “two primary drivers of our performance are changes in spreads and interest rate volatility.”

Marketplace

With the Federal Reserve’s recent drastic moves on interest rate hikes, the market has been anything but stable spreads trending all over the place. The Jekyll and Hyde December quarter illustrates a difficult marketplace for this model. Management noted:

[T]reasury supply concerns and persistent monetary policy uncertainty weighed heavily on the fixed income market, driving the yield on the 10-year treasury and the current coupon agency MBS to 15-year highs of 5% and 7% respectively.”

Followed by the Fed’s announced pivot in December, treasury rates rallied 100 basis points. One indicator noted in our last article, Bloomberg Aggregate Bond Index, rallied 10%. MBS closely tracked treasury yields. Management stated in the prepared remarks, “we believe the investment outlook for agency MBS is decidedly more favorable than the previous two years.”

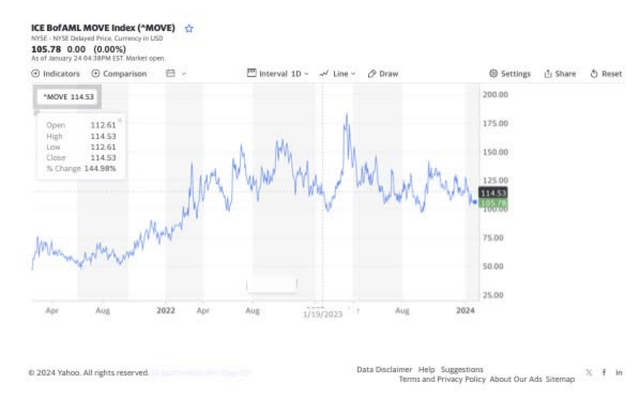

With respect to volatility, the marketplace experienced unprecedented volatility from many unusual factors. An index, MOVE, broadly measures interest rate volatility shown in the next graph.

With the Fed seemingly posturing for stable to lower rates, this index will follow lower at some relationship. Management noted the positive effect for AGNC, “Such a decline would be beneficial to agency MBS and on balance would incrementally reduce the need for and cost of our interest rate risk management activities.”

Finally, management noted an important strength in the MBS spread vs. 10-year treasury being range bound between 140-190 basis points during five different shocks and recoveries in the market.

On the issue of the Fed and the directions of rates, AGNC management and others predict or predicted the December about face with what appears to be a very tough financing and refinancing of debt period. Management noted this,

“[O]ver the next five years at the same time we know now that the treasury is going to have to issue perhaps a couple trillion of new treasuries a year, so we’re talking about multiple trillions of dollars that have to be consumed, not by levered buyers but by unlevered buyers, real money flowing into the U.S. fixed income market for these two high quality assets, both agency MBS and treasures.”

On this issue, we depart drastically from AGNC with a more realistic prediction. The Fed is trapped, drained money market levels will force the Fed’s hand. In addition to quantitative tightening (QT) ending and the lower interest rate hand being forced lower, quantitative easing (QE) seems just around the corner likely fueling higher inflation. This isn’t likely stoppable until the U.S. Government significantly slows spending.

Key Data

In our last article, we included a discussion on critical parameters to monitor. We included information on MOVE, shown above. The investment grade “CDX Index tightened 18 basis points while the Bloomberg IG Index, which represents spreads on cash bonds, tightened by 22 basis points.” Of more importance to AGNC, CRT, RMBS and CRE debt spreads tighten meaningfully.

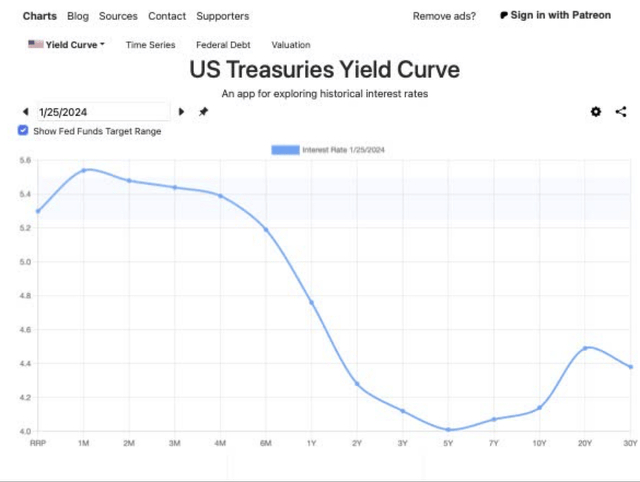

We next include a graph of the yield curve.

The long-end steepened slightly since December, yet is basically unchanged.

Dividend & Cash

The constant contesting over the viability of the dividend at this level continues. Management continues with this answer,

“But again, like I mentioned last time, another key input into that equation is what is our breakeven ROE on our business when you take into account the dividends on both our common and preferred, our operating cost, what is that number on a percentage basis of our total capital. That number, for example at the end of the fourth quarter, if you annualize those numbers, is somewhere as a breakeven ROE of around 15.5%,…”

And management noted levered mortgages are generating mid-teen ROEs. The two are aligned with each other and with the current dividend. AGNC is determined thus far to pay $0.12 a month. Closing, Peter Federico, President & CEO, added, “[b]ut generally speaking, I think it’s fair to say that those two things are still well aligned.” The dividend costs roughly $500 million per year, strangely the approximate amount received from the stock issue.

Action & Opportunities

The interest rate environment, now impacting this type of REIT, is a first with AGNC being formed in May of 2008. Management’s belief of an upcoming less volatile environment, one that existed for most of the first twelve years, brings change from the strong defensive positions now in place towards growth opportunities. Management isn’t in any hurry either. On duration, discussed above, the company plans for various reasons to remain neutral neither leaning toward higher or lower rates.

Risk

With any investment, risk exists. A few comments, regarding replacing the short-term hedges being catastrophic for dividends, is in order. In a Seeking Alpha news release,

In a note dated Jan. 19, Hagen pointed out that he sees some net interest margin sensitivity for Annaly (NLY) and AGNC (AGNC), “as they look to replace short duration hedges between now and year-end.” Timing could be a “blessing” if the Fed starts cutting as the hedges roll off, he added.”

Neither management nor analysts addressed this issue at the call a subject for which more research seems in order.

Our concern, at least at this point, deals with new stock issues and negative effects from dilution. The company issued slightly more than 5% new stock in December. We understand this is part of the plan being executed intended for enhanced future growth. We have also been involved in investments with that intent that quickly changed into carrying the dividend. Once ended, so did the dividend. It is something to watch.

Management isn’t being coy nor hiding its dividend thoughts. Notice in the dividend comment this depth, “what is our breakeven ROE on our business when you take into account the dividends on both our common and preferred, our operating cost…” Since the reason for owning AGNC is dividends, this should ring nicely with investors. Re-phasing a comment from the call, management noted the historically attractive agency MBS spreads with lower interest rate volatility create a compelling environment. Investors must also note that this market condition for AGNC is a first. We continue our buy rating. The gauge still points green.